Investing money in the stock market every month is an excellent way to grow wealthy over time. The key, of course, is knowing which stocks to buy -- and when.

To help you in this regard, here's my best stock to buy right now. This elite business offers investors an incredible wealth-building combination of powerful competitive advantages, enormous growth opportunities, and visionary leadership.

Here's where to invest your money today. Image source: Getty Images.

Few businesses are as competitively dominant as Amazon.com (AMZN 2.26%). The e-commerce colossus commands the lion's share of the online retail market in the U.S. and many other parts of the world. Along with its army of third-party merchants, Amazon provides a wider selection of goods, lower prices, and faster shipping than just about any other retailer. Moreover, its massive global distribution system, best-in-class fulfillment technology, and strong brand recognition form a wide competitive moat around its business that helps to insulate its profits from its rivals.

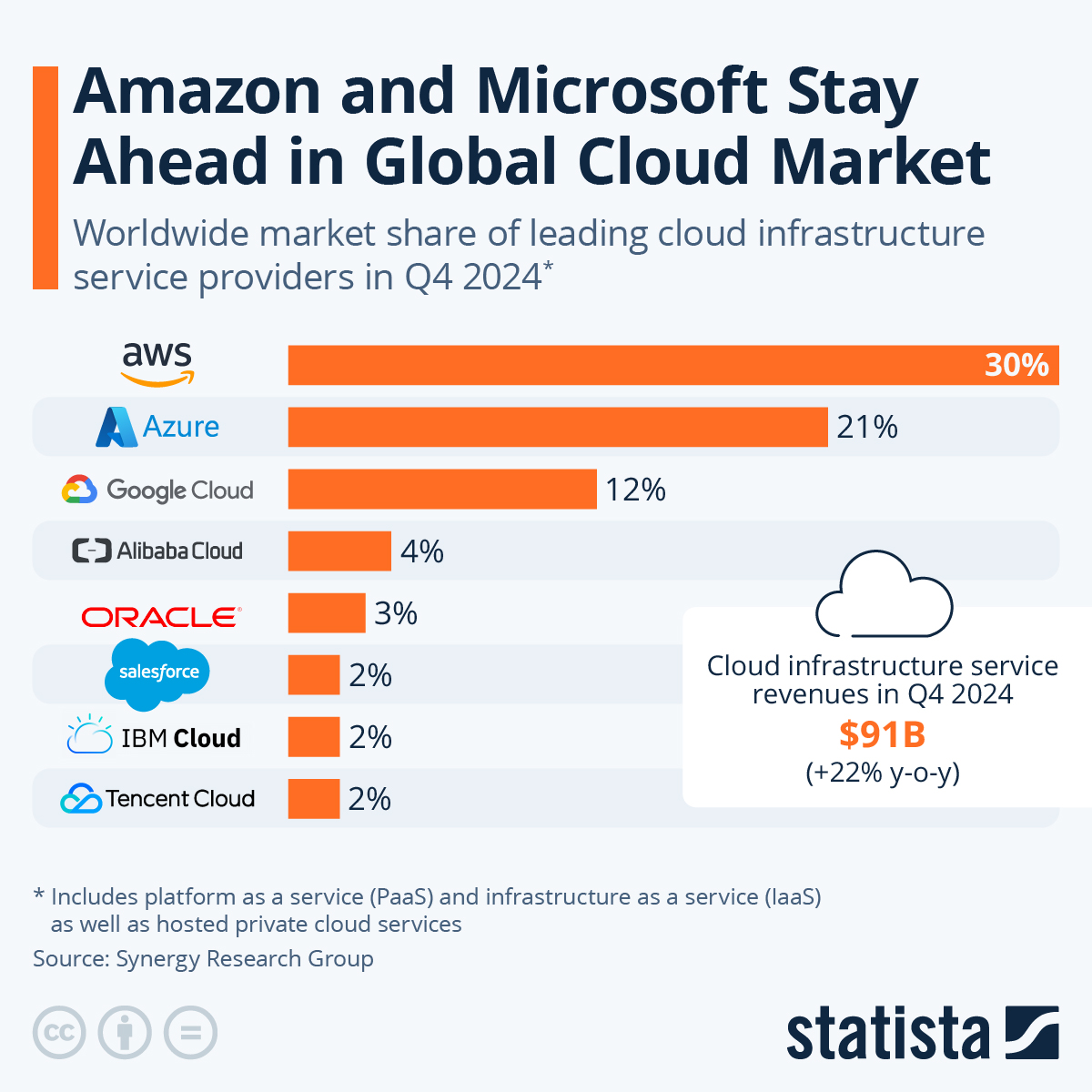

Amazon is also the global leader in the massive and fast-growing cloud computing market. Despite fierce competition from the likes of Microsoft, Alphabet's Google, and Alibaba, Amazon Web Services commands a 33% share of the $100 billion cloud infrastructure market, according to Statista. That's more than its three closest competitors combined.

Image source: Statista.

Intriguing growth opportunities

Yet as dominant as Amazon is today, it still has tremendous room for expansion. As an example, e-commerce sales, despite years of torrid growth, still represent only about 12% of total retail sales in the U.S.

Image source: Statista.

Moreover, the global online retail market will grow to more than $6.5 trillion by 2023, up from $3.5 trillion in 2019.

Image source: Statista.

Meanwhile, the worldwide public cloud services market is set to exceed $350 billion by 2022, up from less than $200 billion in 2018, according to Gartner, with infrastructure services enjoying some of the fastest growth within the industry.

Image source: Gartner.

Combined with enormous opportunities in advertising, healthcare, and logistics, these growth drivers should continue to fuel Amazon's expansion in the years ahead.

Visionary leadership

Helming this juggernaut is Jeff Bezos, who's arguably the greatest business leader of our generation. Bezos excels at identifying long-term trends and growth opportunities. He's also relentless in his pursuit of them. He's constantly driving Amazon to enter new markets, develop innovative technologies, and -- most importantly -- find ways to create even more value for its customers. In the process, he helps Amazon's stock ascend to ever greater heights.

If you buy shares of Amazon today, you can rest easy with the knowledge that you're investing beside Bezos himself; he owns shares worth roughly $160 billion. His massive stock holdings help to align his interests with yours and those of other long-term shareholders.

For all of these reasons, Amazon's stock is still -- even after its incredible gains -- an outstanding investment today, and it will likely remain a great stock to own for many years to come.