What happened

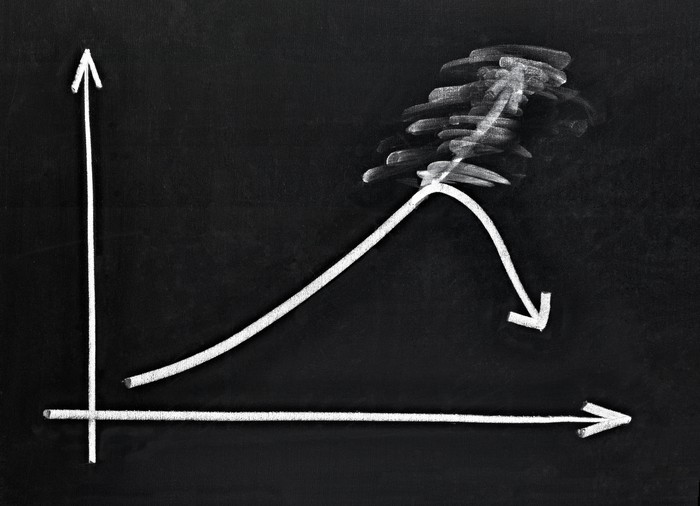

Shares of Appian (APPN -0.95%) stock, which roughly tripled in price over the last month, crashed 28% in Monday trading -- on no apparent news whatsoever.

Appian stock is falling again on Tuesday, if not quite so steeply, down about 4.8% in noonday (EST) trading.

Image source: Getty Images.

So what

Why the run-up, and why the letdown this week? The first part is pretty easy to explain: Reporting earnings Nov. 5, Appian beat analyst expectations when it reported a 40% increase in cloud subscription revenue, total revenue growth from all sources of 17%, a smaller-than-expected GAAP loss on the bottom line, and breakeven profits (calculated pro forma).

That news sparked the rally that tripled Appian's stock price in a month. It also, however, made Appian stock an attractive target for anyone looking to cash in those profits, and this appears to be what's happening this week.

Adding to the selling pressure, British bank Barclays just assured investors that selling Appian stock is the right decision to make. In a note covered by TheFly.com this morning, Barclays downgraded Appian stock to "underweight" (i.e., sell), calling the stock one of the most expensive on the market today and saying the stock's November run-up was "unwarranted."

Now what

And Barclays is not wrong. At its current market capitalization of $9.3 billion, Appian stock sells for an eye-popping 32 times sales, and infinity times the earnings and free cash flow it hasn't got.

Granted, historical sales growth has been phenomenal, with revenues up nearly triple over the last five years. But last quarter's numbers, while better than expected, weren't really anything to write home about. Sales growth of 17% is certainly good ... I'm just not sure it's "triple the stock price in a month" good.

Sometimes, even a good stock just plain costs too much -- and this time, Appian is that stock.