The stock of Nucor Corporation (NUE 0.23%), one of the largest steel mills in the United States, has fallen hard lately. Down more than 55% from its early 2018 highs, investors have an opportunity to add a great company to their portfolio at a pretty good price. Here are five charts that show the value that Mr. Market is offering up for those intrepid enough to invest when others are fearful.

1. The opportunity is unique

Nucor operates in the cyclical steel industry, which tends to track along with the U.S. economy's ups and downs. The company's financial performance, as you would expect, swings from strong in times of economic expansion to weak during recessionary periods. It's just how things go for Nucor and its primary domestic peers United States Steel (X +0.00%) and Steel Dynamics (STLD 0.87%).

Image source: Getty Images

This dynamic, however, can make it hard to figure out the best time to buy Nucor just by looking at its top and bottom lines. Since big earnings aren't likely to stick around, they can give a misleading view of the company's full cycle potential. If you buy when earnings are high, you could end up overpaying at precisely the moment when earnings are about to head lower. That's why you might want to look at a different valuation yardstick: In this instance, Nucor's dividend yield can offer a worthwhile view into valuation.

NUE Dividend Yield data by YCharts

As the chart above shows, Nucor's over 5% yield hasn't been as high as it is today since the last recession. That suggests investors are taking a dim view of the future here, even though Nucor is one of the best run steel makers in the country, if not the world. Now is a good time to take a closer look for investors with a contrarian bent.

2. A survivor

Before getting into deeper detail, it's worth looking at Nucor's bottom line. There are more compelling reasons to select Nucor over any of its peers, but the company's earnings per share history is enlightening when you consider it operates in a highly cyclical industry. As the chart below shows, Nucor has lost money in just one year over the past 30 years or so (just following the deep 2007-to-2009 housing-led downturn that was so bad it's been called "the Great Recession").

NUE EPS Diluted (Annual) data by YCharts

There's no way to tell what will happen with earnings in the future, but this is a clear sign of the company's strength as a business. Note, too, that the dividend has been increased for 47 consecutive years. That's not a record you achieve by accident and puts the company in rare company, along with iconic names like Coca-Cola and Procter & Gamble. Nucor knows how to ride the cyclical waves and still reward shareholders along the way.

3. A modest level of debt

One of the keys to Nucor's long-term success is that management is fiscally conservative. Put a different way, the company's balance sheet is rock-solid and management wants to keep it like that. There are multiple ways to look at this, but the key is to compare Nucor to its peers.

NUE Financial Debt to Equity (Quarterly) data by YCharts

Nucor's financial debt to equity ratio of 0.25 times is lower than that of any of its closest competitors. It's worth noting that AK Steel, a big U.S. steelmaker that has been struggling for years under the weight of a weak balance sheet, is missing from this list. It was recently bought by Cleveland-Cliffs, which essentially provided a financial lifeline to one of its largest and most financially troubled customers. All in all, though, the picture is pretty clear -- when it comes to financial strength, Nucor is top-notch.

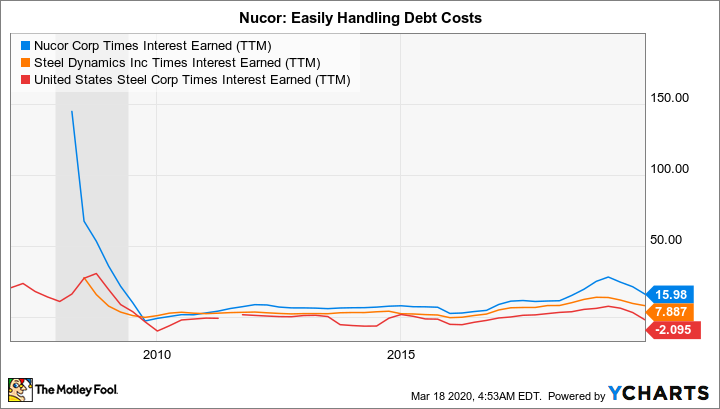

4. Carrying the weight

Having looked at earnings and the balance sheet, it might be worth a look at how the two intersect. One of the best ways to do that is seeing how well a company covers its interest expenses. Called "times interest earned", this ratio helps to show if debt, low or high, is an overwhelming burden on earnings.

NUE Times Interest Earned (TTM) data by YCharts

Clearly, Nucor fell short of covering its interest costs when its top line dipped into the red for one year. But other than that single year, its times interest earned ratio has trended well above those of its closest peers. Most recently its nearly-16-times interest coverage is roughly twice that of runner up Steel Dynamics (which was founded by former Nucor employees, by the way). Earnings have been pretty good lately, so times interest earned is likely to fall from here. But Nucor's position at the top of the industry on this metric isn't likely to change.

5. Doing things better

Being fiscally conservative isn't enough to lead to good results, but it helps. There's one more vitally important factor to consider here: Nucor also runs a great business. There's a number of metrics to look at, but two will suffice: operating margin and EBITDA margin. Nucor is usually near the top on both of these metrics, which effectively tells you how well it runs its business.

NUE Operating Margin (TTM) data by YCharts

One interesting fact is that Nucor has a unique pay structure in the steel space. Employee paychecks are basically made of two parts, base pay and profit sharing. During good times Nucor's employees can make higher-than-industry-average wages because of the profit-sharing component, which the company is happy to pay because it is doing well. However, when times get tough, employees feel the pain along with Nucor, giving the steel giant a break when it most needs to conserve cash. It's like a built-in safety valve for one of the company's biggest expenses (its people).

Time for a deep dive

There's more to understand about Nucor than these five charts show, of course. For example, management has a habit of investing during downturns so it can come out the other side a stronger company. It has big spending plans today that investors need to get their heads around.

But the investment picture should be pretty clear: Nucor looks historically cheap, and that could provide a buying window for long-term investors looking to opportunistically add an industry-leading, and high-yield, company to their portfolios. If that sounds like you, then Nucor is worth a closer look today.