Choosing between consumer discretionary stocks such as McDonald's (MCD +0.38%) and Papa John's International (PZZA 0.28%) involves more than discerning between consumer tastes. On the surface, one is a restaurant that has long operated in nearly every corner of the world. The other serves takeout in North America and internationally on a more limited basis.

But a deeper look at both companies reveals more than meets the eye. Choosing between these two stocks involves not only an understanding of financials but, more importantly, a grasp of two businesses that profoundly differ on fundamental levels.

The two businesses

McDonald's and Papa John's are not as related as some might think. Yes, both are restaurants with an extensive takeout business.

Image source: Getty Images.

However, when looking at the financials of McDonald's more deeply, one might wonder if analysts should classify it as a real estate investment trust. Under its franchise agreements, McDonald's controls the real estate, leasing it to the franchisee who operates a restaurant under the McDonald's system.

Some of these restaurants operate on the most valuable real estate in the country or, in some cases, in the world. In 2019, $11.66 billion of the company's $21.08 billion came from franchise agreements. Still, in one key respect, the stock has become victimized by its own success. With a presence in more than 100 countries, it leaves some investors wondering where it can find new areas to expand.

This is less of a concern for Papa John's, which currently operates in 45 countries. In 2019, Papa John's derived only $71.83 million of its $1.62 billion in revenue from franchise and royalty fees. Both non-franchise restaurant sales and the sale of food products directly to the franchises make up the overwhelming majority of the company's revenue.

Fortunately, revenue levels did not suffer as much as at most restaurants due to COVID-19. This is due to a focus on takeout. In the first quarter, the comparable-store sales of McDonald's fell by only 3.4% on a year-over-year basis. Still, comps in March decreased by 22.2% as it felt the direct effects of the pandemic.

In contrast, Papa John's saw its global restaurant sales rise by 5.3% from the same quarter last year in North America. Its international comps increased by 2.3% over the same period. During the pandemic, it has seen record sales, with May comps up 33.5% in North America.

Since Papa John's has always operated exclusively as a takeout business, its operations felt less of an impact from the pandemic. This stands in contrast to McDonald's, which, like most restaurant chains, lost most of its sit-down business when COVID-19 struck the U.S.

How the financials compare

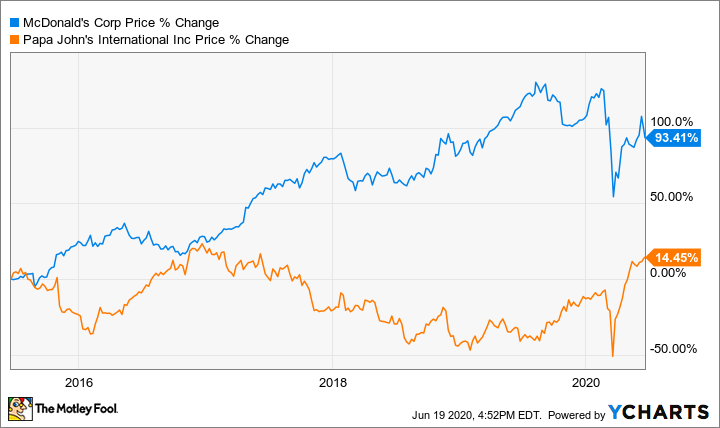

The financials offer a mixed picture for both companies. On the surface, McDonald's may seem like a better choice for investors. For now, it maintains a forward P/E ratio of just under 31.9. This compares favorably with Papa John's, which has risen to around 62.1 times earnings. McDonald's has also seen more stock price growth over the last five years, though Papa John's outperformed the fast-food giant over the last 12 months.

Also, long-term investors in McDonald's have seen a substantial cash return over time. It has not only paid a dividend since 1976, but it has also hiked the payout every year since then. The current annual dividend of $5 per share yields approximately 2.7%.

Since founder John Schnatter did not open the first Papa John's until 1984, it cannot match the dividend track record of McDonald's. Papa John's pays its stockholders $0.90 per share annually. This amounts to a yield of just under 1.1%. The company began paying dividends in 2013. Though Papa John's has never cut the payout, it has kept it at the same level since 2018.

Still, despite this disparity, Papa John's stock may hold more appeal from a growth standpoint. Over the next five years, analysts forecast earnings growth will average 3.6% per year for McDonald's. In comparison, they expect Papa's Johns to grow profits by 8% per year over the same period.

McDonald's or Papa John's?

Both stocks command relatively high P/E ratios. Since earnings growth rates for both companies average in the single digits, both McDonald's and Papa John's appear pricey. Still, despite the higher growth rate of Papa John's, I have to give the edge to McDonald's.

Investors will receive a higher dividend yield and pay a lower multiple with McDonald's stock. And it also offers more diversification. Not only can stockholders profit from the restaurant business, but they can also count on steady and increasing cash flows from the company's extensive real estate portfolio.

Over time, Papa John's holds more potential for further expansion. Nonetheless, in the end, investors receive more cash and face less risk from holding stock in McDonald's.