It's not easy to find great-value stocks in the market right now. Still, I think electrical products company nVent Electric (NVT 2.00%), specialty chemicals distributor Univar Solutions (UNVR), and painting and coatings company Axalta Coating Solutions (AXTA -1.18%) are all excellent stocks for value-orientated investors. Here's why.

nVent Electric

The company is not a household name among investors, but that doesn't mean it's a bad investment. The case for buying the stock rests on its products' critical nature and its customers expanding their spending.

nVent is a leader in "connection and protection." The company operates out of three segments. The enclosures segment (around 48% of revenue) connects and protects electronics, communication, and power equipment. The second-largest segment is electrical and fastening solutions (28%) for electrical and mechanical systems. The third, thermal management (24%), provides electric thermal solutions for critical buildings and infrastructure.

Image source: Getty Images.

As such, nVent plays on the increasing electrification of industry, buildings, infrastructure, and the energy industry; fortunately, it's an excellent megatrend to be in. If you are going to invest in renewable energy, you will need transmission, distribution, and storage. If you are a factory owner investing in automation, you will need more electrification. If you are determined to make buildings and infrastructure better run by becoming "smart" and connected, you will need more electrification -- data centers, 5G networks, power utilities, etc. The list goes on.

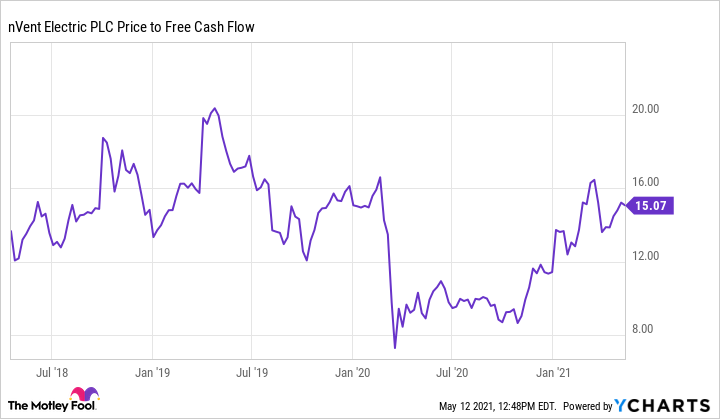

As such, Wall Street analysts have sales growing at a mid-single-digit rate after the initial double-digit growth bounce-back in revenue in 2021. Meanwhile, nVent is forecast to convert around 14% of its revenue into free cash flow (FCF). If you accept a mature industrial as being fairly valued at 20 times FCF, then nVent is undervalued.

Data by YCharts

All about self-help for Univar Solutions

The case for buying this specialty chemicals distributor stock depends on it successfully executing its so-called "S22" objectives for 2022. Specifically, management plans to cut its net debt-to-earnings before interest, taxation, depreciation, and amortization (EBITDA) ratio to below three times compared to 3.5 times at the end of 2020. Meanwhile, management is targeting a 9% adjusted EBITDA margin compared to 7.7% in 2020 while maximizing FCF generation.

Image source: Getty Images.

Management aims to execute its ongoing plan to successfully integrate the $1.8 billion acquisition of Nexeo Solutions, made in 2019, as part of its strategic drive to focus on its core specialty chemicals distribution business. Alongside the Nexeo acquisition, management divested Nexeo's plastics distribution business in 2019. Similarly, Univar sold its environmental sciences business in 2019, its industrial spill business in 2020, and its own plastics distribution business in 2021.

Everything points to a company refocusing on its core competency, and Univar appears to be on target with its S22 plan. For example, management recently raised its 2021 adjusted EBITDA guidance to $680 million to $700 million from a previous range of $630 million to $650 million. Based on Wall Street revenue estimates, the updated guidance implies an 8% EBITDA margin for 2021, and management affirmed it was well on track for 9% by 2022.

Turning to valuation matters, CFO Nicholas Alexos said on the earnings call, "Excluding the final Nexeo integration expenses of the $70 million, our guidance would be in the range of the normalized free cash flow of $325 million to $375 million." If you take the midpoint of the normalized FCF range as underlying FCF, then Univar currently trades on less than 13 times ongoing FCF. That's too cheap for a company set to continue expanding revenue and margin until 2022.

Axalta Coating Systems

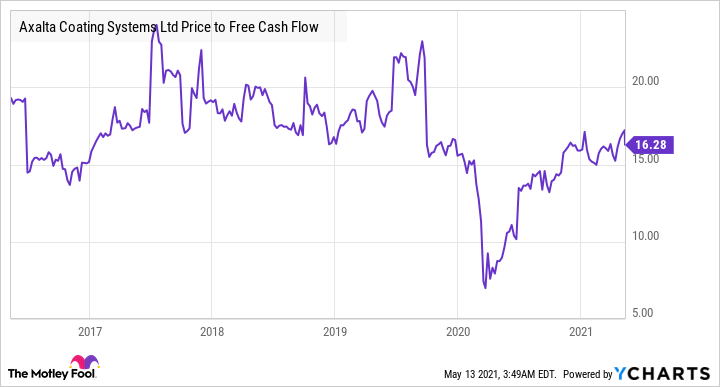

Axalta is one of those stocks that makes you wonder, why it is so cheap? On a price-to-FCF basis, the painting and coatings stock is very attractively priced.

Data by YCharts

The reason for the low valuation probably comes down to its exposure to automotive production -- not a great market to be in in the last couple of years.

But here's the thing, or rather the three things. First, Axalta generates more revenue from the refinish market and industrial markets. It's more tied to the industrial economy, the number of vehicle miles driven, and the accident rate than automotive production.

Data source: Axalta presentations. Chart by author.

Second, the performance coatings segment (refinish and industrial) tends to have a much higher margin than the mobility coatings segment (commercial and light vehicle). For example, in the recent first quarter, the performance segment generated a profit margin of 16.6% compared to just 11% for the mobility segment.

Finally, management expects all its end markets to embark on a nice bounce in growth from the lows of 2020.

| Axalta Coating Systems End Market |

Estimated Industry Net Sales Growth 2020-2024 CAGR |

|---|---|

|

Refinish |

9.5% |

|

Light vehicle |

11% |

|

Commercial vehicle |

10% |

|

Industrial |

14.5% |

Data source: Axalta presentations. CAGR = compound annual growth rate.

All told, Axalta's stock looks like it has plenty of upside potential as the economy recovers.