What happened

Co-Diagnostics (CODX 1.22%) stock surged 24.7% in September, according to data from S&P Global Market Intelligence. For context, the S&P 500 (including dividends) fell 3.8% last month.

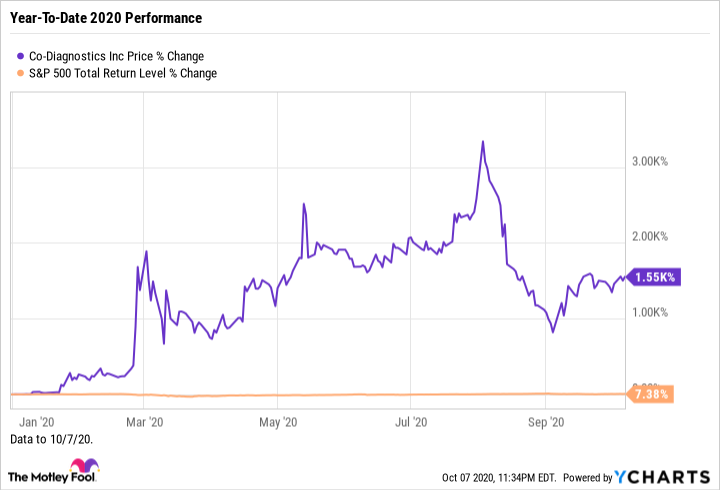

Shares of the healthcare diagnostics company have risen 8.9% this month, through Wednesday, Oct. 7. In 2020, the stock has gained a whopping 1,550%, though it's 52% off its closing all-time high of $30.80, reached on Aug. 3. The broader market has returned 7.4% over this period.

Image source: Getty Images.

So what

Co-Diagnostics stock, which is very volatile, started September off on a down note, falling 21.9% in the first three days of the month. It quickly more than made up for that start, however, when it shot up 42% on the first trading day of the following week, Sept. 8.

We can attribute that post-Labor Day skyrocketing to the company's announcement that Arches Research, a subsidiary of Polarity TE, agreed to expand its use of Co-Diagnostics' Logix Smart COVID-19 test.

Since no financial details of the deal were disclosed, my colleague Keith Speights wrote at the time that a good portion of the pop in Co-Diagnostics stock was probably due to short-sellers (those who bet on the stock falling) covering their positions. I'd agree with that take, as the stock is very heavily shorted, which increases volatility.

That, of course, leads to the question: Why are so many investors betting the stock will fall?

One big reason is likely increasing competition. As I wrote in early June and then reiterated in early August, "Investors need to be careful when investing in the COVID-19 testing space because it's highly competitive and eventually, at least, demand for tests should subside considerably."

Indeed, in late August, formidable competitor Abbott Laboratories announced FDA emergency use authorization for its speedy and inexpensive COVID-19 antibody test. The test costs $5 and delivers results within 15 minutes.

Here's Co-Diagnostics stock chart for 2020 so far:

Data by YCharts.

Now what

In 2020, analysts are modeling for Co-Diagnostics to post adjusted earnings per share of $1.83 on revenue of $93.9 million. Last year, the company had a loss of $0.36 per share on sales of $215,000.

Reiterating once again: Investors need to be careful when investing in the COVID-19 testing space because it's highly competitive and eventually, at least, demand for tests should subside considerably.

Co-Diagnostics stock is suited only for investors comfortable with much risk and volatility.