Growth stocks can be risky, but one or two big winners in this category can outweigh the losses from several unsuccessful investments. Finding the right high-growth investments is often made more difficult by the fact that companies under this banner tend to optimize their business models for maximum revenue growth -- even if that leads to zero or negative bottom-line profits. Skimpy profits, in turn, make it more difficult to pin a reasonable market value on the stock, which triggers high volatility. Finding those future winners helps you look away from the hyper-volatile tickers and punctured business models in your portfolio along the way.

What follows is a high-level overview of three incredibly promising growth stocks. All of them were doing just fine before the COVID-19 crisis turned every market upside down.

Image source: Getty Images.

The doctor can see you online now

Telehealth service expert Teladoc (TDOC 0.63%) is on a roll. Sales have posted annual growth of 66% over the past five years, including a 41% year-over-year jump in the first quarter of 2020. Service subscription fees rose by 29% while the number of remote doctor visits performed over Teladoc's platform nearly doubled.

In a classic growth-stock fashion, Teladoc isn't profitable today and doesn't expect to report positive bottom-line numbers in 2020. Management would much rather sink additional cash flows and operating profits into accelerating the company's market reach and top-line growth at this juncture. Profits will come, but not anytime soon. The coronavirus lockdown and social distancing policies are raising public awareness of telehealth options in general and Teladoc in particular, and the company is using this unexpected windfall to boost its long-term growth trajectory.

"If I look out five years, I would say virtual care will be ubiquitous. It'll be just another methodology for how people access care," CEO Jason Gorevic said in Teladoc's first-quarter earnings call. "It's a unique moment where awareness has significantly increased. And we have the opportunity to invest, to drive more engagement, drive more new users to the platform and we know that we get long-term benefits from them, because they come back and become repeat users."

That sounds like a fantastic long-term growth opportunity to me.

Let's soak up the sun

SolarEdge (SEDG 0.55%) makes power inverters, optimizers, and monitoring systems for solar panel arrays. The company's products have been shown to transfer power from solar cells to the power grid or a local battery with market-leading efficiency.

Revenue has grown nearly fivefold over the past five years, resulting in a compound annual growth rate of 34%. The company is already consistently profitable, though earnings will take a hit during the COVID-19 pandemic. Solar system installations have slowed to a crawl in many parts of the world, including SolarEdge's largest target market in North America:

SEDG Revenue (TTM) data by YCharts

That hasn't stopped the company from introducing a slew of new products in the spring, including a commercial-grade power inverter for very large solar systems and a residential inverter with support for battery packs from third-party manufacturers.

This company is sowing the seeds to torrential growth once the global economy gets back on track.

A Chinese giant

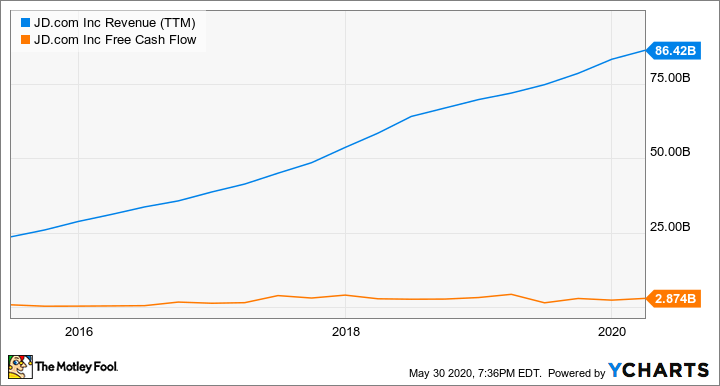

JD.com (JD 0.23%) might be the largest company you've never heard of. As a leading e-commerce specialist in China, JD more than tripled its annual sales in the past five years at an average year-over-year growth rate of 30%. Cash flows followed suit, rising from $708 million to $2.9 billion over the same period:

JD Revenue (TTM) data by YCharts

The ideas behind JD's fantastic growth might surprise you. We are talking about the largest pharmacy and grocery retailer in China. The company's online store is regarded as a source of higher-quality goods than arch-rival Alibaba 's (BABA 1.07%) Taobao and Tmall portals. The incredibly stable demand for groceries and the rising need for online pharmacy options during the coronavirus crisis have helped JD maintain its market momentum in 2020. JD investors have pocketed a 54% return year to date while Alibaba's stock fell 2%.

Don't call it a comeback, because JD's growth never went away. You should buy JD even at the current all-time high share prices because this online retail giant has a lot of growing left to do.