Shopify (SHOP 1.48%) has built its company on enabling businesses to launch e-commerce sites. The platform's ease of use has made it one of the top companies in this niche. As a result of this popularity, the stock price has seen a massive surge over the last five years, especially in the past year as e-commerce sites were in high demand as part of efforts to deal with the coronavirus pandemic.

Shopify's market valuation has been inflated by this enthusiasm for the stock. But with the pandemic restrictions easing, as well as the need for e-commerce alternatives, is the stock still a buy at suck elevated valuation levels?

Let's take a look and try to figure out if Shopify stock is still a buy.

Image source: Getty Images.

Shopify is spending money to make money

Shopify made its name by offering an e-commerce platform that users find easy to adapt. Over 1.7 million businesses now sell on a Shopify platform. Users receive unlimited item postings, 24/7 support, access to sales channels and social media, secure payment options, and many other features.

Still, Shopify does not dominate its market. Businesses have dozens of choices when it comes to e-commerce platforms that can help sell their products. According to Oberlo, WooCommerce holds the largest market share at 26%. Shopify remains a close second at 23%, while Wix (WIX -0.15%) and Squarespace (SQSP) also hold a double-digit percentage market share.

Fortunately for Shopify, it has expanded its competitive moat by serving as more than a mere platform. Shopify Payments, Shopify Shipping, and Shopify Capital helped to take the company into logistical and financial services. However, its competitive edge has become increasingly centered on the Shopify Fulfillment Network (SFN). The SFN service sorts, packs, and ships orders, giving business owners more time to focus on business management.

This makes Shopify a conglomerate while most of its peers remain pure-play tech stocks centered around platforms. But to truly make that competitive moat effective, Shopify will have to invest substantial amounts of capital to build fulfillment centers in its largest markets. That investment could pay off well since most of its competitors remain focused on software.

Measuring Shopify's attributes

Shopify's revenue levels point to the success of this strategy. In the first quarter of 2021, revenue of $989 million increased by 110% from year-ago levels. During that time, the company limited the surge in operating expenses to 33%, earning the company an operating profit of $119 million. Shopify's merchants are driving growth in large part as merchant solutions, the division which runs SFN, experienced the largest revenue increases. Its revenue spiked 137% versus the 71% surge in subscription solutions revenue.

Additionally, an investment in a company called Affirm added close to $1.3 billion to the company's income. Also, income taxes nearly quadrupled, but in the end, the company reported more than $1.26 billion in quarterly net income, well above the $31 million lost in the same quarter last year.

To show how significantly Affirm affected income, Shopify earned only $320 million in net income in all of 2020, and this occurred at a time when revenue rose 86% from 2019 levels.

Moreover, like other e-commerce companies, Shopify has offered only a limited outlook. The company expects customers to again focus on offline shopping as the U.S. emerges from the pandemic. While it predicts its highest revenue in the fourth quarter, it forecasts that operating income for 2021 will fall below 2020 levels.

Nonetheless, it still managed to generate free cash flow of over $130 million during the quarter. Additionally, with $7.8 billion in liquidity and $909 million in debt, the company's balance sheet remains stable. That liquidity means that adding fulfillment centers as needed will not become an issue for the company.

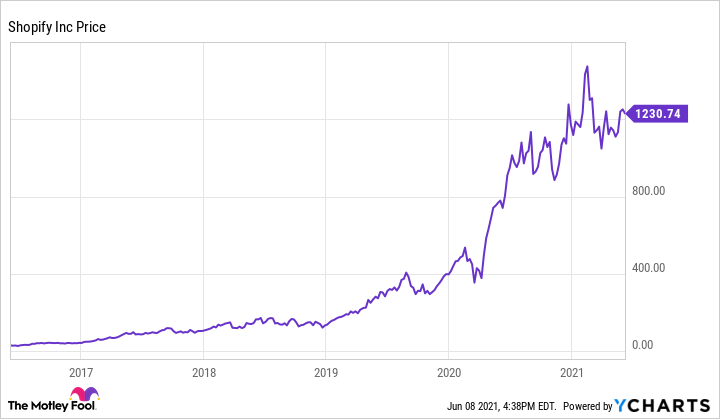

Furthermore, the rapid revenue growth and expanding moat have given prospective buyers an added incentive to buy Shopify. Shopify's stock price has moved higher by over 4,000% over the last five years, though it has only risen by about 10% in 2021. Concerns about the return of in-store shopping amid a receding pandemic may have given some investors pause.

SHOP data by YCharts

As a result, Shopify stock trades at approximately 45 times sales. Its P/E ratio remains elevated. While the income from Affirm helped to take the P/E below 100, it has stood at over 400 before the earnings report. For this reason, the earnings multiple will likely rise again without a similar income boost in the second quarter.

Should you buy Shopify?

Thanks to its rapid revenue growth and expanding competitive moat, Shopify stock should remain a winner long-term. However, with stock price growth slowing in recent months, new buyers may want to hold out for a lower entry point for buying in. As already mentioned, the P/E ratio is likely to rise again if net income doesn't keep pace with revenue growth. Moreover, while its growth should continue, it may not occur fast enough to justify a 45 sales multiple.

But if the stock experiences a significant price pullback, investors might want to take the opportunity to buy in on this growing software-as-a-service operation.