Multi-baggers, or stocks that go up multiple times their original value, are something of a holy grail for investors. That said, these elusive winners aren't always easy to find -- unless, of course, you know where to look.

There are a number of measures investors can employ to gauge the possibility that a stock can double or more from its current value: A company feeding the emerging app economy, one riding the tailwinds of digital advertising, or one that's tapping several megatrends to dominate its corner of the world.

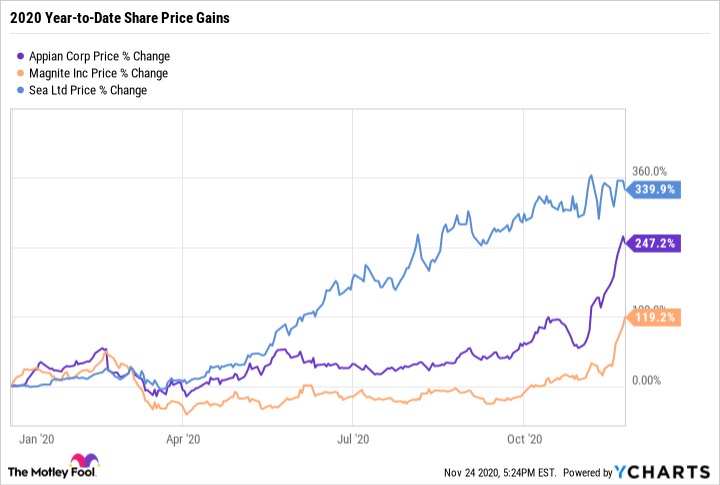

Another telltale sign is a stock that has already doubled investors' money and shows no signs of slowing. Here are three stocks that meet one of the aforementioned criteria, while also having doubled -- or more -- over the past several months.

Image source: Getty Images.

1. Appian: Making low-code mainstream

While it rarely makes headlines, there's an ongoing shortage of software developers. To close out 2019, there were as many as 920,000 unfilled IT positions in the U.S., and only about 165,000 applicants to fill them. As a result, there simply aren't enough code writers to go around, particularly those who create business software applications.

Appian (APPN 1.65%) may not be a household name, but if you've ever used an app, there's a chance you've benefited from this cloud-based service. Appian provides a framework that helps businesses create apps with little or no coding. The company has also incorporated robotic process automation (RPA) into its platform. The system helps with the automation of repetitive tasks, which has experienced a spike in demand as the result of the pandemic.

There was fear that the company would suffer due to the economic upheaval, but business is booming. Appian reported third-quarter revenue that grew 17% year over year, though that figure is misleading. The company is pivoting toward its higher-margin business, which will pay dividends over time. Appian's cloud subscription revenue grew 40% year over year, blasting past expectations. Even more telling, total subscriptions revenue -- which creates the foundation upon which future growth is built -- grew 34%.

Higher margins from its cloud customers are also pushing Appian toward profitability. The company's non-GAAP (adjusted) net loss came in near breakeven. Additionally, excluding the effects of a recent acquisition, Appian is also on the verge of generating free cash flow.

The growing potential for low-code tools has driven Appian higher in recent months. The stock has doubled since the end of September and is up nearly 250% so far in 2020.

Image source: Getty Images.

2. Magnite: The other side of the digital advertising coin

Another company that has largely stayed off many investors' radar is Magnite (MGNI 2.72%). The programmatic advertising specialist took on a new identity earlier this year when Telaria merged with The Rubicon Group to became Magnite.

Digital advertising stocks took a hit earlier this year, as the pandemic forced companies to slash their marketing budgets in the face of economic uncertainty. When it became clear that the sky was not falling, digital advertising came back with a vengeance.

For its part, Magnite has focused on the emerging space of connected TV (CTV), though it can monetize advertising across all screens and formats, including desktop, mobile, and audio. Overall revenue in the third quarter grew 62% year over year and CTV grew 51%. The company's non-GAAP (adjusted) earnings per share of $0.06 improved from a loss of $0.02 in the prior-year quarter.

This was driven by strong growth across a number of verticals, including tech (176%), direct-to-consumer (159%), and consumer packaged goods (86%). Additionally, the number of advertisers using its platform for targeted advertising grew by 250%.

The ability to launch data-driven and measurable advertising campaigns has been driving advertisers to Magnite's platform, as marketing departments seek more bang for their buck. The rebound in digital advertising has investors clamoring for Magnite stock, which has gained more than 100% since early October.

Image source: Getty Images.

3. Sea Limited: E-commerce, digital payments, and gaming

Filling out our trio of under-the-radar stocks is Sea Limited (SE 7.94%). While the company isn't a household name in the U.S., it's a very different story in Southeast Asia. Sea Limited is tapping three of the hottest growth trends out there: E-commerce, digital payments and fintech, and gaming -- and, in the process, has become the most valuable company in the region.

Sea Limited began its life as a mobile gaming platform and gained acclaim for its hit game Free Fire. The title continued its reign as the highest-grossing mobile game in both Latin America and Southeast Asia during the third quarter. From those humble beginnings, however, Sea has evolved into a digital services powerhouse.

Shopee, the company's e-commerce platform, is the leading online seller in Southeast Asia (in terms of gross merchandise volume). It serves a population of more than 585 million consumers and 315 million internet users in the countries of Indonesia, Taiwan, Vietnam, Thailand, the Philippines, Malaysia, and Singapore. The Shopee app ranks No. 1 in both Taiwan and Southeast Asia in terms of app downloads, average monthly active users (MAU), and time spent on the Android version of the app. It also holds the title of second-most-downloaded app globally in the shopping category.

It's still early days for SeaMoney, the company's digital payment, mobile wallet, and fintech offering. It's growing quickly, surpassing 17.8 million paying users, accounting for a total payment volume (TPV) of $2.1 billion.

For the third quarter, Sea Limited's revenue grew 99% year over year, while gross profit more than doubled. The company is still awash in red ink as it works to build out its fledgling platforms, with a net loss that more than doubled as well.

Investors have been thus far been willing to give Sea Limited a pass on the bottom line due to its stratospheric revenue growth. In fact, the stock has doubled over the past six months and is up more than 300% so far this year.

Data by YCharts

Every rose has its thorns

As a result of the significant run-up in these stocks' prices in recent months, these picks are all high-risk, high-reward propositions. There's also been a corresponding increase in the associated sticker price, as Appian, Magnite, and Sea Limited are selling at 31, 23, and eight times sales, respectively -- when a good price-to-sales ratio is generally between one and two. It's also important to note that none of these companies is currently profitable, instead opting to spend their limited resources to secure future growth.

Thus far, however, investors have been willing to pay up for the impressive top-line growth that comes with each company and the potential for the explosive profits that could result in the months and years to come. I'm not just saying that either: I own stock in all three companies.