For years, Domino's (DPZ -1.07%) has been the pacesetter in the restaurant industry when it comes to adopting new technology.

The delivery-first pizza slinger has innovated in a number of ways over the last decade, including adding a web-based order tracker, creating mobile hot spots for getting pizza delivered to outdoor locations, and allowing customers to order in novel ways, including through emojis. The results, along with a commitment to improving the company's recipes and food quality, have driven a remarkable boom: The stock is up more than 2,000% over the last year. Now Domino's is taking another significant step in its tech-first strategy.

Image source: Domino's.

Delivery by robot

Domino's said Monday that it is teaming up with Nuro, a maker of autonomous vehicles, to offer pizza delivery with an autonomous-vehicle (AV) robot to select customers in Houston starting this week. Nuro's R2, the AV being used, is the first completely autonomous, occupant-less, on-road delivery vehicle that has been approved by the U.S. Department of Transportation.

Dennis Maloney, the company's chief innovation officer, explained the move, which was first announced in 2019, saying,

There is still so much for our brand to learn about the autonomous delivery space. This program will allow us to better understand how customers respond to the deliveries, how they interact with the robot and how it affects store operations. The growing demand for great-tasting pizza creates the need for more deliveries, and we look forward to seeing how autonomous delivery can work along with Domino's existing delivery experts to better support the customers' needs.

For Domino's, testing autonomous delivery is a natural extension of its e-commerce strategy, and the company is well positioned to benefit from automation technologies like driverless cars, digital assistants to take orders, and robots to assist with food prep.

Delivery drivers are a significant expense for the company and its franchisees, and hiring drivers can also be a choke point in ramping up with demand. Ride-sharing giant Uber just said it's struggling to find drivers in both its ride-hailing and delivery segments, and Maloney said back in 2019 when the company announced the AV initiative:

This is the future of our company -- this fundamentally changes our business model. The cost will be way different than what it is for delivery drivers. We struggle to find enough drivers. Minimum wage is going up. All of that changes with an autonomous vehicle.

Image source: Domino's.

Where Domino's stock is today

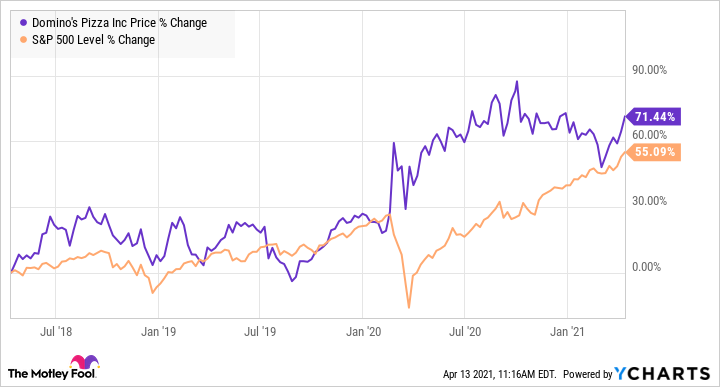

After years of outperformance, Domino's stock has cooled off more recently. As the chart below shows, the stock has only modestly beaten the S&P 500 over the last three years, and that pattern is similar dating back to the beginning of 2020, before the pandemic, even though Domino's has been a big winner during the crisis.

U.S. same-store sales jumped 11.5% last year, while international comps rose 4.4% as the strength of the company's delivery model helped it overcome COVID-19-related challenges. Earnings per share for the year jumped 30% to $12.39, showing it continues to gain leverage.

In its two- to three-year outlook, the company called for annual global retail sales growth of 6% to 8% global net unit growth. That shows that comparable sales will slow down from their brisk clip in 2020 as the company laps the tailwinds of the pandemic, but Domino's is still well positioned for long-term growth. It's also been able to consistently expand its margins.

That pattern should continue, as the pandemic only put Domino's in a stronger competitive position against rival restaurant chains, which have struggled during the crisis and have been unable to invest in growth and innovations like AV delivery.

It's impossible to know where this experiment will go. A few years ago, prognosticators were forecasting that self-driving cars would soon be common. Clearly, that hasn't happened yet. Domino's is only testing robot delivery from one restaurant in Houston, but if it's successful, it could be both a huge cost saver and a crowd pleaser. Meanwhile, it's the latest evidence that Domino's continues to push the envelope in the restaurant industry. Expect the stock to remain a winner.