Walmart (WMT 1.32%) just closed the books on a record fiscal year, with sales and earnings both spiking during the COVID-19 pandemic. The retailer added a head-turning $35 billion to its revenue base in 2020, or about as much as TJX Companies books in a single year. Its free cash flow surged to $26 billion from $15 billion a year earlier.

Yet income investors didn't see a big benefit from those wins. Instead, Walmart last week announced a meager 2% dividend increase, or about the same boost as the chain issued a year earlier. And management signaled several years of heavy spending ahead that might pressure the payout.

With that mixed forecast in mind, let's look at whether Walmart is still an industry-leading dividend stock.

Image source: Getty Images.

Consolidating the gains

Walmart's recent results contained mostly good news for shareholders. Sure, its 9% comparable-store sales increase this past year trailed peers, including Target and Costco. But Walmart still handled a record volume surge that lasted for most of 2020. Its e-commerce business played a big role in supporting extra sales and rising profitability, too.

Expenses tied to meeting that demand surge will last into the next few fiscal years, however. CEO Doug McMillon and his team are expecting to spend $14 billion on capital investments in 2021 compared to around $10 billion in each of the past two years. "We're winning and we intend to keep pushing the ball aggressively down the field," he told investors while predicting several years of elevated spending ahead.

That's likely the biggest reason why Walmart's dividend boost was so small when compared to earnings or cash flow gains in 2020.

Other cash returns

On the other hand, Walmart is still sending plenty of cash to investors, with $20 billion of stock buyback spending expected over the next several years. The new investment focus should also lay the groundwork for faster, more profitable growth ahead. The 4% annual sales gains management is targeting with this plan is "the equivalent of adding a Fortune 100 company every year" to the sales base, management estimated.

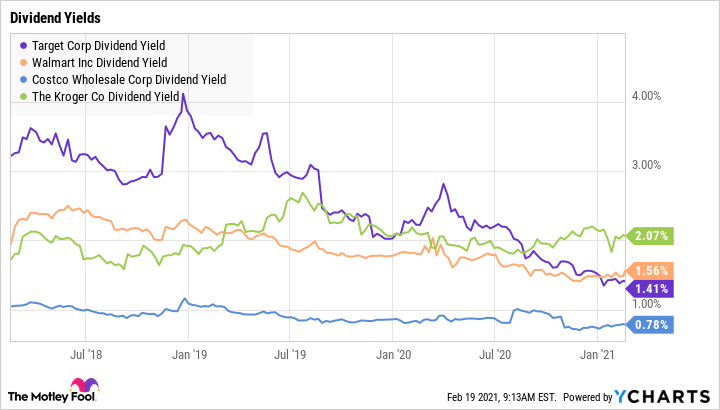

TGT Dividend Yield data by YCharts.

Walmart's yield today puts its in the middle of the pack when compared to peers, with Costco's commitment at the bottom, while Kroger's is just over 2%.

Shifting toward growth

Investors should be excited about Walmart's more growth-focused posture, especially since last year's results suggest that there's a lot of room to expand both in stores and online. That strategy means there might be weak cash returns in the short term, just as fellow Dividend Aristocrat PepsiCo recently announced when it issued its own aggressive spending outlook for 2021.

Walmart is reacting to the growth opportunity it sees and its huge sales footprint means it can direct more cash toward those initiatives than almost any other company on the planet.

Yes, income investors might have to wait a few years for those returns to pick up and really start amplifying earnings and dividend growth. But Walmart has a stellar track record for making these types of long-term capital bets, and there's no reason to think this one will be a flop.