Dividend stocks are proven wealth creators. Since 1973, the average dividend stock in the S&P 500 has delivered annual total returns of 12.83%, according to data from Ned Davis Research and Hartford Funds. That has outpaced the overall index's 12.56% annualized return. Meanwhile, companies that routinely grew their dividends produced even better total returns of 13.2% per year. The powerful returns of dividend growth stocks make them ideal investments for those who don't have a lot of cash to invest.

While there are a lot of great dividend growth stocks out there, Chevron (CVX -0.43%), Brookfield Infrastructure (BIP 0.46%) (BIPC), and American States Water (AWR 1.49%) stood out to our contributors. Here's why they believe this trio can make investors a little richer one dividend payment at a time.

Image source: Getty Images.

Chugging along just fine

Reuben Gregg Brewer (Chevron): Over $200 billion market cap integrated energy giant Chevron has increased its dividend annually for 34 consecutive years. That makes this oil and natural gas giant a Dividend Aristocrat, which is impressive in its own right. However, the industry in which it operates is highly cyclical, with swift and dramatic increases and decreases in energy prices the norm, not the exception. To put up a dividend record like the one Chevron has in the energy sector is simply incredible and speaks to a company that puts returning value to shareholders at the top of its priority list.

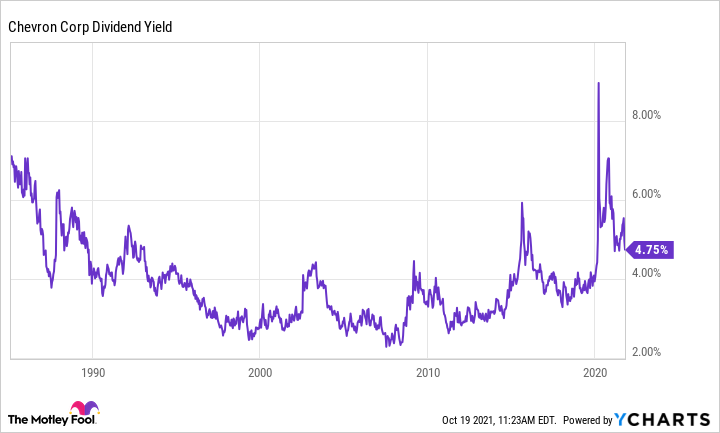

CVX Dividend Yield data by YCharts

What's interesting today is that Wall Street is worried clean energy will quickly displace fossil fuels within the broader energy landscape. Although this is the bigger trend, getting rid of oil and gas will likely take decades. That means Chevron has ample time to keep milking its cash cow business and to make any moves necessary to adjust for a cleaner future when the time comes. But, in the meantime, investors are punishing the stock, which is offering a historically high 4.9% dividend yield, even after a big run up in the shares thanks to rising oil prices.

That suggests that investors can not only buy Chevron at a relatively cheap price, but, given its dividend history, they can keep collecting a fat dividend check for years to come. And if the oil giant starts to shift toward cleaner alternatives, as is highly likely, there could be some upside in the years ahead, as well.

A long history of enriching investors

Matt DiLallo (Brookfield Infrastructure): Brookfield Infrastructure has created a lot of value for its investors over the years. The global infrastructure company has delivered an average annual return of 18% since its inception more than a decade ago. That's crushed the S&P 500's roughly 11% total annualized return during that 13-year period, and would have grown a $500 investment into nearly $4,300.

One of the keys to Brookfield's success in enriching its investors is its dividend. It has grown its payout at a 10% annual rate, making its investors a little richer with each dividend payment. The company has been able to steadily increase its dividend through a combination of organic growth and acquisitions. Brookfield has invested billions of dollars over the years on expansion projects and to acquire expandable infrastructure platforms.

The company believes that it can continue growing at a healthy rate in the coming years. It currently expects organic growth to boost its cash flow per share by 10% this year. Meanwhile, its asset rotation program of selling mature businesses and reinvesting the proceeds into higher-returning opportunities will add another 12% to its earnings. Over the longer term, Brookfield expects to grow its cash flow at a rate that should support 5% to 9% annual dividend growth. That's impressive considering that the company already sends sizable dividend checks to investors, given its 3.6% dividend yield. Its forecast suggests that those payments should continue getting bigger in the coming years, making its investors a little richer with each one.

Don't underestimate this multibagger dividend growth stock

Neha Chamaria (American States Water): If you have some spare cash and love dividends, one of the best uses for your money right now is investing dividend stocks that don't just pay steady and regular dividends, but grow them consistently. If you can reinvest those higher dividends year after year, your investment could eventually compound nicely over the years. Dividend growth stocks are, in fact, so powerful that even the most seemingly boring ones can make you rich if you can patiently hold them for years. Case in Point: American States Water. Check out the chart below.

American States Water is as boring as it can get: It's a water utility stock, after all. Yet, had you bought American States Water shares five years ago, you'd have more than doubled your money already. And had you bought them 10 years ago, you'd be sitting on a sixfold return by now. All you had to do was simply buy some shares, collect dividend checks, and reinvest them diligently without worrying about the stock's day-to-day performance.

The thing is, money compounds with time, and when a stock pays you more each year, you're in good hands. As a regulated water utility, American States Water can generate stable cash flows and comfortably increase dividends. The company can grow its cash flow two ways: Tariff increases, and expansion of its subsidiary's footprint that serves U.S. military bases under 50-year contracts.

In July, American States Water announced a 9% increase in dividend, and said it is targeting compound annual growth in dividends of more than 7% in the long run. In Fact, American States Water boasts the longest dividend growth streak -- of 67 consecutive years -- among all the Dividend Kings. That makes this stock an almost surefire bet to get rich if you can buy and simply forget it.