Stratasys (SSYS 0.86%) is slated to report its first-quarter 2021 results before the market open on Wednesday, May 5. Its conference call with analysts is scheduled that day at 8:30 a.m. EDT.

The 3D printing company's report will come ahead of that of its fellow early mover in the industry, 3D Systems (DDD 3.33%), which plans to announce its first-quarter results after the market close on Monday, May 10, as outlined in this 3D Systems earnings preview.

Like 3D Systems and other companies that have a significant concentration of customers in the industrial sector, Stratasys' 2020 results were hurt by the fallout from the COVID-19 pandemic. The good news, however, is that its results in the second half of last year improved relative to the first half.

In 2021, Stratasys stock is up 10.7% through April 22. This performance is in line with the S&P 500's 10.6% return, but significantly trails 3D Systems stock's 106% gain.

Here's what to watch in Stratasys' Q1 report.

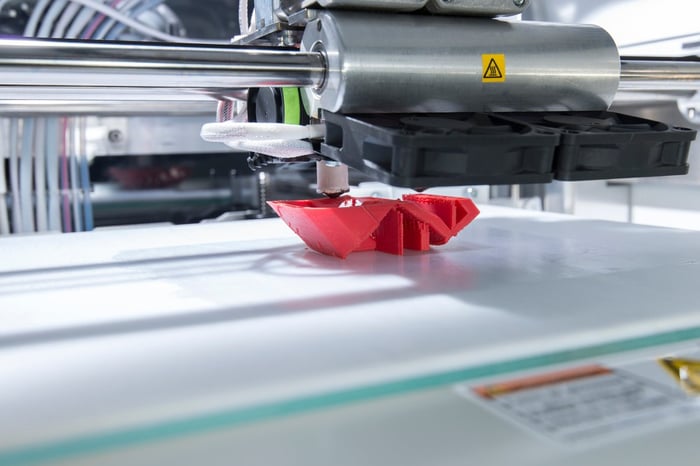

Image source: Getty Images.

Key numbers

Here are the company's results from the year-ago period and Wall Street's consensus estimates to use as benchmarks.

| Metric |

Q1 2020 Result |

Wall Street's Q1 2021 Consensus Estimate | Wall Street's Projected Change (YOY) |

|---|---|---|---|

|

Revenue |

$132.9 million |

$132.3 million |

(0.5%) |

|

Adjusted earnings per share (EPS) |

($0.19) |

($0.06) |

N/A. Loss expected to narrow by 68% |

Data sources: Stratasys and Yahoo! Finance. YOY = year over year.

Management guided for first-quarter revenue "similar" to the company's year-ago revenue, which explains the Wall Street consensus estimate.

For context, last quarter, Stratasys' revenue fell 13% year over year to $142.4 million. That result topped the $135.1 million consensus estimate and was an 11% increase from the prior quarter. Adjusted EPS was $0.13, down from $0.18 in the year-ago period, but much better than the breakeven result ($0.00) analysts had expected.

Last quarter, 3D Systems posted revenue growth of 2.6% year over year, so its top-line performance was notably better than Stratasys'.

3D printer and material sales

Investors should continue to focus on sales of 3D printers and print materials. As I wrote last quarter, "This data reflects how well the company's razor-and-blade business strategy is working. Sales of 3D printers (the 'razors') are ultra-important because they drive sales of print materials (the 'blades'), which have high profit margins."

Last quarter, Stratasys' 3D printer revenue dropped 8% year over year, and print materials revenue fell 10%. These are hardly the type of results investors want to see, but they do at least represent a considerable improvement from the prior couple of quarters, which were torpedoed by the pandemic. In the third and second quarters of 2020, printer revenue plunged 21% and 36% year over year, respectively, while print materials revenue plunged 22% and 31%.

Second-quarter guidance

Last quarter, the company said that "second-quarter 2021 revenue should approximate mid-teens percentage growth year over year."

Any notable change in this guidance would probably move the stock in one direction or the other.