Walgreens Boots Alliance (WBA +0.00%) shareholders dissatisfied with years of stock underperformance breathed a small sigh of relief on Monday. CEO Stefano Pessina, who has headed the company since 2015, says he will transition to the role of executive chairman once the company's board of directors finds his replacement.

Once the board selects a new CEO, the company's current executive chairman, James Skinner will step down from that position, but will remain on the board.

Image source: Getty Images.

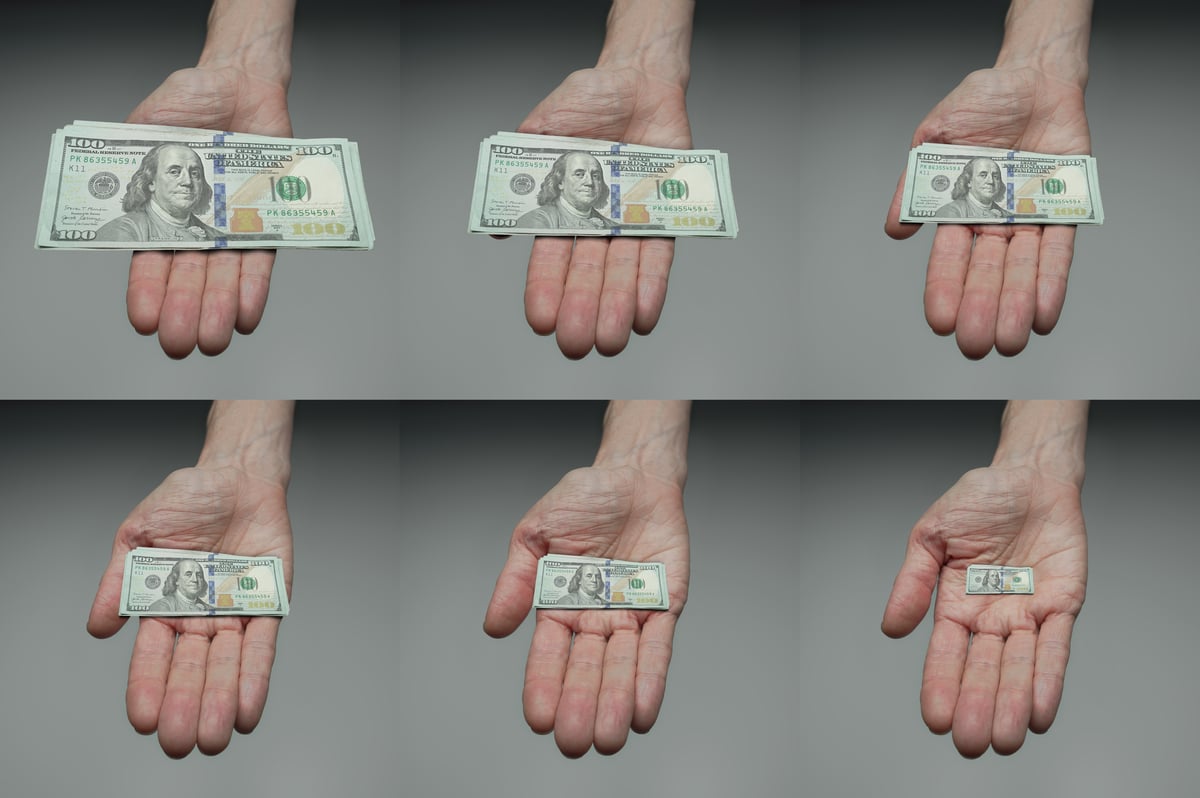

Over the past five years, Walgreens investors have watched their shares lose around 58% of their value. Under Pessina's leadership, the company has steadily increased its total revenues, but its bottom line stagnated for several years before sliding in 2019, then falling off a cliff when the COVID-19 pandemic hit.

On July 9, the company reported that COVID-19 sapped between $700 million and $750 million from its sales in its fiscal third quarter, which ended May 31, 2020. Its operating costs also rose as it laid out money on pandemic-related measures. That, in combination with a decline in the number of customers actually entering its stores, further squeezed margins. Overall, Walgreens reported a $1.6 billion operating loss during the period. Even when the metrics were adjusted to factor out one-time charges, the company's operating income fell 46.5% year over year to $919 million.

Investors weren't too thrilled that the company suspended its share repurchase program, and management's decision to raise the dividend by a measly 2.2% didn't help them feel any better. In 2015, the company earned an adjusted $4.00 per share. In fiscal 2020, management forecasts adjusted earnings of between $4.65 and $4.75 per share. That works out to an annual growth rate of around 3.3% under Pessina's leadership.