What happened

Shares of Atlantica Sustainable Infrastructure (AY) surged 16.6% in November, according to data provided by S&P Global Market Intelligence. Powering the renewable energy stock was its solid third-quarter results.

So what

Atlantica Sustainable Infrastructure generated $52 million of cash available for distribution during the third quarter, 13.6% above the year-ago period. The company benefited from higher production at its natural gas power plants and stronger results at some of its U.S. solar assets.

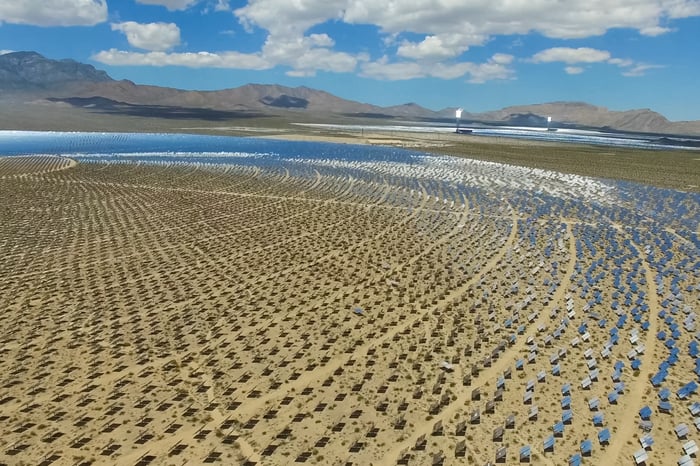

Image source: Getty Images.

The sustainable infrastructure company also made excellent progress on its strategic plan during the quarter. It closed the acquisition of an additional equity interest in Solana, in Arizona. The company invested $290 million into the U.S. solar power plant deal, which should generate a double-digit annual cash available for distribution (CAFD) yield.

Atlantica also secured a $20 million investment to buy a district heating asset in Canada. The business produces stable revenue backed by long-term capacity contracts. It's the company's first district energy investment, which it sees as an attractive growth business because it can help cities reduce their emissions.

Now what

Thanks to its strong showing in the third quarter, Atlantica Sustainable Infrastructure remains on track to achieve its full-year CAFD forecast range of $200 million to $225 million. That will provide it with plenty of cash to fund its 4.8%-yielding dividend. Meanwhile, it has ample growth prospects, expecting to invest $200 million to $300 million per year on new investments. Add it up and Atlantica is an attractive option for investors seeking an income stream backed by sustainable infrastructure.