Memory-chip maker Micron Technology (MU +7.76%) is widely known as a cyclical stock. The company's revenue tends to ebb and flow in predictable multiyear patterns, dragging cash flows and stock prices along for the ride. Here, in the middle of the COVID-19 health crisis, Micron's top-line sales are poised to bounce off another market bottom and swing back up again. We've seen this thing before, but everything is actually different this time.

COVID-19 concerns

Let's talk about the novel coronavirus first. The disease knocked Micron's operations for a loop in March when an important chip-packaging facility was shut down under a martial law order for a couple of weeks. The assembly line is back in action since Malaysia added semiconductor factories to the list of essential services, but it is running at a fraction of its normal volume capacity and Micron has shifted most of this site's operations to other packaging plants around the world. That's a direct benefit from running a worldwide manufacturing network and Micron would not have had this option available a couple of market cycles ago.

The coronavirus pandemic has also changed the end-market demand for some of Micron's products. Lower consumer demand for smartphone memory chips and other memory-toting consumer electronics is balanced by higher memory-chip demands in corporate data centers. All those cloud-based services that come into play when people work and play online, often from home, depend on beefy data center facilities.

So the COVID-19 era is shaping up as a strangely normal demand curve at the bottom of an industrywide market cycle. The product mix just looks a bit unusual, skewed toward the enterprise-grade class of clients.

"We are modeling an improvement in the trajectory of economic activity later into the second half of calendar 2020, with a further rebound in economic momentum into 2021," said CEO Sanjay Mehrotra in Micron's late-March earnings call. "This is a very fluid situation, and we will learn more about the virus, its spread and its economic impact over the next few weeks and months."

Image source: Getty Images.

More on those predictable market cycles

Once upon a time, the memory-chip market was swamped with a plethora of hopeful contenders, all churning out huge volumes of industry-standard commodity products. Market leader Samsung (OTC: SSNLF) was able to control the product flow by maximizing its production volume when the consumer-goods side of the company needed lots of cheap memory chips and pulling back the manufacturing reins when electronics sales weren't so hot.

But the market cycles changed the game over time. Each downturn pushed a few more also-rans out of business, leaving their assets to be snapped up by their surviving peers in bankruptcy deals -- often for pennies on the dollar. Micron always came out ahead, armed with fiscal discipline and a solid balance sheet, and the company bought out many former rivals over the years. Without these deals, Micron wouldn't have the handy global network of alternate manufacturing sites that are making up for the Malaysian troubles today.

And over the years, the hungry horde of smaller rivals boiled down to a mere handful of much larger and more disciplined memory-chip makers. Samsung doesn't hold the pricing power it used to and Micron can control its own destiny to a large degree by playing its own games with the manufacturing volume.

The big difference

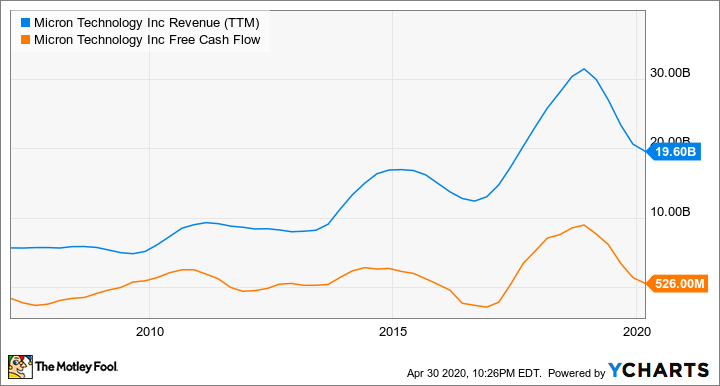

Now, even Micron would see its revenue plunge dramatically in the cyclical downturns, always dragging the company's free cash flows into negative territory. Let me show you what I'm talking about. I hope you like sine waves:

MU Revenue (TTM) data by YCharts.

The current cycle looks ready to bounce upward again, as usual. This time, Micron's revenue at the bottom of the downturn dwarfed the peak sales in the previous upswing, around 2015. The company's trailing free cash flows stand at a beefy $526 million now and are unlikely to dip into red-ink territory this time. The next market peak, most likely somewhere between 12 and 18 months away, is bound to eclipse the late-2018 summit. Micron's share prices tend to double or more in the good years.

Micron is stiff-arming the coronavirus crisis, headed straight for the next ordinary memory-market upswing. This stock is a solid buy right now.