Want to try guessing the name of my favorite health stock for 2021? Here are a few clues. This biotech company generates billions in revenue, promises leadership in its key market for at least the coming 15 years, and is trading at only about 20 times forward earnings (in a sector where 30 is low to average). And this past fall, the company raised its forecast for full-year 2020 product revenue.

I also like the fact that the coronavirus pandemic didn't interrupt the delivery of the company's drugs to patients. This player did well in weathering the coronavirus storm last year, so it should perform well this year -- crisis or not. Ready to see if you know which company I'm talking about? Well, then read on ...

Image source: Getty Images.

4 cystic fibrosis treatments

The top health stock I'm betting on this year is Vertex Pharmaceuticals (VRTX 0.59%), a biotech with four treatments for cystic fibrosis (CF) on the market. Vertex is also developing therapies for blood disorders, pain, and a lung and liver disorder known as alpha-1 antitrypsin deficiency (AATD). Let's take a look at Vertex's prospects in the near term and the long term.

CF is Vertex's main business. About 75,000 people globally have this multi-system genetic disease, which causes poor flow of salt and water in and out of organs. In the lungs, sticky mucus builds up, often leading to lung damage and death.

Prior to the launch of its newest CF drug, Trikafta, Vertex already held 46% of the global market. The U.S. Food and Drug Administration approved Trikafta in October 2019, and its sales have been booming, making it likely that Vertex's market share has increased. In the most recent earnings call, management said it expects to hold on to its leadership in the CF market until at least the late 2030s.

So, what does CF represent in terms of revenue for Vertex? Morningstar predicts the portfolio may generate more than $10 billion in revenue in 2028. And Vertex is on the right track -- Trikafta has already become a blockbuster, with more than $3 billion in revenue since it hit the market.

Product revenue is up 62%

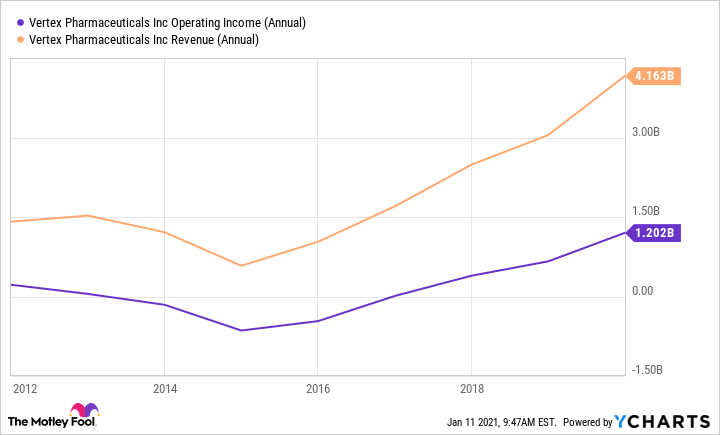

Vertex's total product revenue in the third quarter advanced 62% to $1.54 billion. And management lifted full-year 2020 product revenue guidance to the range of $6 billion to $6.2 billion, up from a range of $5.7 billion to $5.9 billion. Vertex's annual revenue and operating income have been climbing since 2015.

VRTX Operating Income (Annual) data by YCharts

In March of last year, Vertex said the coronavirus crisis hadn't interrupted the Trikafta launch or the supply of any of its treatments to patients.

Sales should continue to climb as Trikafta gains approval in expanded patient groups, based on age and genetic mutations, as well as in more countries. Vertex said Trikafta has the potential to treat about 90% of CF patients. Most recently, the FDA approved Trikafta and two other Vertex drugs -- Symdeko and Kalydeco -- for certain rare mutations that cause the disease. This means about 600 additional CF patients are now eligible for these Vertex treatments. The annual wholesale cost for Trikafta in the U.S. is $311,503 per patient.

Considering all of this, why did Vertex's shares only rise 7.9% last year? Investors sanctioned the stock this past fall after the company halted the development of a candidate for AATD, with shares sinking by 26% in one trading session. Some investors are concerned about Vertex's future beyond CF. But the failure of certain investigational drugs is a normal part of drug development. And Vertex emphasized that moving multiple candidates into early clinical trials and then selecting the strongest is part of its strategy. That's what is happening with AATD. The company has a second AATD candidate in phase 2 studies and expects data in the first halfof this year. So, in my view, the failure of one AATD candidate isn't a reason for alarm.

Vertex is progressing in other programs, too. Regarding a collaboration with CRISPR Therapeutics (CRSP 0.79%), management said the companies' gene-editing therapy helped blood disorder patients remain free of acute pain crises or the need for blood transfusions for months after treatment. The phase 1/2 studies include patients with either sickle cell disease or beta thalassemia.

Near term and long term

So, in both the near term and the long term, we can expect sales gains from Vertex's CF program. And in the long term, the biotech company's pipeline programs may lead to new treatment areas. At the moment, Vertex has seven non-CF treatments in the pipeline. In the meantime, CF leadership for nearly two decades to come sounds good to me.