What happened

Shares of Macy's (M +2.26%) were rising on Thursday, as bargain-hunting investors waded back in following Wednesday's broad-based retail sell-off.

As of 1 p.m. EDT, Macy's shares were up about 6.9% from Wednesday's closing price.

So what

Macy's has had a rough ride lately. The corporate parent of the Macy's, Bloomingdale's, and Bluemercury retail chains furloughed most of its workers to save cash while its brick-and-mortar stores remain shut down due to the coronavirus pandemic.

Image source: Macy's.

As if to add insult to injury, Macy's credit rating was cut to junk levels by Fitch Ratings yesterday.

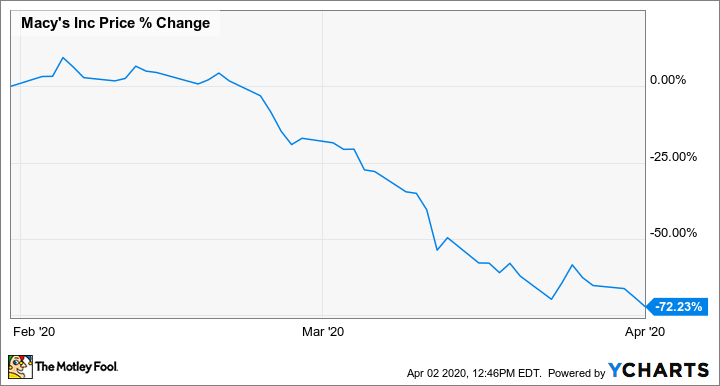

Macy's stock has fallen so far since the beginning of February -- over 70% -- that it will be demoted from the S&P 500 to the S&P 600 Small Cap Index next week.

M data by YCharts. Chart shows the percentage change in Macy's stock from Feb. 1 through the market's close on April 1.

Yes, with a market cap of just about $1.5 billion, American retail stalwart Macy's is now a small-cap stock. It's no wonder bargain-hunters were giving it a spin on Thursday: If it survives the next few months, it's probably a bargain.

Now what

Macy's isn't likely to run out of cash soon. The company ended 2019 with $685 million in cash on hand, and it recently drew down its $1.5 billion line of credit (a move that now looks pretty smart, given yesterday's downgrade). And notwithstanding the downgrade, Fitch's analysts think that Macy's has enough liquidity to get through the pandemic and the likely economic aftermath.

I expect we'll get an update when Macy's holds its annual meeting of shareholders on May 15.