If you invested $1,000 in DraftKings (DKNG -1.33%) stock on Oct. 1, you'd have just $590 now. That's because the stock plummeted a painful 41% over that month. When a stock falls like this, it draws massive attention from bargain-bin investors. After all, if half the game is "buy low," then shouldn't investors scoop up shares of DraftKings at a discount?

Yet there's at least one factor keeping some investors on the sidelines right now. The U.S. presidential election is days away and the uncertainty it's creating is something Wall Street hates.

There are plenty of disparate theories on how things could play out once the polls close on Nov. 3. However, zooming out, the election is mostly noise when it comes to DraftKings stock. There are much bigger issues to consider before buying this fantasy sports and sports betting operator.

Image source: DraftKings.

Why you should block out election noise

John F. Kennedy, a Democrat, was the 35th president of the United States and began his term in 1961. Since then, there have been 10 presidents: six Republicans, four Democrats. The following chart displays the S&P 500 index and U.S. gross domestic product (GDP) since Kennedy took office, and there's really no distinguishable pattern to either index's performance based on which party was in power.

US GDP data by YCharts. Shading denotes economic recessions.

The U.S. economy is capable of thriving under presidents from either major political party. According to research from Yardeni Research, only one president over the past 60 years left office with the S&P 500 lower than when he took office: George W. Bush. Two other 20th-century presidents saw stocks decline only in their second term: Franklin Roosevelt and Richard Nixon. Therefore, if history is any indication, odds are extremely good that stocks will go up over the next four years regardless of who gets elected.

Of course, elected officials can take some actions that nudge the economy in specific directions. For example, they can impose new taxes to curb the use of things they want the U.S. public to move away from. And they can offer tax credits for goods and services they want to see more widely adopted. So one would expect certain industries and sectors to do better/worse depending on election results.

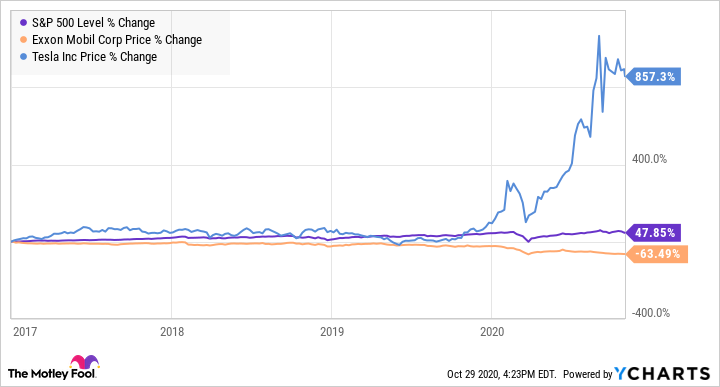

However, I can only offer you wishes of "good luck" in trying to predict the individual stock winners solely based on election results. For example, it's probably safe to say former Vice President Joe Biden will pursue alternative energy initiatives more fervently than President Donald Trump has thus far in his time in office. But there's more to predicting stock winners than that. President Trump has advocated for more fossil fuel production, but the counterintuitive results from legacy-oil company ExxonMobil and alternative-energy company Tesla since Trump was elected create questions about what effect he is really having.

Here's the takeaway for investors: Stocks can provide great returns over the next four years. But as always with investing, each company needs to be considered on its individual merits. How a stock performs, including DraftKings stock, will depend on its own results, not who resides in the White House.

Here are some things you shouldn't block out

In the end, the upcoming election has nothing to do with this gaming stock's performance, but DraftKings isn't a stock I would invest in right now. The stock is down in October for good reasons. Management is raising cash by issuing new shares, and insiders are cashing out by selling theirs. On June 18, DraftKings announced it was issuing 16 million shares and certain shareholders were selling 24 million shares. Then on Oct. 7, it announced it was selling 16 million more while insiders sold an additional 16 million.

In just under four months, DraftKings and its insiders put an additional 72 million shares out on the market. For perspective, when the company became public earlier this year via a special purpose acquisition company (SPAC) transaction, there were 336 million Class A shares. After the second quarter, there were almost 356 million -- an increase of nearly 6% in under a year.

Image source: Getty Images.

Here's what may be a bigger problem for DraftKings long term. Technology companies often have a fixed-cost structure, allowing their businesses to scale well. But DraftKings' costs, by contrast, are mostly variable. Known as "cost of revenue," these are expenses the company can't avoid. This means that as its revenue grows, so will its costs, making the future profit potential less attractive.

Speaking of growth, DraftKings does have a large opportunity as sports gambling and iGaming legalization increases. However, as it's expanded in 2020, the company has spent more in sales and marketing than it recorded in gross profit. This means any hopes of net profits are likely still years away, making the stock impossible to value on an earnings basis.

Devoid of earnings, investors are left to value DraftKings stock based on sales, and its valuation is sky high at 40 times sales. Of course, high-enough growth could justify this valuation. But management is only guiding for between 22% and 37% revenue growth in the second half of 2020, which I don't believe is enough to warrant the price tag.

For these reasons, I'd cast my vote for other growth stocks.