What happened

Shares of mega-technology stocks Alphabet, Microsoft, and Facebook slumped on Wednesday as the stock market continued to convulse due to the novel coronavirus pandemic. At 2:50 p.m. EDT, the S&P 500 index was down about 8.7%.

Here's how these tech stocks were doing a little more than an hour before market close:

Data source: Yahoo! Finance.

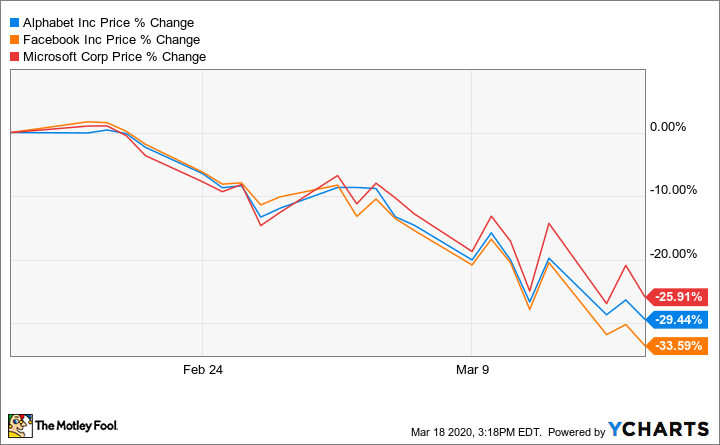

And here's how the stocks have performed over the past month:

So what

The stock market was panicking again on Wednesday as the economic ramifications of the pandemic and the steps taken to contain it spooked investors. There's a tremendous amount of uncertainty, and a potentially deep recession has become a near guarantee.

Google parent Alphabet depends on selling advertising for much of its revenue. In 2019, the company generated $134.8 billion of revenue from advertising, roughly 83% of its total.

While Google may see increased usage for some of its products, like YouTube, as more people stay home to slow the spread of the virus, advertising activity could slow dramatically. Advertising spending from the travel industry may very well drop close to zero as the demand for flights, hotel rooms, and attractions is decimated.

Other industries, like restaurants, will be hit hard as well. While it's impossible to predict exactly how Google's core advertising business will fare, there's the potential for a fairly steep revenue decline. Revenue should rebound once this crisis is over, but the pain could last for many months.

Image source: Getty Images.

Microsoft has already warned about weak sales in its "more personal computing" segment, which includes Windows, Surface devices, and gaming. As of Feb. 26, the company said the rest of its business was performing in line with expectations. But a lot has changed since then.

If business activity slows down broadly, Microsoft's fast-growing cloud computing business could suffer. If commercial customers suffer bankruptcies or are forced to lay off employees, the core software business could be affected. LinkedIn will likely see weak results if employers aren't hiring.

The good news is that Microsoft will be able to weather the storm. The company had over $130 billion of cash on the balance sheet at the end of the latest quarter, along with roughly $70 billion of debt. Microsoft's result may be rough for a while, but the company will be fine in the long run.

Facebook faces a similar problem as Google: Usage of its platforms may surge during the pandemic, but advertising spending will be tougher to come by, particularly from certain industries. Analysts at Needham lowered their outlook on Facebook earlier this month due to the company's exposure to the travel, retail, packaged goods, and entertainment industries. Advertising spending from those four industries account for between 30% and 45% of Facebook's revenue, according to the analysts.

Again, there's a lot of uncertainty, and advertising spending from other types of businesses may pick up some of the slack. But it's likely that Facebook's results will suffer for a while.

Now what

The selling wasn't quite as frantic for these large tech stocks on Wednesday compared to the broader market, but all three stocks are still down substantially over the past month. No one really knows how well their respective businesses will hold up in the coming months. They may outperform rock-bottom expectations, which could lead to a rally in the not-too-distant future. Or they may suffer substantial declines in revenue and earnings. Uncertainty is running very high right now.

In the long run, all three companies should be just fine. But in the coming months, expect a steady stream of bad news to weigh on the stocks.