Ballard Power Systems (BLDP -3.61%) reported a 3% year-over-year fall in its second-quarter revenue last week. This was the third consecutive quarter in which Ballard reported a fall in its revenue. But declining revenue isn't the only thing concerning Ballard Power investors right now. Let's take a closer look at Ballard Power's performance in the latest quarter, as well as the outlook for the company and its stock.

Ballard Power's gross margins shrink

The fall in Ballard Power's revenue was primarily due to lower sales in China and a decrease in sales to Plug Power (PLUG -3.87%). Declining sales in China is a key concern, and the trend isn't restricted to this quarter alone. Randy MacEwen, President and CEO of Ballard Power, noted in the press release that there are "clear commitments" relating to hydrogen in Europe and the U.S. but "further clarity regarding the China hydrogen and fuel cell policy" is "still to come." China is Ballard Power's key market and accounted for more than half of its total revenue last year. So, weakening sales there is driving down the company's overall sales growth.

Image source: Getty Images.

The second reason behind the drop in Ballard Power's revenue is equally concerning. Ballard Power sells fuel cells for material handling applications to Plug Power. Though Plug Power's primary focus has so far been the material handling market, it is looking to expand into the heavy-duty segment, which is Ballard Power's key target segment. Depending on your potential competitor for revenue isn't a great idea, as evident by a 12% decrease in Ballard Power's material handling revenue in Q2 due to lower shipments to Plug Power. Notably, Plug Power grew its gross billings by 75% in Q2 with significant contribution from its material handling business.

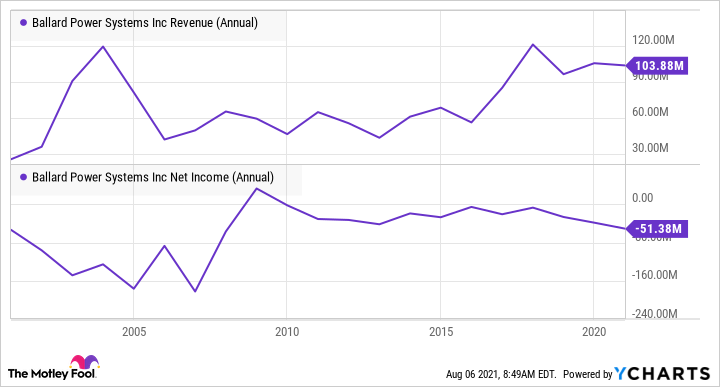

The fall in revenue, combined with a shifting of revenue mix to lower-margin products and services, caused Ballard Power's gross margins to shrink to 15% from 21% in the year-ago quarter. Ballard Power has been generating losses for years.

BLDP Revenue (Annual) data by YCharts

Restricted revenue growth and falling margins mean that it might continue to incur losses in the foreseeable future, too.

Strong cash reserves

On the operational front, there was little to like in the report. However, Ballard ended the quarter with strong cash reserves of $1.24 billion. While that much cash could cover the company's operating expenses for the next several years, it isn't really a sustainable business model. In the last year, Ballard Power's outstanding shares have increased by more than 20% while its stock price has come down back to roughly where it was a year ago, after rising above $40 in February. The company raised $550 million in February this year and $402 million in November last year through common stock offerings.

Ballard Power needs to start generating profits from operations to grow, rather than dilute existing shareholders.

Another positive point in the report was the growth in Ballard Power's order book. The company received $26.1 million in new orders, up from $11.8 million in Q1. The order backlog rose to $113.3 million at the end of the quarter from $112.1 million at the end of Q1. This growth should bode well for Ballard's revenue growth in the coming quarters.

Is Ballard Power stock a buy?

Hydrogen fuel cells have several useful applications. But advancements in batteries may restrict growth of hydrogen fuel cells. Increased competition in the fuel cell market means squeezed margins for providers. With profits still nowhere in sight, fuel cell companies remain an extremely risky bet.

Ballard Power stock is trading at a price-to-sales ratio of more than 40. To justify such a valuation, the company needs to grow its sales, and eventually start making profits. While Ballard Power's revenue fell in the latest quarter, Plug Power's revenue rose 83%. Ballard Power is also struggling on the margin front.

Though Ballard Power's price-to-sales ratio has fallen to less than half of what it was in January, it still looks too high considering the company's performance. Ballard Power's latest quarterly results failed to address this concern.