What happened

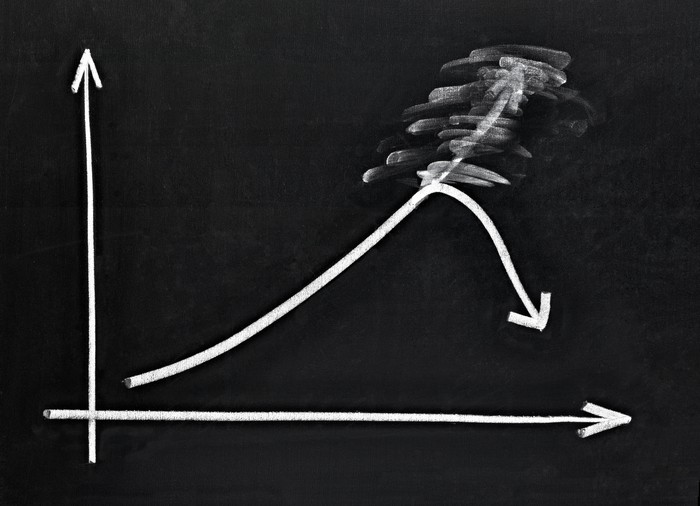

A funny thing happened on the stock market today. Diversified industrial products maker NN (NNBR 1.75%) announced that it will be selling its life sciences division for $825 million, and the stock exploded higher on the news -- up more than 22% in early trading. But then it gave it all back, and more.

As of 12:30 p.m. EDT, NN stock is trading 2.9% below where it closed last week.

Image source: Getty Images.

So what

Why? We're going to have to dig into some details to find the answer to this one. According to the company's press release, it has agreed to sell its life sciences division to private equity firm American Securities LLC, which will in turn combine the division with its own MW Industries, "a provider of highly engineered springs, specialty fasteners, bellows and other precision components."

In exchange, NN will receive $755 million cash up front, and as much as $70 million more in earnout cash paid based on the division's performance through 2022. NN says it plans to use $700 million of this to "pay down its debt and strengthen its balance sheet."

Now what

So far, so good. NN is carrying nearly $950 million in debt, and $700 million in new cash will go a long way toward making that burden easier to bear. Moreover, while NN is selling its most profitable division (7.8% operating profit margin) to obtain the cash, what remains after the sale will still be respectably profitable -- a mobile solutions division earning a 3.2% margin and a power solutions division earning 7.3%.

On balance, therefore, I have to agree with the folks who responded to this news by buying NN stock today, and I must disagree with the sellers. While it's certainly disappointing to see NN sacrifice its largest and most profitable division, the price it's getting -- 2.3 times sales -- seems more than fair, the debt load will get more manageable, and there's every hope that NN will emerge from all this a still-profitable company and a leaner one to boot.