There are few income stocks more elite than the Dividend Aristocrats. These are the rare S&P 500 component companies that have lifted their dividends at least once per year for a minimum of 25 years running.

While these are understandably popular with investors because of their exemplary payout track records, there is a clutch of stocks with shorter streaks that are just as worthwhile. One would-be Aristocrat in the financial sector is particularly worthy of investor consideration, in my view.

Image source: Getty Images.

It's good to be the middleman

Step onto the stage, CME Group (CME 0.58%). CME Group is the operator of the Chicago Mercantile Exchange (hence the initials), which is the largest and most important derivatives exchange on these shores. It also operates three smaller derivatives markets.

Like other such operators -- equity market kings Nasdaq and Intercontinental Exchange (which owns the New York Stock Exchange) being two notable examples -- CME Group makes its money on trading. The bulk of its revenue comes from clearing and transaction fees related to trades effected on its exchanges.

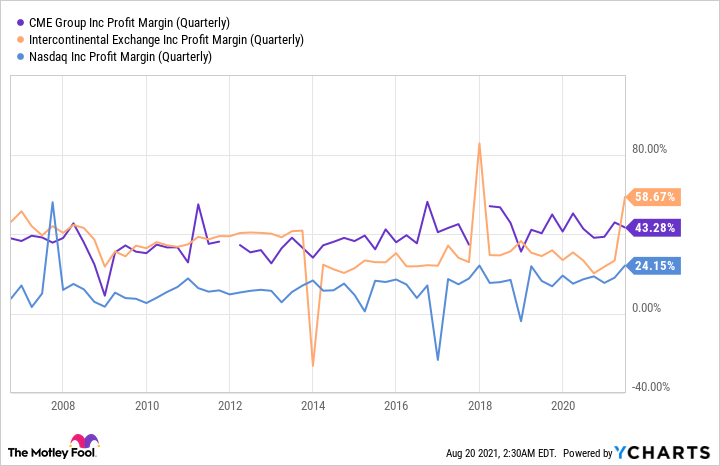

That middleman position is a nice one to be in. By facilitating trades -- and not being more deeply involved in them -- this financial sector mainstay operates in a high-margin business. Actually, that's something of an understatement. Check out the margins enjoyed by CME Group, Nasdaq, and Intercontinental Exchange:

CME Profit Margin (Quarterly) data by YCharts

By the way, notice that of the three, CME Group's margins are the only ones that have not recently dived into negative territory. They're also more consistent (typically floating around the 40% level) than either Nasdaq's or Intercontinental Exchange's.

The fundamental performance of all three is, naturally, dependent on trading volumes. While there's some justifiable concern that these might be tapering off, CME Group's robust business and its relatively modest costs should keep profitability high.

And as for the dividend, the company's free cash flow is solidly in the black. Even though that line item in its most recently reported quarter was relatively light at just over $460 million, it was more than enough to fund the $322 million-plus in dividend payouts. The company's debt, meanwhile, is manageable, with interest expenses putting only a small dent in its finances.

So CME Group is happy to share its profits with stockholders. In 2011, with the rubble of the financial crisis still smoldering around it, the company began to raise its dividend once every year, and it has shown no intention of stopping. From then to now, the distribution has advanced steadily from $0.28 to $0.90 per share -- a more than three-fold increase.

What's more, at the end of every good year (and there have been plenty of those) CME Group also pays out a variable dividend depending on how it performed. Some of these variables have been rather generous; the last two were $2.50 apiece, which alone would yield 1.2% -- a higher rate than many finance sector peers. Taken together, the four quarterly 2020 payouts plus the variable made for a combined dividend yield of 3.1% at recent prices.

Stock exchanging

Dividend stock investors who've piled into CME Group might be concerned that the company is heavily rumored to be buying its longtime colleague Cboe Global Markets for $16 billion. Any acquisition, particularly an 11-figure one, can put a real strain on even a monster company's finances.

However, according to the latest media reports (which CME Group is denying), the company is offering an all-stock buyout of Cboe. So while the deal would be expensive, it apparently would be funded purely with equity, which won't directly affect the cash pile that funds the dividend.

To sum up, I think the dividend from the ever profitable and cash-vacuuming CME Group is not only safe, but almost certainly set to grow -- to the point where, some years from now, it ultimately earns its Dividend Aristocrat badge.