The leaders of large nations (the U.S., for example) generally feel that there is a need to support a strong military and the industries that supply that military. The dollars directed toward the defense industry do wax and wane a bit with changing political and world environments, but companies like Lockheed Martin (LMT 0.18%) have basically become necessity businesses in the military-industrial complex.

But that government support doesn't mean Lockheed Martin stock is always worth buying. It's important to take into account both the business it is pursuing and the current stock valuation before deciding to step aboard. Here's a quick look at this defense industry giant.

Lockheed Martin's stock price tag suggests sale prices

Before getting into what makes Lockheed Martin tick, let's look at a few stock valuation metrics. The price-to-sales ratio works well because defense industry sales tend to be more consistent over time than earnings, which can vary dramatically from year to year. Lockheed's price-to-sales ratio is currently at 1.6. Taken alone that figure is not so interesting, but when compared to the company's five-year P/S average of 1.7 times, you see that the company looks at least a bit cheaper than usual.

Image source: Getty Images.

That discount trend flows through to the other key valuation metrics. The price-to-earnings ratio is at 15.3 versus a five-year average of 22.9. Price-to-cash-flow is around 14.1 times versus a long-term average of 17.2 times. And price-to-book-value is sitting at about 16.8 times versus a five-year average of 50 (there's some noise in that average, but the current number is also below the ratio of 20 seen in 2020).

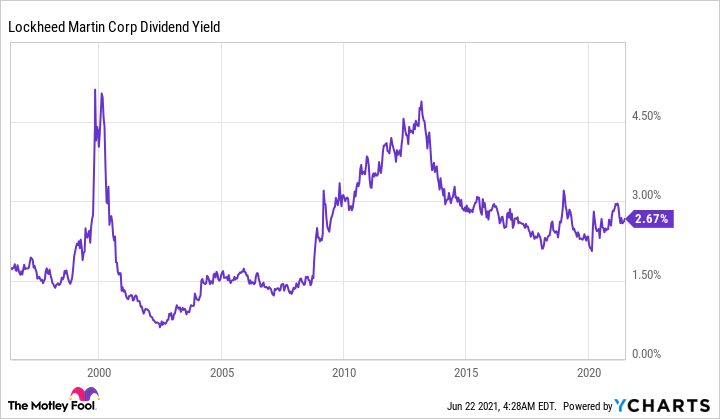

Lockheed Martin's dividend yield, meanwhile, is toward the higher end of the company's historical range. That said, the current yield of roughly 2.7% is extremely generous compared to the broader market (the yield on the S&P 500 index is a scant 1.3% at the moment), but hardly a massive figure. Still, all of these numbers point to a stock that appears relatively cheap today.

What does Lockheed Martin do?

Lockheed Martin is a diversified company and one of the biggest military-industrial names you can buy. The company breaks its business down into four segments: aeronautics (about 40% of sales), rotary and mission systems (nearly 25%), space (18%), and missiles and fire control (17%). As for profits, the large aeronautics business contributes about 40% to segment profits (roughly in line with its share of sales). Space and rotary and mission systems fall a little short of their sales contributions with segment profits of around 15% and 23%, respectively. The missiles and fire control division punches above its weight, contributing segment profits of around 22%.

Those figures are just a snapshot in time and don't take into consideration how the world is changing. For example, getting humans and other objects into space has increased in importance for customers like the U.S. government. When you consider that 74% of sales in 2020 were tied directly to the U.S. government, having a space segment takes on added importance. And yet, 25% of sales came from international customers, many of which are military sales contracted through the U.S. government.

A scant 1% of sales come from commercial customers. Basically, if you have one customer, you do what they ask, even if that means some businesses you end up in might not be as profitable as others.

LMT Dividend Yield data by YCharts

While over-reliance on the U.S. government is a worry, the necessity of military spending means that Uncle Sam will always be a ready customer. And a good portion of the business is contract-driven, which allows for some stability from year to year. For example, Lockheed Martin had a backlog of $147 billion in contract work at the end of the first quarter. The company had $65.4 billion in sales in 2020, suggesting that the backlog represents more than two years of sales. That's a vast simplification of a complex business, but the key point is that there's a lot of work on the books to support the company's top and bottom lines over time.

In fact, Lockheed Martin actually increased its sales and segment profit outlook in the first quarter. It was a fairly small change, but it was in a positive direction, which is significant given the historically low price point the stock is currently trading.

Lockheed Martin stock: To buy or not to buy

All in all, Lockheed Martin has a widely diversified business with a strong (and strengthening) outlook, and it is trading at what appears to be a modest price. If you can stomach the reliance on one main customer, Lockheed Martin does, indeed, appear worth a close look today. Investors who don't want to support military efforts in any way might want to avoid Lockheed Martin stock.

Deep-value investors might less than enthused as well. The stock looks relatively cheap, but it has been notably cheaper in the past, with its yield spiking above 4.5% in the early 2000s and again in the early 2010s. If you can wait, consider keeping the stock on your watch list to see if you may be able to get a better entry point.

But if you are content with a solid company whose stock is trading at a fair-to-slightly-cheap price, Lockheed Martin could make a good long-term addition to your portfolio.