Many investors have no choice but to get much-needed cash from their investments. Traditionally, most investors turned to bonds and bank CDs to get the income they needed. However, with interest rates at low levels, bank accounts and bonds just aren't getting the job done.

The best alternative for those needing to draw income from their portfolios is to look at dividend-paying stocks . Even if you don't like risk, there are some stocks that have reliable track records of consistent dividend payments. In fact, all three of the high-yielding dividend stocks below have paid their shareholders for more than a century.

Image source: Getty Images.

1. General Mills

General Mills (GIS -1.26%) has been a familiar company at breakfast tables for a long time. The maker of cereal and other food products started paying dividends way back in 1898, and it hasn't stopped since.

In fact, as you can see below, General Mills has done a good job of consistently raising its payout. The per-share dividend has tripled since the late 2000s. That's produced a strong yield of 3.5%, which is well above the market's average of around 2%.

GIS Dividend data by YCharts.

Many investors fear that General Mills' best days are behind it. Yet the food giant has worked hard to diversify its product offerings. Recently, the company has seen strong demand not just for cereal, but also for baking products, yogurt, and pet food.

The last year has been tough for General Mills' institutional food sales, given that restaurants and many other food-service organizations have had to suspend or cut back during the pandemic. Nevertheless, General Mills is staying on top of the situation, implementing cost controls to support earnings. The company might not bounce back right away, but dividend investors can be comfortable with their prospects for income while conditions return to normal.

2. Consolidated Edison

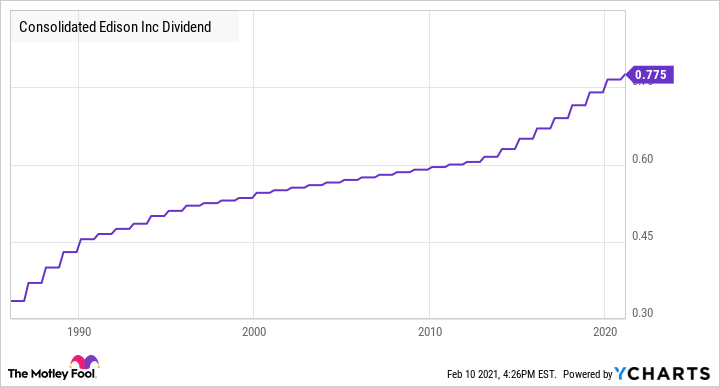

The utilities sector can be a great place to look for dividends, and Consolidated Edison (ED -1.30%) is one of the oldest. The New York-area electric utility has been making dividend payments since 1885.

It's also put up great numbers in terms of dividend growth. For 47 straight years, the utility has boosted its annual dividend payout. That includes its most recent 1.3% hike to $0.7750 per share every quarter. That works out to a generous dividend yield of 4.3%.

ED Dividend data by YCharts.

ConEd has faced plenty of challenges recently. The company has considerable debt, and it's had to deal with damage to some of its infrastructure from massive storms last summer. Meanwhile, the COVID-19 pandemic has had unforeseen effects on electricity demand that have scuttled projections the utility company and investors had made about its business.

The benefit of having a regulated utility business, though, is that ConEd can appeal to rate-setting regulators to ensure a reasonable profit. That won't necessarily produce huge short-term gains in the stock price, but it should keep dividend income flowing to Consolidated Edison shareholders.

3. ExxonMobil

ExxonMobil (XOM -0.74%) might be last on this list, but it's by far the largest company as well. Tracing the oil giant's history to its roots as part of the John D. Rockefeller Standard Oil empire, shareholders can enjoy dividend payments that began way back in 1882.

Dividend growth has also been part of ExxonMobil's history. For 38 straight years, the oil giant's payout has been on the rise, although 2020's total dividend payments exceeded 2019's only because the 2019 quarterly hike came in the middle of the year. Even so, the company's yield is the most impressive by far in this trio at 6.7%.

XOM Dividend data by YCharts. Note: The dive in the early 2000s represents a small special dividend paid in addition to regular dividends.

Among these three stocks, ExxonMobil arguably faces the most risk. Energy prices plunged to multidecade lows briefly during the depths of the coronavirus crisis. That crushed many smaller oil and gas companies, and even put pressure on ExxonMobil's more massive operations.

However, crude is now approaching the $60 per barrel level. That could be enough to provide the cash flow ExxonMobil needs to start supporting its dividend payments without extraordinary effort. If that's the case, then the share price could well rise as well, providing both income and growth for investors.

Get the cash you need

When bonds and other investments can't get the job done, dividend stocks are your ticket to portfolio income. There's risk involved, but picking the best dividend stocks can help you balance your need for cash with your desire for safety.