Low-cost stocks often attract the attention of investors who hope to buy the next AMD or Monster Beverage Company. Unfortunately, most stocks below $5 per share, or "penny stocks," tend to have earned that price, often because of challenges such as unbearable debt levels or outdated business models.

However, some penny stocks have positioned themselves for potentially significant gains. Investors looking for such stocks should consider names including Aphria (APHA), Hecla Mining (HL 0.58%), and Nokia (NOK -0.29%).

Aphria

Canadian marijuana stocks such as Aphria had their day in the sun as Canada was preparing to legalize cannabis. However, when legalization actually took place in October 2018, it became a "sell the news" event for weed stocks. The industry suffered as the country faced a massive supply glut. Moreover, many Canadians continued to buy cannabis illegally as high taxes and supply issues drove them back to the black market. This curtailed revenue growth across the industry. Aphria, which once traded at close to $18 per share, has fallen as low as $1.95 per share in recent months.

Initially, Aphria did not attract as much attention as names like Canopy Growth or Tilray. However, unlike many of those more prominent names, it did turn a profit in the most recent quarter. Lately, Aphria stock has seen a resurgence that has taken it to the $4.95-per-share range.

Also, just because marijuana stocks have fallen out of favor does not mean their growth has stopped. In the latest quarter, Aphria's revenue nearly doubled from the same quarter last year. Analysts also expect 128% revenue growth for the current fiscal year and a 57% increase in net income. Once more investors take notice of the positive earnings amid massive growth, they will likely bid Aphria stock well above the $5-per-share level.

Image source: Getty Images.

Hecla

At first glance, Hecla Mining might seem like a strange choice. As late as 2008, it traded below $1 per share. However, over the past 12 months, it has risen by more than 120%. Today, it trades at about $4.40 per share.

It likely has the Federal Reserve to thank. Since the beginning of the year, the Fed has added almost $3 trillion to its balance sheet. Similar moves by other central banks have also bolstered Hecla's position.

Such moves can weaken confidence in currencies and stoke demand for gold. Thus, Hecla finds itself in an ideal place to prosper. Most analysts expect Hecla to lose money in 2020. Though gold prices have bolstered revenue, prices of other commodities such as silver and zinc have lagged.

However, for 2021, Hecla forecasts a 23% revenue increase and a return to profitability as gold prices rise. Prospects also continue to improve for the company on increasing silver prices. Should current trends continue, the bull run for Hecla stock could easily take it well above $5 per share.

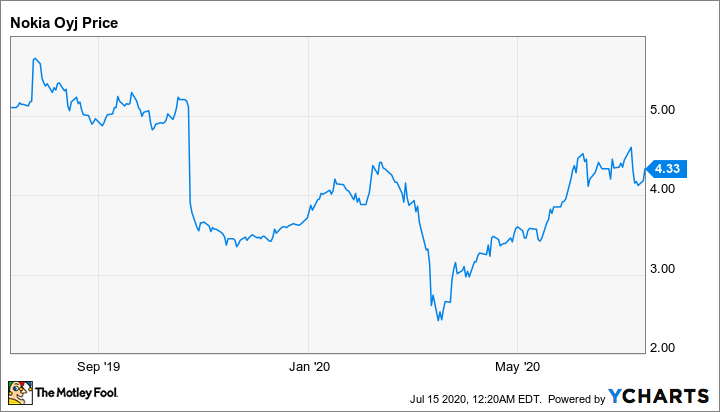

Nokia

In recent years, telecom equipment maker Nokia has been both a victim and a beneficiary of geopolitics. Losing a contract with China Mobile brought pain to Nokia stock, and a subsequent decision to suspend the dividend led to further selling.

However, Huawei has become a victim of the U.S.-China trade war. The Commerce Department has banned the company from using U.S. technology in its products, and companies working with Huawei must apply for a license with the Commerce Department. These restrictions effectively sideline Huawei as a competitor, which could mean more 5G contracts for Finland-based Nokia in both North America and Europe.

Moreover, Nokia has also implemented a Digital Operations Center that is native to the cloud. This will allow the company to earn revenue by lending out slices of bandwidth to clients like sports stadiums or large events that need it temporarily.

At present, Nokia trades at about $4.30 per share, which means the stock has risen since the dividend suspension. Moreover, after the company lost money this year, analysts expect profits to increase by more than 30% in fiscal 2021.

Investors should not expect a return to the near-$40 per share Nokia saw in 2006. However, if it can win more 5G-related business, it could move well above current levels.