The market is pretty volatile today, falling into bear territory within weeks and then roaring back in just a few days. And if history is any guide, the turbulence isn't over.

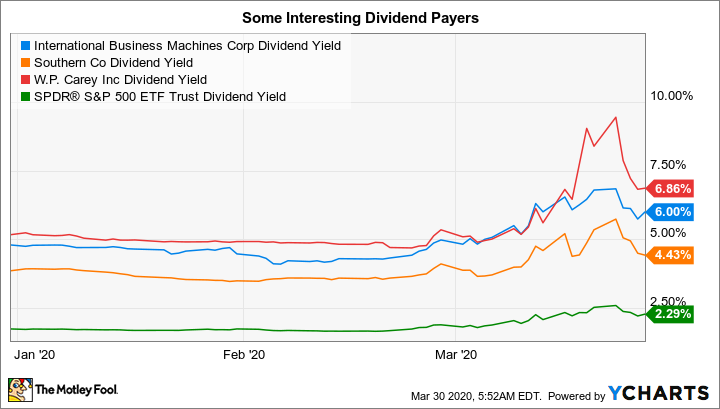

That could be a good thing for long-term investors with a dividend focus. In uncertain times, intrepid investors can find some pretty good deals. Today you might want to look at International Business Machines (IBM 0.89%), Southern Company (SO +0.19%), and W.P. Carey (WPC +0.84%). All three are yielding more than 4% today, and each appears well positioned to prosper over the long term.

1. A tech industry also-ran

IBM has been working to shift its giant business into growth mode for around a decade. It hasn't been easy, requiring legacy businesses (like building computers) to be jettisoned and new ones (like cloud computing, artificial intelligence, and quantum computing) to be created. Revenue has been in a general downtrend, and investors have taken a dim view of the progress being made.

Image source: Getty Images

That said, the company recently bought Red Hat, a longtime partner, which furthers IBM's push to provide services that span across its competitor's cloud businesses. This helps IBM address what it calls the hybrid cloud, where companies (IBM sells primarily to businesses) operate their cloud assets on both internal and external systems. IBM is banking on the fact that many companies either don't want to or can't put all of their information on external systems because the data is either too valuable or too sensitive. Companies being forced to adapt to work-from-home situations because of COVID-19 are likely to make the need for IBM's hybrid approach that much clearer.

IBM's yield is 5.7% right now. The dividend has been increased for 24 consecutive years, and the company has made it clear that it prioritizes dividends. Although leverage is a bit high today because of the Red Hat acquisition, IBM has already begun paying down debt -- long-term debt declined by around 14% in the second half of 2019. And even with the added debt, IBM's financial debt to equity ratio is a reasonable 0.5 times or so. With a product focus that seems to fit the times, long-term investors should probably take a second look at this out-of-favor tech name. Note that IBM's new businesses now make up around half of its revenue, so a key turning point in its makeover could be fast approaching.

2. A slow and steady utility option

The next name that investors might want to consider is a bit more mundane: the Southern Company. One of the nation's largest regulated utilities, it offers investors a hefty 4.5% yield today. That's roughly in line with the company's average over the past couple of decades, suggesting that Southern is trading at a fair price.

The key here, however, isn't the yield. It is the fact that Southern is super boring. As a utility, the vast majority of its top line is tied to monopoly electricity and natural gas businesses. These are the types of things that customers keep paying for even during tough times. A recession, which seems likely because of COVID-19, will hit demand from business customers. But that shouldn't impact the company's long-term earnings power, because it is the only game in town for its customer base.

Further, in exchange for this monopoly, Southern has to get its rates approved by regulators. That means the pricing dynamics in the industry largely lie outside of typical market dynamics. In fact, rate agreements usually last years, and are driven by long-term capital spending meant to ensure reliable service. That type of spending can't stop because of a recession or the grid would suffer.

IBM Dividend Yield data by YCharts

Right now Southern has capital spending plans of around $40 billion over the next five years. It expects that spending to lead to slow and steady earnings growth of roughly 4% to 6% a year. Dividends should track higher along with earnings. COVID-19 might lead to Southern's performance hitting the low side of guidance for a bit, but it won't derail the company. This isn't an exciting investment, but dividend investors looking for some stability will probably like what they see here.

3. A diversified REIT that's light on retail

The last name here is W.P. Carey, a large and diversified net lease real estate investment trust (REIT). It owns a diversified portfolio of single-tenant properties for which the tenants are largely responsible for the properties' operating costs. It is a fairly low-risk model that comes complete with long leases -- Carey's average lease life was nearly 11 years at the end of 2019. That helps net lease REITs survive economic downturns.

When it comes to the net lease sector, most investors think of Realty Income (O +1.07%). That makes sense -- it's a great company. But there's one big difference between these two REITs: retail. Realty Income generates nearly 85% of its rents from retail. With the United States effectively shutting down to help soften the blow from COVID-19, this exposure is going to be a near-term problem, as lessees not bringing in revenue will likely be asking for rent concessions. Realty is still a great company, but Carey, with just 18% of its globally diversified portfolio in retail, looks better positioned.

To be fair, office, industrial, and warehouse make up roughly two thirds of Carey's rent roll. And the businesses that lease these assets are likely to feel at least some hit from a global recession. However, Carey generally tries to own vital assets that aren't easily replaced or vacated. The key benefit here, however, is the diversification inherent in the business. Carey is probably the single most diversified net lease REIT an investor can buy. Now add in a 6.8% yield and long-term investors should be even more interested (for reference, Realty Income's yield is around 4.8%). W.P. Carey isn't without risk, but investors don't appear to be giving its diversified approach to real estate enough credit today.

No easy choices

Buying when markets are volatile can be difficult. The fact that we still don't know what impact COVID-19 will have makes that even more true today. However, IBM, Southern, and W.P. Carey appear to be in relatively good places business-wise, and they offer investors hefty dividend yields. If you step into one of these names (or more), you can watch their generous quarterly dividend payments instead of the market while you ride out this crazy period.