High expectations for solar power demand has sent solar stocks soaring lately. Stocks of top solar component suppliers SolarEdge Technologies (SEDG 16.74%) and Enphase Energy (ENPH 3.83%) have also risen significantly in the last couple of years. Both companies supply products that improve power generated from solar modules. In the last 12 months, though, Enphase Energy stock rose around 370%, outperforming SolarEdge's nearly 200% rise. Let's see what's driving Enphase Energy stock's recent outperformance and if it's a better buy right now.

Enphase Energy is catching up, fast

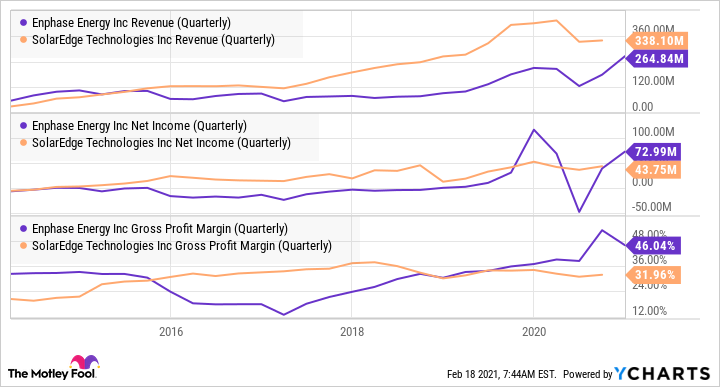

Five years back, both SolarEdge and Enphase Energy were earning roughly the same revenue. SolarEdge then expanded rapidly, far exceeding Enphase Energy in terms of revenue. In comparison, Enphase Energy found itself struggling to grow its top and bottom lines. In fact, the company faced a cash crunch in 2016. But Enphase Energy then turned itself around and came back in a big way.

ENPH Revenue (Quarterly) data by YCharts

In the last two years, Enphase Energy has beaten SolarEdge in terms of revenue growth. What's more, it is generating higher gross margins as well.

ENPH Revenue (Quarterly) data by YCharts

In the fourth quarter, Enphase Energy grew its revenue by 26% year over year, with a gross margin of 46%. In comparison, SolarEdge's revenue fell 14% year over year. Its gross margin for the quarter was 30.8%.

Likewise, Enphase Energy performed better than SolarEdge for the full year of 2020 as well. Enphase's revenue grew 24% for the year while its gross margin rose from 35.4% in 2019 to 44.7% in 2020. In comparison, SolarEdge's annual revenue grew just 2% while its gross margin fell from 33.6% to 31.6%. Enphase Energy stock's recent outperformance reflects the company's better operational performance.

Enphase Energy's efforts toward reducing costs and growing revenue along with its laser-focused approach toward profitability are paying off well.

Enphase Energy stock may not be as overvalued as it looks

Due to recent rises, both SolarEdge and Enphase Energy stocks are trading at valuation multiples much higher than the broader market. Moreover, Enphase Energy's multiples are much higher than those of SolarEdge.

ENPH PS Ratio data by YCharts

That may make Enphase Energy look far overvalued compared to SolarEdge. However, considering that it is growing at a faster pace, the premium valuation may be justified. To account for Enphase's higher growth, it would be better to compare the stocks' price-to-earnings-to-growth (PEG) ratios.

ENPH PEG Ratio (Forward 1y) data by YCharts

PEG ratio accounts for future expected growth of a company and so is a better metric to compare companies with significantly different growth rates. A lower ratio is better. Based on the companies' estimated earnings-per-share growth rates, Enphase Energy's forward PEG ratio is slightly less than one, which generally suggests fair valuation. In comparison, SolarEdge's ratio is nearly 1.4. So, based on estimated earnings growth, Enphase looks better valued than SolarEdge.

Growth prospects

Enphase Energy's guidance for revenue growth in Q1 is also higher than SolarEdge's. For the first quarter, Enphase Energy expects a 41% increase in its revenue year over year, and non-GAAP gross margin to range between 38% to 41%. In comparison, SolarEdge expects its first-quarter revenue to fall 8% year over year, and its non-GAAP gross margin to range between 34% to 36%. Lower demand for solar installations due to the pandemic impacted the performance of both companies. However, Enphase Energy seems to be bouncing back nicely.

Image source: Getty Images.

Enphase Energy is expanding its production to meet increased demand. The company recently set up a microinverter production facility in India, which started shipping in Q4. It is also progressing well with its newly launched storage battery, witnessing a 35% sequential increase in megawatt-hours of batteries shipped in Q4. Enphase Energy is investing in technologies and actively working to make sales and installations of its batteries easier for installers. Storage batteries are likely to be a key growth avenue for both SolarEdge and Enphase Energy.

SolarEdge, too, has grown handsomely over the years and is on track to launch its own battery in the second quarter. Outside solar, the company is looking to expand in the electric vehicle market in Europe. Carmaker Stellantis recently selected SolarEdge to supply powertrain units and batteries for its electric version of the Fiat e-Ducato model. SolarEdge expects its e-mobility division to generate roughly $100 million to $120 million in revenue in 2021.

Conclusion

Both SolarEdge and Enphase Energy look well placed to grow in the highly promising solar components segment. However, based on its higher revenue growth, higher margins, and growth prospects, Enphase Energy may continue outperforming SolarEdge. That makes it a better buy right now.