The energy industry has undergone a number of major changes over the last decade. Coal use is in decline, renewable energy continues to grow, and electric vehicles continue to gain market share. Despite these changes, energy stocks have been led by fossil fuel producers in 2021. Oil, natural gas, and coal prices are up, and supply appears to be constrained for the foreseeable future.

As investors look for opportunities to make money long-term in energy, I think there's one company that has the tailwinds at its back. First Solar (FSLR -0.87%) is a leader in renewable energy. It should benefit from short-term supply constraints facing the industry, and it can grow along with solar energy production. Here's why it's my top energy stock for October.

Image source: First Solar.

The short-term energy picture

As the global economy comes out of the economic decline caused by the pandemic, we're seeing how supply and demand are affecting the energy markets. When oil and natural gas prices plunged in 2020, companies cut back on investment, and that's having cascading impacts on the supply/demand balance as demand picks up quickly. At the same time, supply chain disruptions are impacting China, the main source of solar materials. Here are some factors that shape the picture for First Solar:

- Oil, natural gas, and coal prices are up, which will ultimately drive utilities and power plant developers to see solar energy as more economical than fossil fuel options for new generation.

- The price of polysilicon -- a raw material for most solar panels -- is up in 2021 and supply may be constrained as China forces manufacturers to reduce energy consumption.

- Constraints on exports from China -- due to energy and strained supply chains -- could reduce the availability of commodity solar panels.

- Solar panel prices are starting to rise as a result of higher costs and limited supply, forcing solar developers to look for alternative suppliers.

First Solar has a few advantages in the current environment. The main advantage is that First Solar is not a silicon-based solar panel manufacturer; it uses cadmium-telluride technology instead. It also controls more of its manufacturing because of the process it uses to manufacture solar panels. First Solar also makes about half of its solar panels in the U.S., which could be a supply advantage as global shipping routes remain congested.

There should be short-term tailwinds for solar energy broadly and First Solar specifically versus silicon-based competitors. That's why I like the company's position in renewable energy right now.

First Solar is riding a long-term trend

Zooming out even further, the solar industry is clearly taking market share from fossil fuels, and the short-term rise in fossil fuel prices could help further entrench solar energy in the long run.

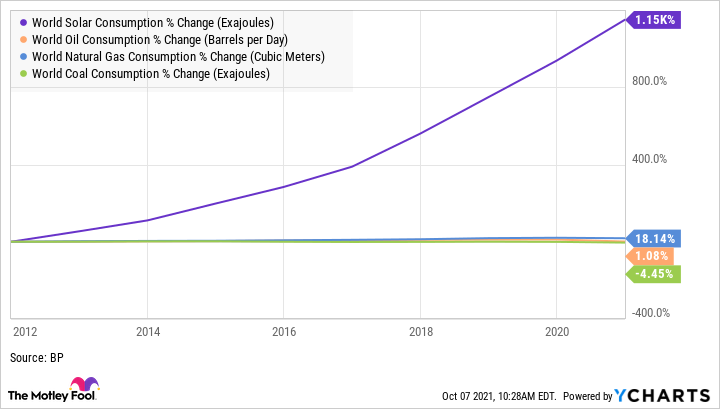

You can see below that global solar energy consumption is growing much more quickly than coal, natural gas, or oil consumption. And remember that once a solar power plant is built, it generates power for decades. So, if high fossil fuel prices lead to more solar installations than currently projected, it shrinks the future addressable market for fossil fuels.

World Solar Consumption data by YCharts

On the cost side, higher fossil fuel prices will give developers an incentive to sign contracts for solar panels long into the future, which will give manufacturers the confidence to build more supply, which will help lower the cost of solar...and the virtuous cycle continues. Over a little over four decades, the cost of solar panels has fallen 99%, and that trend is likely to continue (albeit not at the same pace).

Remember that solar energy is the most abundant energy source on earth. If exploiting that energy source makes financial sense, why wouldn't it continue to grow versus fossil fuels?

Why First Solar is the best bet in solar energy today

Earlier this year, First Solar's management announced plans to increase production by 3.3 gigawatts (GW) in the U.S. and another 3.3 GW in India. In total, the company will more than double solar panel production by 2025 to 16 GW.

On top of the growth story, First Solar has a rock-solid balance sheet. The company has $2.1 billion in cash on the balance sheet, and even after starting to spend on expanding production, management expects the net cash balance to be $1.35 billion to $1.45 billion by the end of this year.

First Solar is also profitable, and it's projecting $4.00 to $4.60 in earnings per share in 2021. This is a profitable growth stock in a growing segment of the energy industry, which is why it's my top pick of the month.