There's no way to sugarcoat the fact that Enterprise Products Partners' (EPD +0.25%) units are down roughly 50% so far in 2020. Most of that pain has come since OPEC and Russia got into an oil price war. There are definite risks in that fight for Enterprise, but it doesn't change the basics of the business. Here's a primer on Enterprise works and why, despite low oil prices, it might still be worth buying today.

Strong stomach

Before getting into the nitty gritty here, it's important to note that COVID-19 and the OPEC/Russia price war have made owning Enterprise (or any energy stock) a bit more stressful than usual. In fact, in today's volatile market, investing at all can turn your stomach. So Enterprise is not an investment for the faint of heart. It requires going against the grain on multiple levels and buying when others are fearful, which is a value investing approach that has worked well in the past.

The problems, though, are many.

Image source: Getty Images

For example, the coronavirus looks likely to cause a worldwide recession. At the very least economies are drastically slowing, with key industries for oil demand, like air travel and cruise ships, taking a massive hit. That is reducing demand for oil and natural gas. This, in turn, is likely to lead to a buildup of excess inventory that will have to be worked off over time once the world gets back to normal. That might take some time, and means that energy prices could remain weak for a while.

Weak energy prices, oddly enough, are the goal of the OPEC and Russia tussle. For many years now, U.S. oil production has been growing. That's disrupted the normal world order for oil and natural gas, putting downward pressure on prices. Although production cuts had been the main approach to deal with this, Russia recently decided that it wasn't willing to do that anymore. OPEC called Russia's bluff and lowered prices while also increasing production. The end goal, however, isn't mutually assured destruction -- it's to push marginal U.S. drillers out of the market. The hope is that this will help to stabilize the supply side of the equation. We're not there yet, so there's likely more pain to go.

A look at Enterprise

So why get into the middle of all of this? For starters, the master limited partnership Enterprise is sporting an over-12% distribution yield. That's exceptionally high, and yet it isn't likely to be cut. The partnership has an over-20-year record of annual distribution increases that proves its dedication to the disbursement. And then there's the important fact that Enterprise covered its distribution by 1.7 times in 2019. That provides a huge amount of leeway to deal with the current adversity.

The key thing to note here is that Enterprise operates in the midstream space. That means it owns the pipelines, storage, processing facilities, and transportation assets that help get oil and natural gas, and the things they get turned into, from the well to the end customer. Roughly 85% of its gross margin is fee-based and backed by long-term contracts. These contracts often contain regular price escalators as well. So the price of oil isn't the main determinant of Enterprise's financial results.

That's not to suggest that oil has no impact here, because that would be untrue. For example, around 15% of Enterprise's gross margin will vary along with energy market fluctuations. And the partnership's growth prospects depend on expanding, building, or buying assets. Management has already announced that it is rethinking its capital spending plans based on the massive drop in oil prices. Thus, the growth picture from here, including distribution growth, is likely to be slow at best. That's not ideal, but Enterprise has always been something of a reliable tortoise. Slow and steady is the norm -- it's just likely to be slower for a bit.

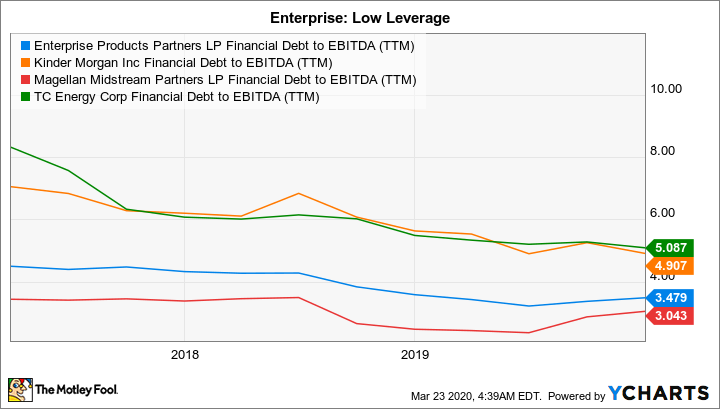

EPD Financial Debt to EBITDA (TTM) data by YCharts

Enterprise is going into this situation very well positioned, however. It is one of the largest and most diversified midstream entities in North America. It would be virtually impossible to replicate the partnership's portfolio from scratch. And it has long taken a conservative approach, with financial debt to EBITDA toward the low end of its peer group. The long-term goal has always been to make sure the business is strong and that investors get their distributions -- this hasn't changed because oil prices are low today.

Worth the risk?

It would be untrue to suggest that there is no downside to owning Enterprise Products Partners. The oil price environment and weak global economy could keep pressuring the units and the energy sector for a long time. However, Enterprise appears fairly well-positioned to deal with the headwinds, even if that means growth crawls along for some time.

The thing is, when you add in a massive 12%-plus yield backed by a financially strong partnership with irreplaceable assets and a long history of returning value to unitholders -- well, it looks like intrepid investors are being paid very well for taking on the risks that exist here.