What happened

Shares of Nikola (NKLA -14.27%) dipped 23.3% in March, according to data from S&P Global Market Intelligence. The electric vehicle (EV) stock slumped amid mixed coverage from analysts and sell-offs for the broader EV space.

Many growth-dependent technology companies suffered steep valuation pullbacks last month, and Nikola's sell-off pushed its stock into negative territory on the year. Its share price may also have been negatively impacted by the company announcing that it had filed for a $100 million new stock offering on March 15.

Nikola's Tre semi-truck. Image source: Nikola.

So what

J.P. Morgan analyst Paul Coster published a note on Nikola stock on March 5, downgrading the firm's rating on the stock from overweight to neutral, and lowering his one-year price target on the stock from $33 per share to $30 per share. However, other analysts were more bullish on the stock last month.

Vertical Research's Jeffrey Kauffman initiated coverage on March 26, giving the EV stock a buy rating and establishing a price target of $24 per share. Nikola is betting that it can make a splash in the trucking industry with electric- and hydrogen-powered vehicles, and Kaufman expects there could be a fairly smooth, post-pandemic recovery in the transportation and freight sector. If that proves to be the case, it could create opportunities for Nikola.

Now what

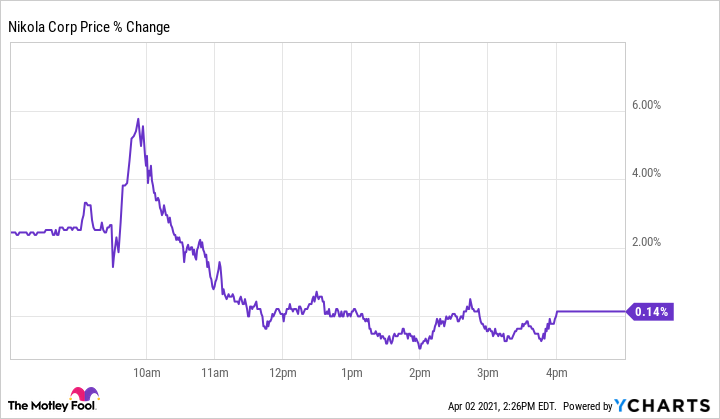

Nikola's stock has traded roughly flat early in April.

Nikola is still a very young company that has yet to ramp up manufacturing and vehicle deliveries. The company expects that it will start trial production at its German joint venture manufacturing facility this June and then start production at its Arizona facility in the third quarter. It also expects to begin construction of its first commercial hydrogen station this year and deliver its first Tre battery electric vehicles in the fourth quarter.

Nikola has a market capitalization of roughly $5.5 billion and is valued at approximately 306 times this year's expected revenue.

![Nikola_DiageoDHL[11] copy](https://g.foolcdn.com/image/?url=https%3A%2F%2Fg.foolcdn.com%2Feditorial%2Fimages%2F795204%2Fnikola_diageodhl11-copy.jpg&op=resize&w=92&h=52)