For several years, Macy's (M 5.75%) has been looking for ways to capitalize on the massive real estate value of its iconic flagship store in Manhattan. Two years ago, it began promoting the concept of building an office tower above the Herald Square flagship to unlock some of this value.

The pandemic gave Macy's bigger fish to fry, forcing it to halt work on its skyscraper proposal. However, with the pandemic easing and the core retail business looking more stable, the department store giant is pressing ahead with its effort to cash in on its best piece of real estate.

What Macy's is planning

At its investor day in early 2020, Macy's said it hoped to build a 1.5 million-square-foot office tower above the Herald Square flagship. The skyscraper would rise 700 to 950 feet above the middle of the store, which occupies a full city block. Importantly, Macy's would keep the flagship store intact. During normal times, the Manhattan flagship generates a huge amount of sales and profit for the retailer.

Image source: Macy's.

Aside from the technical challenges of building a skyscraper above an existing building, changing the zoning of the Herald Square property represents the biggest hurdle to moving forward. Macy's recently made an important announcement that shows how it intends to overcome this obstacle.

Offering carrots to win approval

In a press release last week, Macy's laid out a plan for the department store chain to invest $235 million in the Herald Square neighborhood, primarily in the form of infrastructure improvements. Macy's proposes to upgrade the existing entrances to the Herald Square subway station: the third busiest in the New York City subway system. It would also add ADA-accessible elevators in two locations and create a new entrance to the Herald Square subway station from 7th Ave. (the opposite end of the Macy's property).

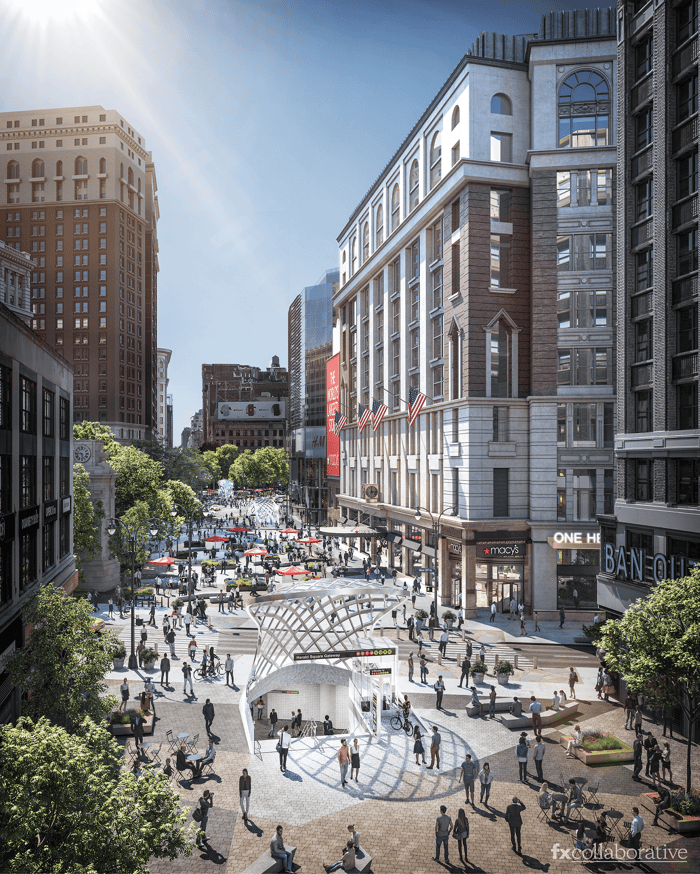

Macy's wants to create a permanent pedestrian plaza outside its Manhattan flagship store. Image source: FXCollaborative.

All of these upgrades would help relieve congestion in the Herald Square area: a key concern among many people who live and work nearby. Macy's also proposes to enhance the existing car-free zone on Broadway (outside the store's main entrance) into a permanent pedestrian plaza.

Macy's estimates that the addition of a 1.5 million-square-foot office tower and its planned infrastructure upgrades would together create 16,290 jobs, $4.29 billion of annual economic output, and $269 million of new tax revenue annually. It hopes that the proposed infrastructure investments and these potential economic benefits will help it win enough local support to get the zoning changes it needs to proceed.

A promising step forward

It will probably take Macy's at least another year -- and potentially quite a bit longer -- to get all of the necessary approvals to move ahead with its skyscraper project. That's not necessarily a bad thing, though. Macy's is counting on people returning to offices later this year, kick-starting a recovery in Manhattan office demand and thereby increasing the likely value of its planned office tower.

If Macy's ultimately succeeds in getting the zoning changes it needs, it will have been worth the wait. The company's willingness to spend $235 million on infrastructure upgrades should give investors an idea of just how much it thinks development rights for a 1.5 million-square-foot office tower would be worth.

Macy's would most likely monetize the skyscraper opportunity up front by selling the project to a developer. That would allow it to continue reducing its debt. (Alternatively, it could contribute its property in return for a joint-venture stake in the tower project.)

In the long run, Macy's would also benefit from having thousands of workers commuting to offices above its biggest store every day. Similarly, pedestrian improvements in front of the main entrance and other infrastructure upgrades could boost customer traffic. For all these reasons, investors should watch closely as Macy's works to bring its office tower concept to life over the next few years.