Since the COVID-19 pandemic reared its ugly head, investors have experienced unprecedented volatility in the stock market. In the five weeks between mid-February and late March, the S&P 500 plunged 34%, marking the fastest decline into bear market territory in history.

Experienced investors will recognize that market corrections such as these have historically been an excellent time to pick up top-quality stocks at a discount, a move that will yield benefits for years to come. Even as the markets have regained much of the losses they suffered during the initial market plunge, investors can still benefit by investing in some top-tier companies at discounted prices.

These opportunities aren't just for the affluent either: If you have just $1,000 in spare cash that you don't need for immediate expenses or to augment your emergency fund, putting it to work in these three top stocks will look like a brilliant move years from now.

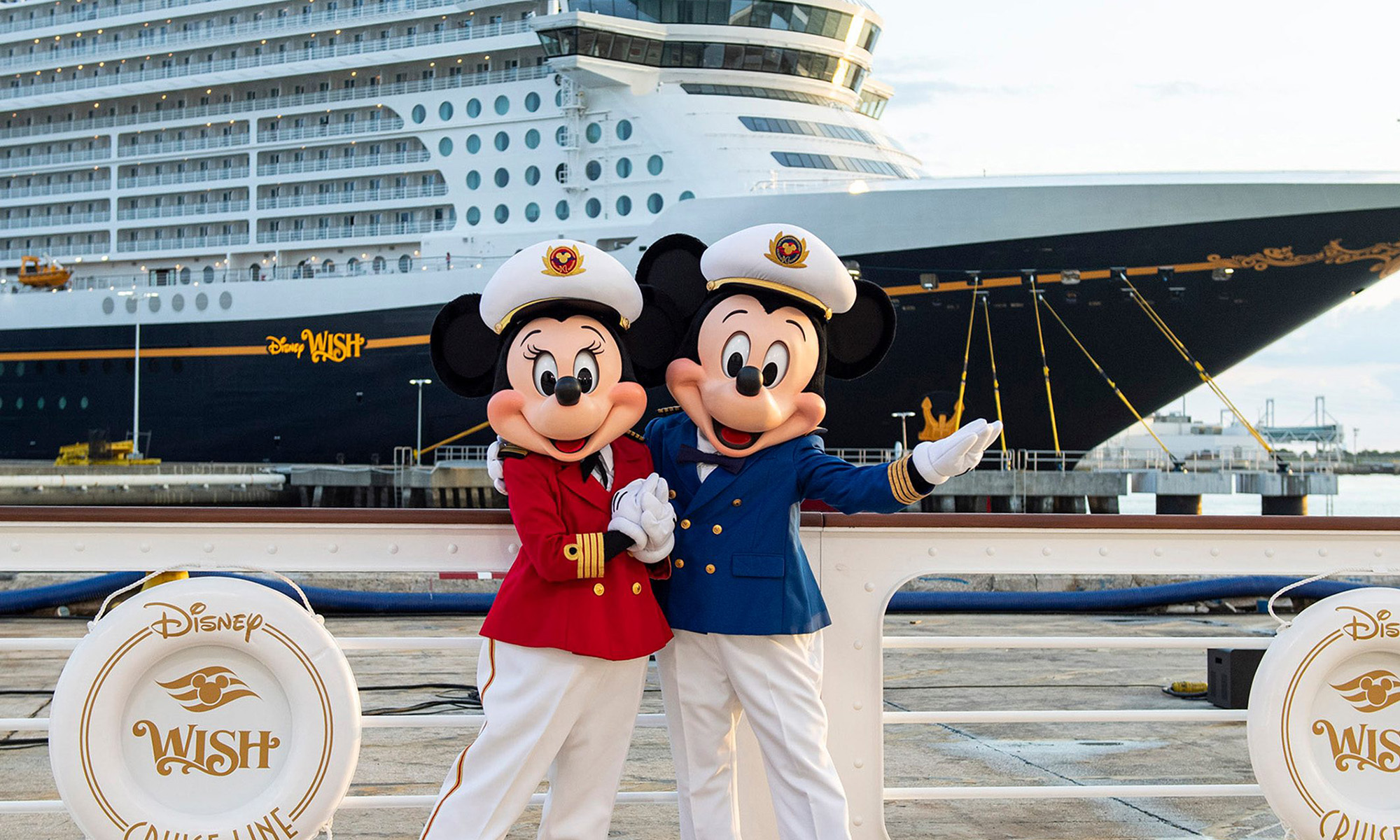

Image source: Author.

1. Walt Disney

There's no denying that Disney (DIS 7.40%) has been among the companies hardest hit by the pandemic. Theme parks and resorts were forced to close to help slow the spread of COVID-19. Movie production ground to a halt, cruise ships were docked, and retail stores were shuttered, affecting almost every money-making segment across Disney's vast entertainment enterprise. Even worse for investors, some of these issues could persist for months before returning to normal.

Yet all is not lost for the House of Mouse. Its streaming service, Disney+, debuted in November to rave reviews and quickly attracted a huge following. By early May, the platform had amassed more than 54 million subscribers. This puts Disney+ on track to achieve its 2024 goal of 60 million to 90 million subscribers sometime later this year and potentially reach profitability years ahead of schedule. Hulu has also experienced an uptick in paying customers as well, to 32 million, up 27% compared to the prior-year quarter.

Additionally, media networks, Disney's most profitable segment, held up remarkably well during the pandemic, with revenue up 28% year over year, the result of higher affiliate revenue from its cable operations and broadcast networks. As a result, total revenue grew 21%, while operating income slumped 37% during the first quarter.

Disney stock is selling for a discount of 18% compared to its pre-pandemic levels. At the same time, analysts see the company's revenue edging down this year, before resuming its growth in 2021. Don't get me wrong. I still believe there are several more quarters of pain in store for Disney, but parks and resorts are set to reopen, and retail stores and movie production won't be far behind. It won't be long before Disney is once again the happiest stock on Earth.

Image source: Starbucks.

2. Starbucks

Starbucks (SBUX 0.23%) was the canary in the coal mine, among the first stocks to be hit by the coronavirus pandemic. The company was forced to close the majority of its stores in China, then across the world.

Yet Starbucks faced the challenges head-on, suspending share repurchases, cutting discretionary spending, and deferring certain capital expenditures. Beyond that, the locations that remained open became hubs for takeout and delivery orders, which helped minimize the damage to the coffee purveyor's business.

While the company's second-quarter results were nothing to write home about, they were far better than many investors feared. Comparable store sales slumped 10%, causing net revenue to fall 5% year over year, while EPS declined 47%. But the coffee cup was also half full, as the company continued to generate a profit, even in the face of a significant global disruption. The third quarter won't be pretty either. Having faced the brunt of the COVID-19 closures, it will likely be worse than Q2.

Yet look out several years, and the investing thesis for Starbucks remains firmly intact. People simply aren't going to give up their caffeine addiction and their daily cup of Joe. States are beginning to ease their stay-at-home restrictions and once consumers begin to venture out, they'll be eager to get back to their daily routine, which will no doubt include a stop at their friendly neighborhood Starbucks.

Analysts expect the company's revenue to decline by 10% this year, but return to growth in 2021. The stock is also selling at a discount of 15% to its pre-COVID levels, giving forward-looking investors the chance to scoop up Starbucks shares on the cheap.

Image source: Getty Images.

3. Booking Holdings

Another company profoundly affected by the pandemic is online travel specialist Booking Holdings (BKNG +2.38%). Over the past couple of months, the company has faced one of the toughest travel periods in its history. Leisure travel was among the industries hit hardest by the pandemic, particularly given Booking's focus on international travel destinations. The news gets worse, as the travel industry may be among the last to recover as consumers slowly emerge from government-imposed lockdowns.

Booking took immediate steps to conserve cash and increase liquidity, halting stock buybacks, slashing marketing spending, cutting non-essential costs, and implementing a hiring freeze. Additionally, many of the top execs voted to forego their salaries until things stabilized.

Booking's latest financial results tell the tale. During the first quarter, gross travel bookings -- which includes taxes and fees and is net of cancellations -- declined by 51% year over year. This resulted in revenue that slumped 19%, and pushed the company's bottom line into the loss column. The company was profitable on a non-GAAP (adjusted) basis, but the results were even more dismal, with EPS declining 66%.

But as consumers begin the long road to economic recovery, and their discretionary income returns, there will be plenty of pent up demand for travel. During the first-quarter earnings conference, CEO Glenn Fogel said: "While the virus' impact on travel is unprecedented, I am confident that this crisis will eventually end and people will travel again. Travel is fundamental to who we are." He went on to say Booking was positioning itself "to capture travel demand when it returns so we can emerge from this crisis on strong footing and extend our leadership position."

While the next couple of quarters could be difficult, Booking Holdings has faced existential crises before, including the Great Recession. Yet the company has bounced back stronger than ever, to become one of the most successful stocks of the past decade.

Analysts are pointing to a 50% decline in revenue this year, but for sales to come roaring back, up 68% in 2021 on easier comps. The stock is still off more than 12% from its pre-coronavirus levels, giving investors the opportunity to get a great business at a discounted price.