According to The Wall Street Journal, April 6 to April 17, 2020, saw the best two-week performance by the Dow Jones Industrial Average since the 1930s.

If you feel like you've missed out on the market's rise, don't worry, there's value if you know where to look. Here are three value stocks that have the financial strength to take you far over the long term.

Image source: Getty Images.

Waste Management

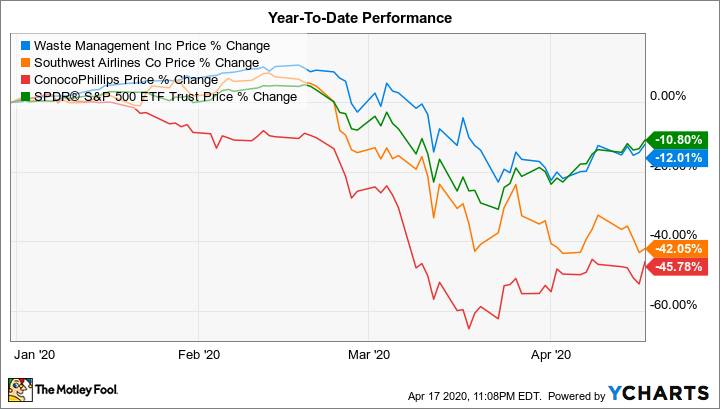

While the S&P 500 is up 29% since March 23, Waste Management (WM 0.40%) has only clawed back 14%. At around $100 a share, it's still over 20% off its 52-week high.

Waste Management is one of those companies that impacts everyday life, but you may have never considered as an investment.

The company has the largest waste collection, transportation, and disposal business in the United States. Environmentalists may like the company for its transition from diesel to liquefied natural gas (LNG) and compressed natural gas (CNG) for its trucking fleet, its conversion of waste into energy, and its status as the largest recyclables collector in the U.S. Value investors may like the company for its strong market position due to its lack of competitors.

Aside from the public sector in the form of county and city waste programs and a few other companies, the waste management business isn't exactly easy to get into. Federal and state permits vary based on the type of waste and in what capacity it's being managed. Factor in all of the start-up costs like trucking fleets, storage, health and safety, and more, and it's soon apparent the barriers to entry are high.Since Waste Management is the market leader, you can be confident knowing that competition is not a primary concern with this company.

Although not necessarily a value stock from a P/E ratio or price-to-free cash flow (FCF) perspective, Waste Management's value is that it is about as recession-proof as you can get for an industrial company. Trash has been a growing business. A growing population means more waste and an environmentally conscious population means a greater emphasis on recycling, sustainability, biofuels, and landfill efficiency, making Waste Management an industrial you can buy and hold forever.

Southwest Airlines

Southwest Airlines (LUV 2.02%) has had a rough two months as airlines are losing money every day amid the COVID-19 (coronavirus) pandemic. Southwest's differentiating factor is its reputation for solid fundamentals and financial discipline. Despite droves of airline bankruptcies in the early and mid-2000s, including United Airlines and Delta Air Lines, followed by American Airlines in 2011, Southwest has remained profitable for 46 consecutive years.

Even with its struggles in 2019, Southwest entered 2020 as the best major U.S. airline in terms of its balance sheet. At the start of 2020, Southwest had the lowest debt-to-capital, second-lowest debt-to-equity, and the lowest total net long-term debt out of the six major U.S. airlines. Its industry-low debt-to-capital ratio means the company's capital structure is based mostly on equity, not debt, which means less leverage and better solvency.

As a result of the government bailout announced on April 14, Southwest will receive disbursements of more than $3.2 billion -- $2.3 billion in grants to support payroll, and nearly $1 billion in unsecured low-interest rate loans, all backed by warrants that would dilute Southwest shares if exercised. This government assistance, paired with Southwest's experience getting through tough times, makes Southwest the best-positioned U.S. airline. That being said, bear in mind that there are a few key headwinds facing the airline industry right now, so Southwest's recovery is likely to take years.

The Walt Disney Company

Around the world, Disney (DIS +1.09%) is one of the most well-known and well-loved brands. Its stock is typically an "insta-buy" whenever it goes on sale, but this time, there's a little more to it.

Although the stock's trailing twelve month P/E ratio of 16 looks great on paper, those earnings came when the global economy was humming along. Disney was coming off a great fiscal year (FY) 2019 where it was able to grow revenue 17%, and that was before the launch of Disney+. The immediate success of Disney+ paired with a stock market that was near its all-time high allowed Disney to reach its own all-time high in November. The losses the company was experiencing in its direct-to-consumer and international segment from investing in digital content for Disney+, ESPN+, and Hulu were expected to go down once it was confirmed that Q1FY2020 Disney+ subscribers were 26.5 million.

According to the New York Times, "analysts expected Disney Plus to take until 2022 to reach 50 million subscribers," a milestone it passed in early April.That's no surprise considering the number of bored kids and adults stuck at and working from home. The added subscribers will help Disney recover its investment and transition to profitability for its streaming services, but they are still only a fraction of the company's revenue.

The fact of the matter is Disney is an entertainment company that depends on packed parks, movie theatres, sports events, and more. The timing isn't exactly great either, considering Disney just acquired a sizable amount of debt for the purchase of 21st Century Fox. Shutdown parks and vacant movie theatres mean a critical blow to what was almost all of Disney's FY2019 profit.

| Segment | FY 2019 Revenue | FY 2019 Income |

|---|---|---|

| Media Networks | $24,827 million | $7,479 million |

| Parks, Experiences, and Products | $26,225 million | $6,758 million |

| Studio Entertainment | $11,127 million | $2,686 million |

| Direct-to-Consumer & International | $9,349 million | $(1,814 million) |

| Eliminations | $(803 million) | $(241 million) |

| Total | $69,570 million | $14,868 million |

Data Source: The Walt Disney Company, Fourth Quarter and Full-Year Earnings For Fiscal 2019

2020 is going to be ugly for Disney, the silver lining being a surge in Disney+ subscribers who the company hopes will keep the service even after things gradually return to normal. Considering the depth and breadth of its diverse entertainment offerings, it's hard to imagine the stock won't come back from this difficult time. Currently trading at about two thirds the value of its all-time high, now could be a good time for long-term investors to pick up a few shares of Disney.

A medley of value

Waste Management, Southwest Airlines, and Disney are three completely different companies in different industries. All three provide value in different ways for investors who want to be involved in the market but don't want to chase high-flying stocks.