As a retiree, you're probably in a stage of your life where you prefer to generate income instead of taking risks. Not all of your money is in stocks, but what is should be allocated toward solid companies that consistently pay sizable and growing dividends.

Starbucks (SBUX 0.28%), United Parcel Service (UPS -1.34%), and Johnson & Johnson (JNJ 0.24%) are three completely different companies that could add diversity to your investment portfolio. Here's why all three are good buys now.

Image source: Getty Images.

1. Starbucks

Gone are the days of Starbucks' rapid global expansion and high growth -- at least for now. Starbucks has gradually transitioned to a low- to medium-growth stock. This is great news for retirees and anyone looking for a stable source of dividend income.

Starbucks' dividend is one of the best-kept secrets on Wall Street. Since instituting a $0.05 quarterly dividend in 2010, Starbucks has grown its payout nine-fold. Over the past 10 years, the company's dividend has grown at a higher rate than any stock in the Dow Jones Industrial Average (DJIA). The DJIA is full of dividend stocks intended to reflect the broader economy. And although Starbucks isn't in the index, it's probably surprising for investors to hear that the coffee giant -- which isn't as well-known for its dividend -- has been growing it at an impressive clip.

Starbucks has been a hot stock to buy. Although its shares are now trading near an all-time high, the company has recovered well from the pandemic. After reporting drastic revenue declines and its first quarterly loss in years, Starbucks suffered just a 9% year-over-year revenue decline in its most recent quarter. This is a sign that business is improving. The company also issued positive guidance for 2021 that suggests strong revenue growth, more store openings, and a continued ramp-up of drive-thru and digital. 2020 was a bad year for Starbucks, but the company's recovery and commitment to its dividend make it a worthy investment to help build retirement wealth. Shares of Starbucks yield 1.9%.

2. United Parcel Service

UPS is another great stock to help you build retirement wealth. Like Starbucks, shares of this transportation stock are near an all-time high. But unlike Starbucks, UPS has benefited from several pandemic-induced tailwinds.

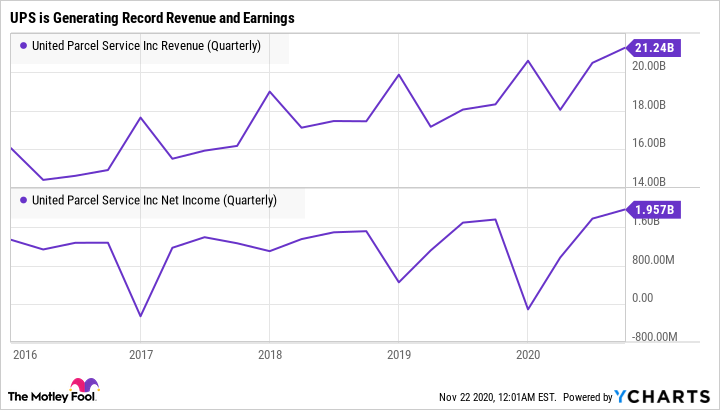

The company's business-to-consumer (B2C) segment is thriving thanks to surges in e-commerce and adoption of UPS's Digital Access Program (DAP) by small to medium-sized businesses. Launched in October 2019, UPS wanted to prepare for what it expects to be multi-year growth in the e-commerce industry. Its DAP is one of UPS's under-the-radar tailwinds that connects leading service providers with smaller merchants so they can give their customers the same sophisticated payment, shipping, and logistics solutions their bigger competitors have. The program's timely launch has been one of the big success stories of UPS this year. In the third quarter, UPS earnings were better than what the market gave it credit for. The company grew revenue and net income by 15.9% and 9.9%, respectively, pushing both metrics to a new all-time high.

UPS Revenue (Quarterly) data by YCharts

Many of the businesses enrolled in the DAP could continue to utilize its benefits even after the pandemic. It's important to remember that UPS didn't create the program in response to the pandemic -- it created it last year because it saw long-term growth in e-commerce. Investors should be on the lookout for DAP retention after the pandemic ends and track whether the company can continue adding new accounts. For reference, UPS added 150,000 new DAP accounts in the third quarter and 120,000 in the second quarter of this year.

UPS is performing well, but its dividend is the icing on the cake for retirees. The company's $1.01 per share quarterly dividend has grown nearly six-fold since the year 2001, when it was paying $0.17 per share per quarter. Shares of UPS yield 2.5%.

3. Johnson & Johnson

Johnson & Johnson (J&J) is a tailor-made stock for retirees. It is the largest healthcare stock by market capitalization and generates a diverse revenue stream across three primary divisions. Most people are familiar with its consumer brands like Band-Aid and Tylenol, but the vast majority of the company's business is actually in pharmaceuticals and medical device sales. J&J continues to perform well, even during the pandemic.

Moderna and Pfizer's vaccine news has the headlines now, but J&J has its own vaccine candidate too. The company has been advancing the phase 3 trial of its vaccine since September. J&J's chief scientist expects the U.S. will authorize its vaccine in February 2021 or earlier. Unique characteristics of its vaccine compared to its competitors could make Johnson & Johnson the coronavirus vaccine maker most likely to blow past Pfizer and Moderna.

J&J's steady earnings growth and vaccine upside is one thing, but its dividend is really what makes it an ideal stock for retirees. J&J is one of the longest-tenured Dividend Aristocrats, having increased its dividend for 58 consecutive years. Starbucks and UPS have impressive dividend stories of their own, but it's hard to compare either to J&J. J&J yields an impressive 2.8%.

A diversified basket perfect for retirees

Investing equally into Starbucks, UPS, and J&J produces a dividend yield of 2.4%, which is a great amount for retirees who want to get a little more from their investments than what a certificate of deposit has to offer. And although all three dividend stocks have slightly underperformed the market over the past five years, they are arguably better suited for retirees looking for a conservative way to invest in the stock market.