High-growth stocks often come from some of the most disruptive and innovative companies on the market. But growth investing can be difficult, because from an investment standpoint, growth can be very hard to price. Valuations look crazy when you compare them to current financial performance, but with the benefit of hindsight, even stocks that looked expensive at the time can turn out to have been great values.

The three companies that I think are great growth stocks and hold a durable competitive advantage are Spotify (SPOT 6.19%), Okta (OKTA +0.52%), and Zendesk (ZEN +0.00%). They're positioned to disrupt a lot of what businesses do online, and they've got the potential to become giants in their industries decades from now.

Image source: Getty Images.

Spotify

Spotify was built on making the world's music accessible to users with ad-supported or premium monthly plans. And it now has 130 million premium subscribers and a solid position in the music-streaming business. But that isn't what I think will keep the company growing for the next decade.

In the last few years, Spotify has gone all-in on podcasts. The company bought Gimlet and Anchor for a combined $340 million last year, acquired The Ringer for nearly $200 million, and signed a $100 million licensing deal with Joe Rogan that will make his podcast exclusive to Spotify later this year. This is really the future of the business, and it could have decades of growth ahead, so Spotify is amassing talent right now.

In music, Spotify is a big player, but it's still beholden to the labels that control music content. But in the podcast industry, there are hundreds and maybe thousands of independent producers. If Spotify becomes the place they need to go to distribute and monetize their content, it could build an extremely valuable position in the industry.

Okta

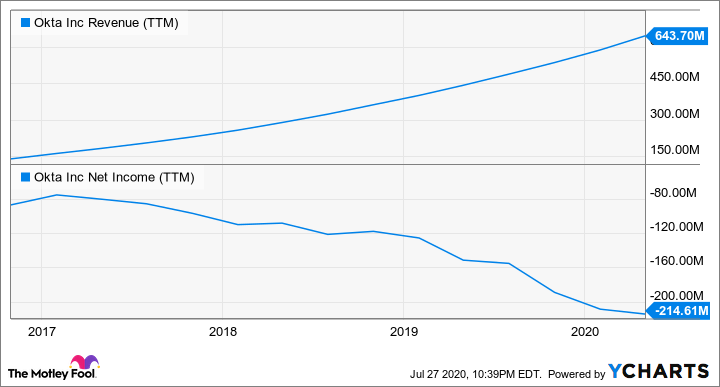

Securing software access has become critical for businesses and consumers, and that's created a valuable niche for Okta. You can see below that the company's revenue has grown more than fourfold in under five years as people have flocked to its services.

OKTA Revenue (TTM) data by YCharts.

What's great about Okta's business is that it's a necessary independent company between software makers, businesses, and users. It's effectively a three-sided market with Okta in the middle. That means its position becomes more valuable as software partners grow, business users increase, or consumers grow.

Okta's stock is still extremely expensive at 38 times sales and the company is far from profitable, but a business growing this quickly can make that price worth paying. Investors need to watch whether Okta can begin turning its net losses into profits, but that will likely come as revenue grows and the company solidifies its place as a leader in the market. And if that happens, this could be a tremendous growth stock.

Zendesk

Customer support has changed rapidly over the last decade, as the internet has allowed consumers to reach out in new ways. And one of the increasingly common ways to reach a company is through a Zendesk widget on a company's website.

Like Okta, Zendesk has spent a lot of money growing revenue and building out its business, leading to the losses that you see below.

ZEN Revenue (TTM) data by YCharts.

Zendesk's ultimate value is in providing the tools businesses need to offer customer support. And with a growing suite of automated and personal solutions, this is a company whose clients will increasingly need its services -- especially clients that are themselves prepared to be growth drivers for the broader economy looking ahead. I like Zendesk's potential for further gains.

High-potential stocks

All three of these stocks are expensive any way you look at them, but they deserve their valuations for a reason.

SPOT PS Ratio data by YCharts.

Spotify could own the podcast industry in the future, Okta is a giant in software security, and Zendesk is changing customer support as we know it. Those are three disruptions I am willing to bet on, and it's why I'm adding them as outperform calls on my CAPS page.