Last July, American Airlines (AAL 0.99%) and JetBlue Airways (JBLU 3.90%) announced plans to team up through a new alliance covering New York and Boston. Earlier this week, the U.S. Department of Transportation (DOT) closed its review of the proposed alliance. The DOT will allow the partnership to go forward in exchange for several key concessions and commitments by American and JetBlue. Let's take a look.

A new level of cooperation

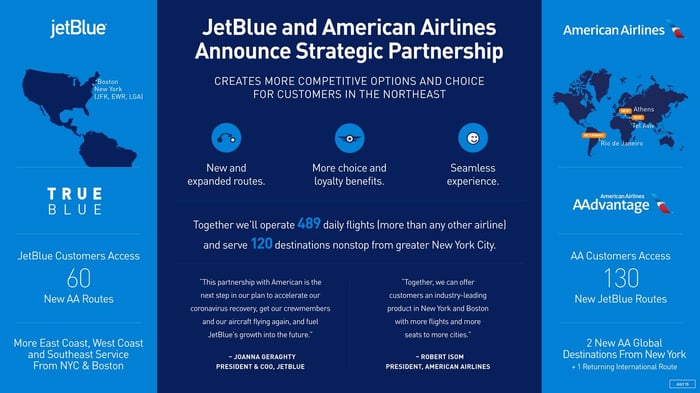

American Airlines and JetBlue are planning for a level of cooperation that is unprecedented among major U.S. airlines (excluding mergers, of course). When they initially announced the partnership last year, American and JetBlue pointed to codesharing, slot swaps at New York's LaGuardia and JFK Airports, and reciprocal frequent-flyer benefits as some advantages of teaming up. These forms of cooperation are all tried and true in the domestic market, but have limited benefits.

Image source: American Airlines and JetBlue Airways.

The DOT agreement reveals that the two airlines plan to go a step further, though, by actively coordinating their schedules on routes to and from New York and Boston. That will allow them to offer more connecting opportunities and provide better time-of-day coverage on routes they both serve today.

This level of cooperation is common within international joint ventures. However, it represents a potential antitrust violation. As a result, American Airlines and JetBlue had to seek the DOT's blessing. Essentially, they had to convince regulators that the deal's consumer benefits would outweigh any harms. This became particularly critical after rivals Spirit Airlines and Southwest Airlines objected to the proposed partnership.

The DOT strikes a deal

Since announcing the alliance six months ago, American Airlines and JetBlue have said that the agreement would allow them to grow in New York and Boston and offer their respective customers access to more flights and destinations on a nonstop basis. But in order to gain DOT approval, the airlines had to turn those plans into clear commitments.

First, American Airlines and JetBlue will have to divest seven slot pairs at JFK Airport (four from American and three from JetBlue). They will be sold in a single block to a new permanent owner. Additionally, they will have to lease out six slot pairs at Reagan Airport near Washington, D.C. (four belonging to American and two belonging to JetBlue). American and JetBlue could potentially reclaim the Reagan Airport slots in the future, though, if they unwind their Northeast alliance.

Second, American Airlines and JetBlue are forbidden from discussing pricing or revenue management strategies or attempting to influence each other's competitive behavior. They may not discuss scheduling or capacity decisions for any route outside the scope of the alliance, either. (This is to ensure they remain robust competitors in other markets, such as South Florida.) Lawyers will be required to supervise all joint planning meetings to ensure that the two companies discuss only permitted topics.

Image source: JetBlue Airways.

Third, JetBlue agreed not to exit any markets it served year-round from JFK as of last February, with a few minor exceptions.

Fourth, American Airlines and JetBlue will be required to divest additional slots at JFK if they fail to meet specified growth targets in New York. Essentially, the carriers are committing to expand their combined seat capacity at JFK and LaGuardia Airports to at least 115% of pre-pandemic levels by 2025. Reporting requirements will allow the DOT to monitor the two airlines' compliance with their commitments.

Everyone wins -- if all goes to plan

It remains to be seen whether American Airlines and JetBlue can forge a good working relationship, particularly when they will remain fierce competitors in markets outside the scope of the new alliance. But the partnership has great promise if they can cooperate effectively.

For American Airlines, the partnership will provide its existing customers in New York and Boston far more nonstop flight options. (JetBlue currently has a much bigger footprint in both cities than American.) JetBlue can also supply a substantial volume of connecting traffic to support American's international routes at JFK, including new service that will launch in 2021 and beyond.

Meanwhile, JetBlue will be able to give its customers instant access to American's global route network. It will also gain access to a substantial number of slots at LaGuardia (and, to a lesser extent, JFK), enabling growth that wasn't possible previously. American Airlines hasn't fully utilized its slots in New York in recent years, and it has used inefficient single-class 44-seat and 50-seat jets on many regional routes from LaGuardia and JFK.

Consumers should win, too. American Airlines plans to withdraw all of its 44- and 50-seat jets from the New York market by the end of 2021. It will replace them with larger, more comfortable jets that include first class sections. Plus, as American and JetBlue consolidate frequencies on routes they both serve, they will be able to launch new routes from New York. Lastly, their commitment to increase seat capacity significantly by 2025 should help hold fares down over the next few years.