Impossible Foods and Beyond Meat (BYND +0.97%) are two of the biggest plant-based meat-substitute companies in the world. Impossible Foods isn't publicly traded yet, but it's still a prominent competitor for Beyond Meat and one investors should understand.

Even though both sell meat alternatives, they are very different companies. Here are three key ways they differ.

In addition to giving flavor, heme gives meat substitutes their color. Image source: Impossible Foods.

GMO vs non-GMO

Which company has the better-tasting product? The answer is subjective. However, if you lean toward the Impossible Burger, there's a scientific reason for that. It contains a molecule called heme, which is found naturally in foods and essentially tells our brains we're eating meat.

There's one problem: To get enough of it, Impossible Foods genetically engineers heme by inserting soybean DNA into modified yeast. That sounds really futuristic, and Dr. Michael Eisen, a scientific adviser for Impossible Foods, makes a strong case for eating GMO foods without fear. Nevertheless, GMO foods are viewed negatively by a segment of the population.

In a guest appearance on the Eat for the Planet podcast, Beyond Meat CEO Ethan Brown said, "We made a very conscious decision to not use the process of genetically modifying plants to produce heme." It's part of the company's mission to build consumer trust by eliminating ingredients with negative perceptions.

Beyond Meat's products don't contain any genetically modified ingredients. By contrast, Impossible Foods actively pursues these to make their faux meat more "meaty." Therefore, Beyond Meat might appeal more to the health-conscious consumer. But its aversion to GMOs could also leave its products behind Impossible Foods in taste tests.

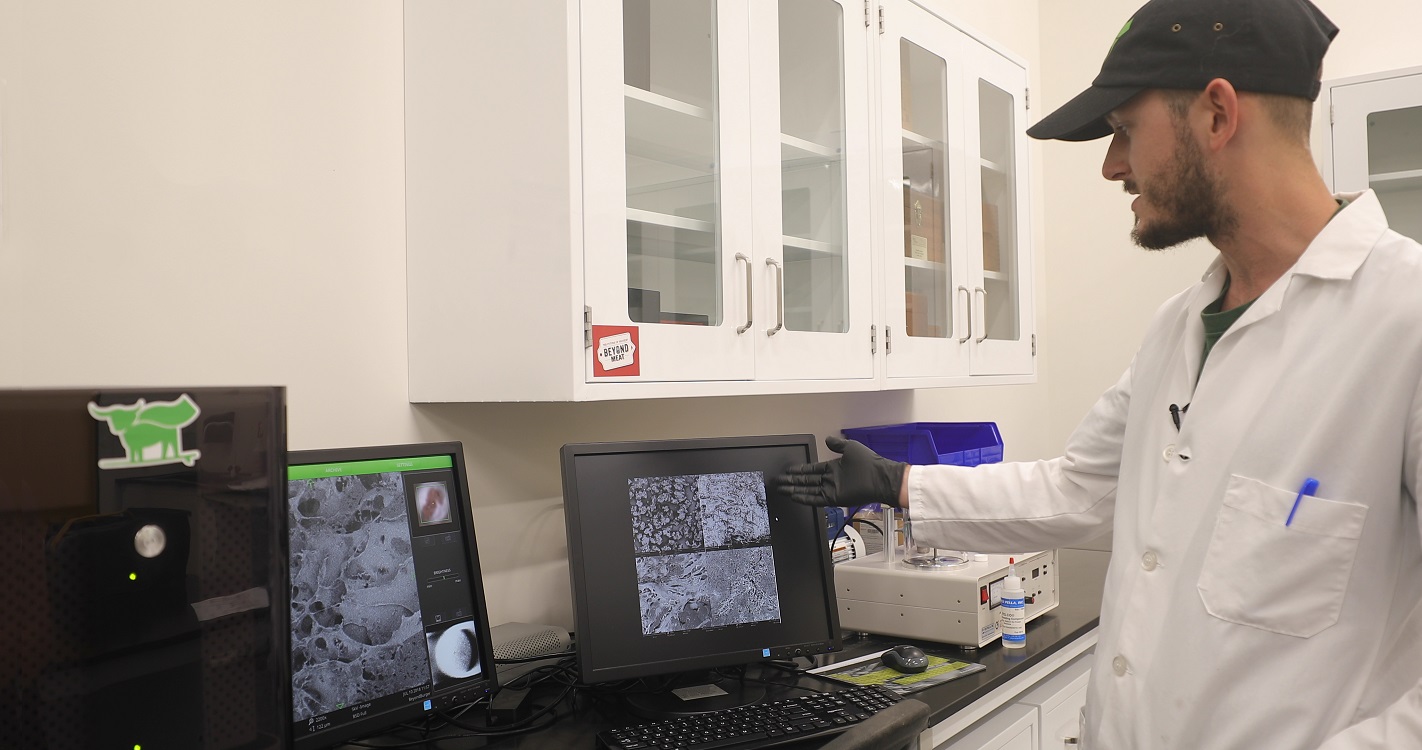

Both Beyond Meat and Impossible Food invest in research and development. Image source: Beyond Meat.

The product pipeline

Beyond Meat and Impossible Foods each have over 100 people, including scientists, working in their respective research and development departments. These teams dig into the biochemistry of meat and look for ways to make their products mimic the real thing.

In an interview with the food news website The Spoon, Impossible Foods CEO Pat Brown said "The next categorically new product that we'll launch is almost certainly going to be like a beefsteak." His reasoning for pursuing steak is simple: His company is small, with limited resources and scale. Therefore, it prefers to solve the problem with the highest upside, even though it's a tough nut to crack.

Beyond Meat's CEO would love to launch a steak, too, since it has that "wow" factor. But his highest priority is getting the price of meat alternatives below the price of meat, and that's achieved with scale. The most logical products for scaling production are the meats consumers eat most. But Beyond Meat continue to focus on innovating across its three main platforms: beef, pork, and poultry.

Chicken is likely to be a big area of focus going forward. Two scientists from the University of Missouri developed a process to produce plant-based chicken with realistic texture, and Beyond Meat helped commercialize it. But the product was pulled last year as the Beyond Burger took off, with the team going back to the drawing board to improve the recipe.

As a private company, Impossible Foods can afford to take on the risk of producing a substitute for steak, whose texture is challenging to replicate. But a public company like Beyond Meat must focus on the most attainable innovation right now. It already has a decade of experience with a chicken substitute, and it ran new trials with Yum! Brands' KFC in the past year. This makes the most sense for Beyond Meat, and I wouldn't be surprised to see it relaunch Beyond Chicken in some form soon.

Beyond Meat is focused on producing products at scale. Image source: Beyond Meat.

Scale

In January, Impossible Foods told Reuters it couldn't pursue a partnership with McDonald's because it wasn't capable of meeting the potential demand. We don't know how much the company can produce, nor how much McDonald's would want. And we don't really know what Beyond Meat is capable of, either. But we do know Beyond Meat is still pursuing the world's largest restaurant chain, suggesting it does have the scale needed.

Beyond Meat stock recently fell after its trial with McDonald's in Canada expired. Some believe it signals the end, but there may be a simpler explanation: A global pandemic isn't a good time to launch new menu items. In fact, McDonald's cut regular menu items during the coronavirus to reduce operational complexity.

It's possible McDonald's will launch a plant-based burger when its business normalizes. When that happens, I believe Beyond Meat is still the top partner candidate due to the large infrastructure it already has in place, making it a good growth stock to consider.