In an environment of ultra-low interest rates, dividend stocks have become a refuge for investors wanting to generate income. While many dividend stocks remain safe, COVID-19 has hit some hard. Companies such as BP, Ford, and Macy's had to reduce or suspend their dividend payouts amid harsh economic conditions.

Many companies, particularly in the energy industry, continue to forgo dividend cuts for now. Nevertheless, investors need to remain wary of large payouts, especially in the cases of Delek US Holdings (DK -0.87%), ExxonMobil (XOM 0.02%), and ONEOK (OKE 0.75%).

Delek

Many investors may not know the name Delek, which has operated since 2001 in refining and other energy-related industries. Refining is one of the less-affected sectors in the industry when oil prices fall. However, this downturn brought an unprecedented drop in demand.

The second-quarter earnings report showed the extent of the effects. The Brentwood, Tennessee-based energy company reported an adjusted loss of $110.5 million, or $1.50 per share, as demand for refined products has plunged amid the COVID-19 pandemic.

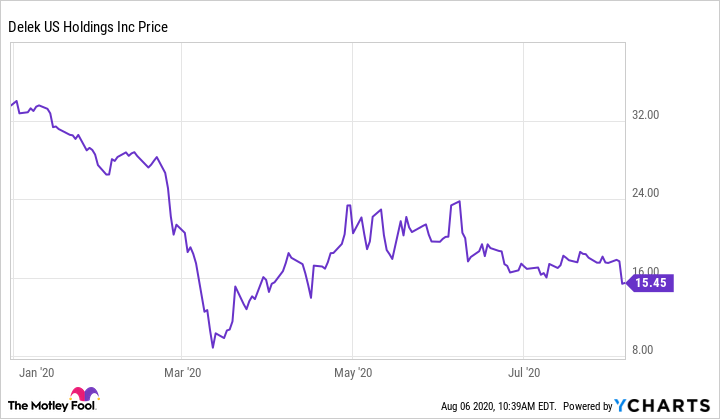

Delek stock lost 13% of its value following the announcement. It has also fallen by more than 50% since the beginning of the year.

Delek Year-to-Date Stock Performance, data by YCharts.

Moreover, with negative free cash flow last quarter, the company had to take on additional debt to bolster its cash position and fund its dividend.

Delek's current annual dividend of $1.24 per share yields about 8.4%. Considering its cash position of $849 million, Delek can cover its dividend (which amounts to $23 million per quarter) and the losses for now. However, with only a short streak of dividend increases, it should surprise few if Delek decides to slash its payout.

Image source: Getty Images

ExxonMobil

ExxonMobil has been well prepared to weather downturns in the past. As a Dividend Aristocrat, it has increased its payout annually for 37 years.

However, even this oil giant could not prepare for the kind of drop in demand it has experienced in 2020. As demand fell through the floor and oil prices briefly dipped into negative territory, losses mounted, and many investors have become concerned about the dividend.

ExxonMobil lost $1.08 billion in its most recent quarter alone. Nonetheless, the company has shown a commitment to maintaining its hard-earned Dividend Aristocrat status. It has borrowed money, sold assets, laid off workers, and even scrapped its 401(k) match for employees.

As matters stand now, ExxonMobil stock trades more than 40% below its 52-week high. Due to this drop in the stock price, the current dividend of $3.48 per share yields about 8%. Also, without an increase in the fourth quarter, ExxonMobil would lose its Dividend Aristocrat status. Hence, investors will likely receive a slight payout hike at that time.

ExxonMobil Year-to-Date Stock Performance, data by YCharts.

Nonetheless, the dividend payout ratio, or percentage of trailing-12-month net income devoted to the dividend, is now above 200%. Also, due to the company's negative free cash flow, this situation is not sustainable. If low oil prices and weak demand persist, ExxonMobil may eventually have to reduce its payout.

ONEOK

The pain continues for natural gas company ONEOK. A massive drop in natural gas usage caused ONEOK stock to lose more than 80% of its value at the sell-off's peak. Despite a slight recovery, ONEOK stock is trading about 60% below its price at the beginning of 2020.

Oneok Stock Year-to-Date Performance, data by YCharts.

This has taken its $3.74 per share annual dividend to a yield of about 12.6%. Also, while the company is not a Dividend Aristocrat, its dividend has risen steadily over the years. ONEOK has not slashed its payout since 1988.

However, the dividend payout ratio now stands at just under 250%. Moreover, all analyst profit forecasts through 2023 come in well below $3.74 per share.

The latest earnings report showed the extent of the pain. Net income in the second quarter came in at just over $134 million, or $0.32 per diluted share. This missed analyst estimates by $0.21 per share. It is also a 57% reduction from the company's earnings per share of $0.75 in the same quarter of last year.

Moreover, ONEOK's $946 million cash hoard will offer little help, as the company has already spent $774 million on dividend payouts in the first half of 2020. CEO Terry Spencer ruled out a dividend cut for now. However, during the company's recent earnings call, he described a dividend cut as a possible "lever" if "deleveraging expectations are not being met." ONEOK may have to pull this lever barring a relatively quick recovery in natural gas consumption.