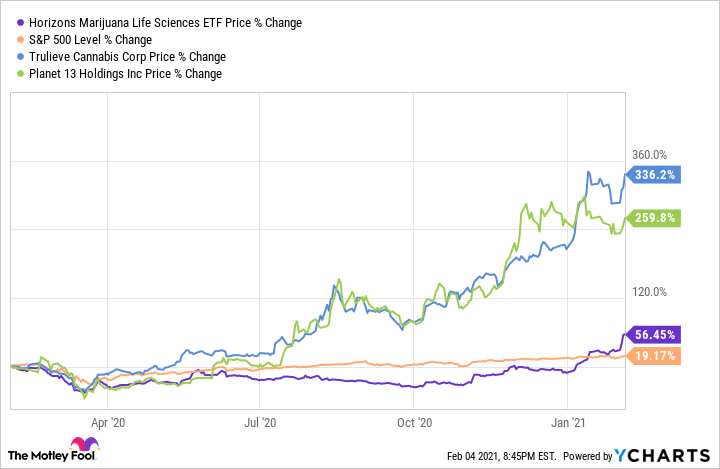

The performance of the marijuana industry as a whole -- as measured by the Horizons Marijuana Life Sciences ETF -- was trending well below that of the S&P 500 for most of the past 12 months. But the U.S. presidential elections, during which voters in several states opted to make recreational and medical uses of cannabis legal, provided a nice boost to the sector.

Since Nov. 3, 2020, the Horizons Marijuana Life Sciences ETF has skyrocketed nearly 149%, and it is up by about 80% in the past twelve months, compared to nearly 17% gains for the S&P 500 in the same period. Two pot stocks that have performed consistently well over the past 12 months are Trulieve Cannabis (TCNNF 0.52%) and Planet 13 (PLNH), as the graph below shows.

Data source: YCharts.

There are good reasons to think both of these companies can continue outperforming the market not just throughout 2021 but also in the long run. Read on to find out why both cannabis stocks are worth serious consideration.

Putting down roots in the Sunshine State

Trulieve Cannabis has focused most of its attention on Florida's cannabis market, and there are advantages to this approach. Cannabis remains illegal at the federal level, meaning it isn't legal to transport or ship the substance across state lines. Many pot growers have tried to establish a strong presence in multiple states by owning their entire supply chains in each state, but doing so can spread a company's resources thin.

Of course, there are also advantages to doing business in many different locales, but Trulieve Cannabis's focus on Florida has worked wonders so far. The company currently owns 75 dispensaries, 70 of which are in the Sunshine State. It holds an impressive 52% market share in the medical cannabis market in the state, and its financial results continue to impress.

During its third quarter, which ended Sept. 30, 2020, Trulieve Cannabis reported revenue of $136.3 million, a 93% year-over-year increase. The company also posted a net income -- a rarity in the marijuana industry -- of $4.7 million, although it decreased significantly from the $60.2 million in net income recorded during the prior-year quarter.

Image source: Getty Images.

The decline was due to a decrease in the fair value of biological assets and the revaluation of the company's warrants. In other words, Trulieve Cannabis's business isn't to blame for the drop in its bottom line. In fact, the company's operations seem to be booming. The pot grower boasted an excellent retention rate of 79% during the third quarter -- meaning it has very loyal customers -- while same-store sales grew 19% year over year. The pandemic did little to slow down Trulieve Cannabis.

Meanwhile, Florida's cannabis market is projected to continue expanding at a compound annual growth rate (CAGR) of 25.3% through 2025. While Trulieve Cannabis has a presence in other states, its strong roots in Florida will remain a major growth driver. Investors looking to cash in on cannabis companies would do well to add shares of this marijuana stock to their portfolios.

A unique business model

According to a poll conducted by Expedia, 74% of Americans prioritize experiences over products. Planet 13 is building its brand around this fact. The company is headquartered in Las Vegas, where medical and recreational uses of pot are legal. But Planet 13 does more than sell cannabis to its consumers.

In fact, the company's superstore, which is strategically located close to the famous Las Vegas strip, is a tourist attraction for cannabis aficionados and non-aficionados alike. Visitors can witness Planet 13's production process and, of course, purchase cannabis products. But it also includes a restaurant and a facility for special events.

How did Planet 13 perform at the height of the pandemic as the tourism industry stalled? Better than one might think. During the third quarter, the company recorded $22.8 million in revenue, a 36.5% year-over-year increase, and this despite operating at 50% capacity in its Las Vegas superstore. Meanwhile, Planet 13 posted a net income of $0.2 million, compared to a net loss of $1.7 million recorded during the year-ago period.

At least two major growth drivers could help this pot company continue to perform well. First, Nevada's cannabis market is projected to grow at a CAGR of 16.9% through 2025. Planet 13 currently accounts for about 9% of the total pot sales in the state, and it plans on maintaining its share of the market.

Second, the company is looking to build superstores in additional high-profile U.S. cities, including San Francisco, Miami, New York, and others. If the company manages to replicate the success it has had in Las Vegas elsewhere, the sky is the limit. With these opportunities at its disposal, Planet 13 looks well on its way to continue delivering market-beating returns in the long run.