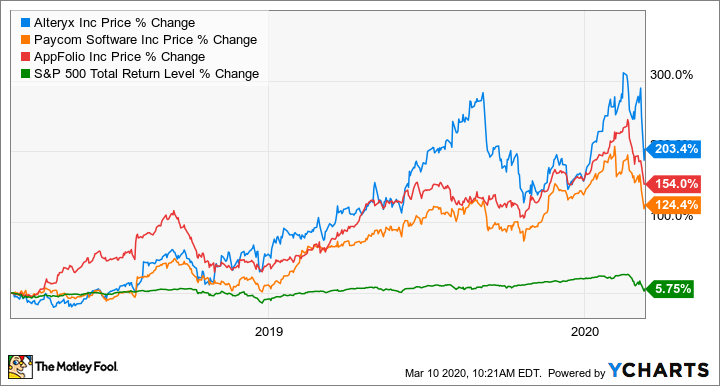

Even with the recent market pullbacks, three software companies -- Alteryx (AYX +0.00%), Paycom Software (PAYC 2.86%), and AppFolio (APPF 0.84%) -- have doubled over the last two years, trouncing the market's single-digit returns. This group has turned in solid results for 2019 and is projecting 2020 to be even better.

Let's dive into what is propelling these stocks and whether it's a good time to add one or all of this trio to your portfolio.

Note: Chart timeline is from March 9, 2018, to March 10, 2020. AYX data by YCharts

1. Alteryx: Turbo boost for the spreadsheet jockey

Alteryx builds a set of powerful tools enabling corporate data analysts to get more done. A large part of its customer base is what CEO Dean Stoeker calls the 47 million "disenfranchised analysts who hate their jobs." These specialists waste up to 26 hours a week completing non-value added work to prep data in spreadsheets even before beginning analysis. Alteryx tools eliminate and reduce much of that work and make the analysis process simpler and more robust.

The company had incredible growth numbers for 2019. Over the previous year, customers grew 30%, revenue 65%, and the dollar-based net expansion hit an impressive 130%. Alteryx expects 2020 revenues in the range of $555 million to $565 million, a 33% to 35% gain over this year's $417.9 million.

In addition to the estimated $24 billion market for the turbo boosting productivity tools for spreadsheet users, its competitive edge gives it reach into the $49 billion big data and analytics market. Based on 2019 revenues, it's only captured less than 1% of its total potential, giving it plenty of room to grow.

Image source: Getty Images.

2. Paycom: Managing payroll and more

In 1998, Paycom started as one of the first online payroll services for small employers. By 2001, it expanded into other tools for human resources organizations and now has a cloud-based software suite that can track the full life cycle of an employee. It's focused on small companies under 5,000 employees, but that doesn't mean it has small revenue.

In 2019, it posted $738 million in revenue, up 30% from the previous year. The number of clients grew by 12.7%, and customer revenue retention rates improved by a percentage point to hit 93%. But what investors are most excited about is that larger customers are becoming a bigger driver to power its 30% top-line growth rate. Its ability to attract customers with more employees shows the quality of the platform and its ability to compete against larger competitors. With this confidence, the company expects the coming year to eclipse $911 million in revenue, or at least a 23% year-over-year growth.

As it approaches $1 billion mark in yearly revenue, investors should note that's still only a single-digit percentage portion of its $20 billion market opportunity, providing the potential for this stock to double again.

3. AppFolio: Collecting rent has never been easier

Property managers have a lot of balls to juggle -- collecting rent, managing maintenance, attracting tenants, and much more. AppFolio provides cloud-based software to help keep busy property managers from dropping the ball. Property management customers grew 10% year over year to 14,385, and units under management grew 19%. Subscription fees make up 35% of its revenue, with the majority (60%) driven by its Value+ offerings, which are transactional fees for things like rent payments, tenant screening, and insurance services. Full-year 2019 revenue increased 34.9% over the previous year to $256 million, accelerating from the previous full-year growth of 32.2%. It also serves the legal industry, but revenue for that segment accounts for less than 10% of its total.

The future looks bright for this under-the-radar software-as-a-service company. It's projecting 2020 revenue to be $312 million to $320 million, representing growth of 22% to 25%, which is still a tiny fraction of its $7 billion total addressable market.

Taking advantage of the market churn

Companies that have built great products that customers love and have a track record of growth should continue to grow well into the future. The fact that this threesome has had strong price appreciation in the past couple of years is actually a sign that Motley Fool co-founder David Gardner views as a buy signal. These companies have a huge runway ahead, and with the share prices taking double-digit dips from recent all-time highs, it could be a good time to add one or all of these growth stocks to your portfolio.