As COVID-19 cases continue to rise in a number of states, the S&P 500, much to the relief of investors, has held steady. In fact, it's actually risen about 3.5% through the first full month of summer. Nonetheless, the memory of the market's record-breaking downturn in March is enough to unsettle even the most confident investors, and many people believe that a second crash is likely.

Whether you're preparing for the market to plunge again or you're merely interested in balancing the higher-risk stocks in your portfolio with more-conservative holdings, you're in luck. There are plenty of compelling, low-risk opportunities available right now -- stocks like American Water Works (AWK +1.06%), Waste Management (WM +1.39%), and Wheaton Precious Metals (WPM +3.96%).

Image source: Getty Images.

Have both oars in the water with this utility stock

For risk-averse investors, utility stocks often represent an ideal option. Generating consistent cash flows, utilities frequently operate in regulated markets, giving them a clear sense of their future finances and helping fortify their positions during economic uncertainty. Such is the case with American Water Works, the largest publicly traded water utility in the United States, which derived 86% of its operating revenue in 2019 from its regulated businesses segment.

The geographic diversity of the company's footprint is a key reason the big dog among water utilities is an ideal candidate for low-risk investors. In total, American Water Works provides water and wastewater services to approximately 15 million customers in 46 states, mitigating the risk of drought conditions or other environmental phenomena in local markets. And management has set its sights on growing this customer base even further, identifying acquisitions that would represent about 695,000 new customers over the next five years.

Investors will find that the company retains an investment-grade balance sheet as rated by Moody's and S&P Global Ratings, both of which have assigned it a stable outlook. Management, moreover, seems committed to strengthening its balance sheet over the next few years. Whereas it had a debt-to-capital ratio of 61% at the end of 2019, the company has targeted a debt-to-capital ratio of 59% to 60% by 2024.

Talking trash but not trash-talking

Uninterested in dipping your toes in a water utility? Perhaps Waste Management can help you scratch that low-risk stock itch. Helping more than 20 million customers to take out the trash, Waste Management operates extensively throughout the United States and Canada, representing a well-diversified customer base that leaves the company well suited to withstand a downturn in any particular market.

Additionally, the differentiation in the company's operations should appeal to risk-averse investors. There's significant diversity among the customers that contribute to the company's waste and recyclables collection business, which accounted for 55% of its overall revenue in 2019.

Image source: Waste Management investors presentation.

Although Waste Management may encounter downturns in individual components of its revenue stream (local stay-at-home orders, for example, may hurt the company's revenue from construction and retail customers), it certainly won't cripple its business.

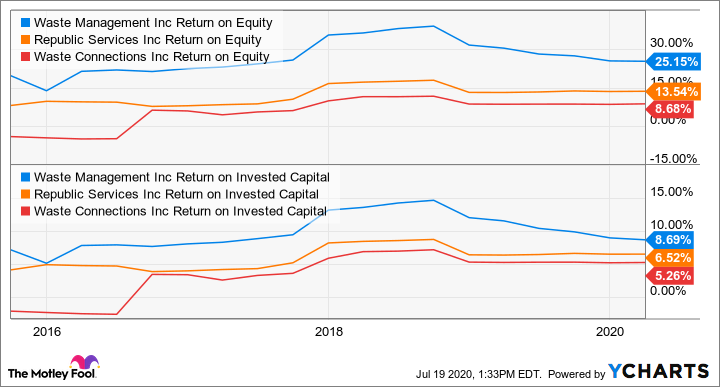

While the company's recent financial success is no guarantee of how it will perform in the future, it should suggest to investors that they can feel confident in management's ability to grow the business, especially compared to its peers Republic Services and Waste Connections.

WM Return on Equity data by YCharts.

Not only has Waste Management proved to be more adept at turning shareholders' investments into profits than its peers have, but the company has also distinguished itself in generating profits through its strategic deployment of capital. Further demonstrating its responsible approach to capital allocation, management announced during its Q1 2020 earnings call that "as a prudent step to preserve cash in this uncertain environment, we decided at the end of March to temporarily suspend our share repurchases."

Strike gold with this streaming company

Another way to reduce risk is with precious metals. Acting as a financier with a particularly narrow focus, Wheaton Precious Metals is a streaming company that provides up-front payments to mining companies to help finance their capital-intensive projects and, in return, agrees to purchase a portion (or all) of the mined commodities.

By entering into these agreements, which have pre-set prices, Wheaton mitigates the risks associated with steep downturns in the prices of the related metals. At the same time, it will profit from an uptick in commodity prices. Currently, Wheaton has 20 streams in its portfolio with many of the mining industry's leaders, including Newmont, First Majestic, and Vale. And there's potential to gain even more luster with nine projects in development.

Image source: Getty Images.

Although the company also has streaming interests in silver and palladium, gold accounts for the lion's share of the company's revenue: 63% in 2019. With the price of gold averaging $1,660 per ounce, and Wheaton forecasting gold cash costs of $431 per ounce in 2020, it seems as if the company's financials may glitter brightly this year.

In addition to a conservative approach to leverage (its net debt-to-EBITDA ratio was under 1.5 at the end of Q1 2020), management will attract low-risk investors with its approach to its dividend. Uninterested in jeopardizing its financial health with unsustainable payouts, Wheaton has tethered its dividend to its operating cash flow, averaging the operating cash flows from the previous four quarters and returning 30% to shareholders.

Several ways to help you sleep soundly

There's no need to toss and turn all night, worrying about your portfolio in a downturn. By providing indispensable services, American Water Works and Waste Management are two companies whose strong balance sheets will appeal to investors with minimal tolerances for risk. Likewise, Wheaton Precious Metals, with its circumspect approach to leverage and its dividend, offers a different sort of golden opportunity for low-risk investors.