If you jump on the bandwagon of a stock that's been rising sharply in value, you can run the risk of buying a company that's overpriced -- or one that's just not a good investment. But if you go against the grain and look for stocks that hordes of investors aren't crazy about, you'll be more likely to find some bargains.

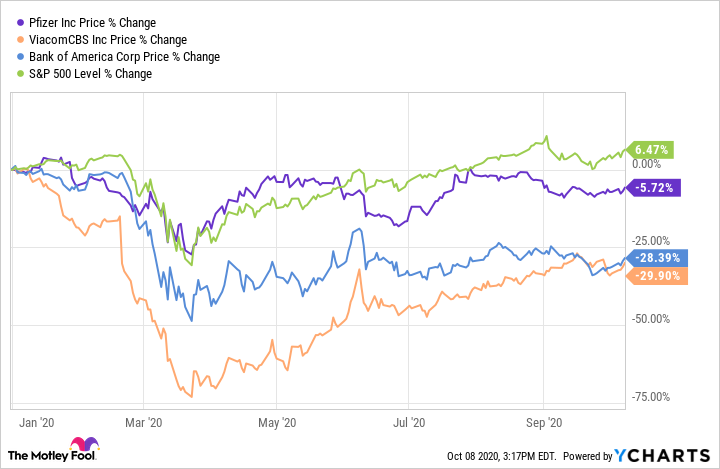

Pfizer (PFE 0.34%), ViacomCBS (PARA 0.23%), and Bank of America (BAC -2.19%) are all underperforming the S&P 500, which is up by more than 6% this year -- but that doesn't mean they're bad investments. On the contrary, now could be a great time to buy these companies, as they're cheap and possess lots of potential growth.

1. Pfizer

A big reason Pfizer is an attractive buy is that it's working on a COVID-19 vaccine with BioNTech; phase 3 trials began in July, and the results could be available before the end of the year. It's also one of the safer healthcare stocks to invest in. Unlike some pure-play vaccine makers, it doesn't present a lot of risk for investors if it fails to develop a successful vaccine -- either way, Pfizer still makes for a great long-term investment. And if its vaccine candidate is successful, it could stimulate lots of bullishness (not to mention billions of dollars in additional revenue) and send the stock on a positive trajectory -- it's currently down 6% year to date.

Pfizer has recorded a profit in eight of its past 10 quarterly results, demonstrating strong consistency over the years. While investors may be unimpressed with the company's lack of growth -- sales of $51.8 billion in 2019 were down by more than 3% from the previous year -- there's reason for optimism. And that's because the company is spinning off its generics business, Upjohn, later this year.

Image source: Getty Images.

The New York-based drugmaker will be a smaller company after the spinoff, with a focus on growth and on developing new medicines. That could make it a more appealing long-term investment, especially for growth-oriented investors. In its most recent quarterly results, which Pfizer released on July 28 for the period ending June 28, its sales of $11.8 billion were down 11% year over year. But the biggest drag on the top line was Upjohn, which generated just over $2 billion in revenue -- down 32% from the prior-year period. In the first six months of this year, Upjohn's sales are down another 35%. Pfizer's biopharma segment, however, is up 7% this year, and already makes up the bulk of the company's revenue.

Today, Pfizer's stock trades at a forward price-to-earnings (P/E) ratio of 12. Although that's about where it was a year ago, factoring in the potential of a successful COVID-19 vaccine makes this a potential bargain buy.

2. ViacomCBS

Another good value stock to consider adding to your portfolio today is ViacomCBS. The media and entertainment company is down 30% this year, having fallen sharply during the March crash to a low of just over $10. Though it's tripled since those lows, it's still nowhere near where it started 2020. But for value investors, that makes this an attractive buying opportunity. The stock is trading at a forward P/E of 6, while investors are paying a multiple of more than 15 for rival Comcast.

This is another New York-based business that could have a lot of growth on the horizon. COVID-19 heavily affected its second-quarter results because it meant companies were spending less on ads; in Q2 results, released Aug. 6 for the period ending June 30, sales of $6.3 billion were down 12% year over year. Advertising revenue posted the most notable decline, down 27% to $1.9 billion. That should be temporary, however; the resumption of professional sports, and the advertising they bring, will likely help give those numbers a boost next quarter.

ViacomCBS is also rebranding its subscription streaming service, CBS All Access, into Paramount+, which it will launch in multiple international markets next year. More content available via this service could help generate more revenue for the company; in Q2, streaming and digital video brought in $489 million, up 25% from the previous year, with the number of paying subscribers up 74% to 16.2 million. (Netflix, in contrast, has more than 192 million paid subscribers around the world as of its most recent quarterly results.)

3. Bank of America

It's not a popular time to be buying banks, not with a recession and pandemic going on. But that's also why it's a perfect time to do so, because values are low. Warren Buffett's Berkshire Hathaway is still holding on to its 12% stake in Bank of America despite the current economic challenges.

Shares of this top bank stock are down 28% this year, as low interest rates and a poor economic outlook aren't giving investors many reasons to buy. Because of this, Bank of America is trading at a forward P/E of just 11 -- below its book value -- meaning investors who do buy now can get a lot of bang for their buck. The last time Bank of America stock was priced this low was during the market's dive in the fall of 2018, when it fell below $24.

Through the first six months of 2020, Bank of America has set aside $9.9 billion in provisions for credit losses, as it anticipates a tough road ahead for the economy. A year ago, its year-to-date provision stood at just $1.9 billion. That $8 billion increase is the reason why the bank's year-to-date profits of $6.8 billion are half what they were this time last year.

Although it's coming off some disappointing quarterly results due to the provisions, the bank will bounce back. It may take some time, but over the long run Bank of America's stock can deliver some great returns for investors who are willing to hang on as the economy gets back to its pre-COVID levels. Once COVID case numbers start coming back down, which could happen once a vaccine becomes available, some bullishness will return to the economy, which will benefit financial stocks like Bank of America.

The director of the National Institute of Allergy and Infectious Diseases, Dr. Anthony Fauci, haas said he believes life could get back to normal by the end of next year. If that's the case, we could see a substantial economic recovery at that point in time, meaning interest rates would start to rise again -- and that would be great news for bank stocks.And that's why a recovery for Bank of America's stock may not be all that far away.

Which stock is the best buy right now?

Before deciding which of these investments looks best today, let's first recap how they're doing against the S&P 500 this year:

Although they're all underperforming right now, that doesn't mean things will stay that way. To me, the stock that looks most attractive today is Bank of America. It's hard to argue with the Oracle of Omaha! It's also a stock that's likely to recover along with the economy, and its cheap value today makes it a hot buy.