What happened

Shares of Chinese stocks traded down on Thursday, despite the country's health ministry saying earlier in the day that the country has passed the peak of the coronavirus outbreak.

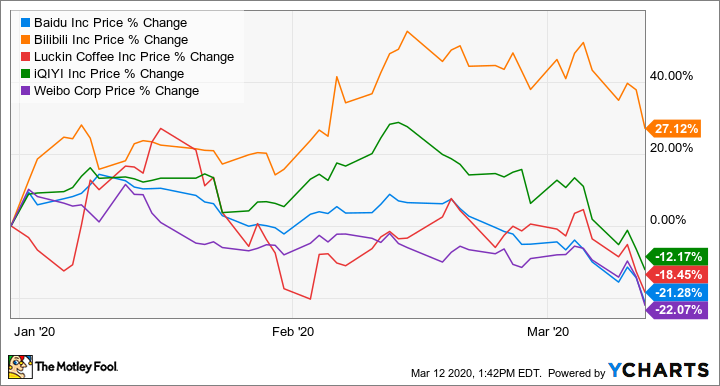

That didn't stop shares of Weibo (WB 2.10%) from trading down more than 9% on Thursday afternoon, and shares of Baidu (BIDU 2.50%), Bilibili (BILI 4.12%), Luckin Coffee (LK +3.38%), and iQiyi (IQ 1.51%) from all trading down more than 7%.

So what

These companies are all engaged in different businesses, but are all focused on China. Baidu is the leading Chinese-language internet search provider, while Luckin is a growing Asian coffee chain, Bilibili and Weibo are social networking platforms, and iQiyi is focused on video streaming.

A collection of Chinese stocks year to date data by YCharts

Like U.S.-based start-ups, many of these companies are in growth-mode right now, and as the novel coronavirus rolled through China and stunted the country's economic momentum, it surely took its toll on the near-term results of these businesses. However, most of these U.S.-listed stocks held up well through the China portion of the coronavirus story and have only been hit hard in recent weeks as the outbreak spread globally.

Luckin Coffee, the outlier on this list in terms of its reliance on traditional retail locations and consumers being out in public, is also the only one of these stocks that was hit hard in late January and early February. Bilibili shares, by contrast, are still up for the year, though down from highs hit in February.

Now what

What's an investor to take from this price action? It could point to how much the recent downturn in stocks has been fueled by sentiment, and not fundamentals. Even if the outbreak is past its peak in China, and the country is starting to get back to normal, these Chinese stocks that trade in the U.S. remain under pressure because the novel coronavirus is front and center on the minds of U.S. investors trading the shares.

Image source: Getty Images.

That's not to say that the impact of the novel coronavirus will not be substantial and will not affect companies both in the U.S. and China. But if it is an indication that much of the current selling is driven by sentiment, it suggests that as the western world begins to rein in the outbreak, markets are likely to stabilize. On the other hand, it also suggests the selling could continue for as long as the outbreak rages, even if individual stocks appear to be oversold.

All of these companies, like their U.S. counterparts, are going to need time to calculate the damage caused to their businesses from the novel coronavirus. For now, the focus for investors and governments is on stemming the outbreak as quickly as possible.