Honeywell International (HON 0.48%) appears to be the next company in line for a breakup after its iconic peer, General Electric (GE 0.87%) announced plans to separate into three different companies over the next few years. So let's take a look at whether it makes sense or not for Honeywell. If it does, investors buying the stock might have some upside to look forward to.

Image source: Getty Images.

The case for a breakup of Honeywell

The subject last received a highly vocal airing in 2017 when an activist hedge fund campaigned for Honeywell to spin off its aerospace business. The gist of the argument back then, as now, is that:

- The businesses would be valued higher by the market if management separated them than if they were still part of Honeywell.

- The separation would lead to businesses being better run than if they were still part of Honeywell.

To gauge these arguments, investors typically look at the valuations and operating performance of the businesses that compete with the constituent parts of Honeywell and its industry peers in general.

In the case of GE, there is a compelling case that the sum of the parts is worth more than the businesses valued together under the GE umbrella. Similarly, there's plenty of evidence to suggest that industrial companies are better run when broken off of conglomerates.

Image source: Getty Images.

Honeywell has already spun off businesses

While the case for breaking up GE and others may be compelling, it's hard to say the same thing about Honeywell.

First, Honeywell's management has already started shedding non-core businesses with the spin-offs of home comfort and security products company Resideo Technologies and turbocharge manufacturer Garrett Motion in 2018. Resideo is a consumer-focused business, and Garrett plays in a market that's non-core for Honeywell.

Honeywell already enjoys a premium valuation

It's hard to make the case that Honeywell's stock will get a positive rerating from a breakup, because it already enjoys a valuation premium. Nevertheless, the table shows a breakout of segment profit in 2020, with a list of key competitors in each segment.

| Honeywell Segment |

2020 Segment Profit |

Competitor |

|---|---|---|

|

Aerospace |

$2,904 million |

Raytheon Technologies, Garmin |

|

Honeywell Building Technologies (HBT) |

$1,099 million |

Siemens, Johnson Controls, Carrier, Schneider |

|

Performance Materials and Technologies (PMT) |

$1,851 million |

Emerson Electric, Siemens, Schneider |

|

Safety and Productivity Solutions (SPS) |

$907 million |

3M, Zebra |

Data source: Honeywell International presentations.

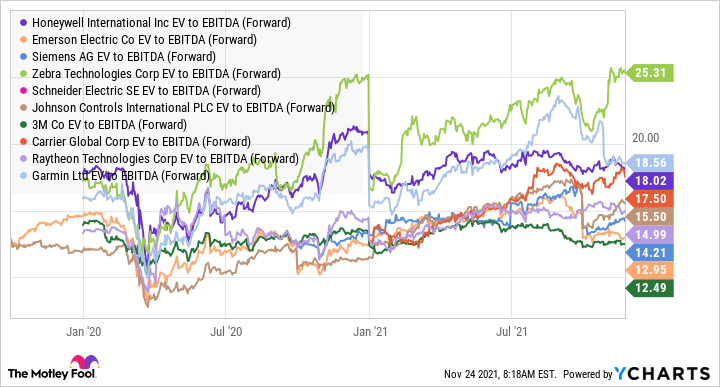

The following chart shows a comparison of Honeywell's valuation against a collection of its peers. The valuation used here is enterprise value (market cap plus net debt) to earnings before interest, taxation, depreciation, and amortization (EBITDA). As you can see below, Honeywell is more highly rated than all bar two industry-focused companies, Zebra Technologies and Garmin.

Data by YCharts

Honeywell is already well run

Third, turning to the argument that a separation might improve the business's profitability, the evidence suggests Honeywell is already well run. One way to gauge this is by comparing selling, general, and administrative expenses (SG&A) as a share of revenue. The lower the ratio, the less money a company is using to run its operations.

As you can see below, Honeywell has one of the lowest SG&A to revenue ratios in the industrial sector -- lower than nearly all its competitors and its industrial conglomerate peers.

Data by YCharts

Honeywell is better off as it is

Corporate activity in the form of mergers, acquisitions, divestitures, etc., is part and parcel of the year-to-year running of an industrial conglomerate. Indeed, Honeywell's management is actively looking at deals. However, that's all far removed from the kind of wholesale breakup that GE is planning, and what other industrial conglomerates have done in recent years.

There's always a case for companies being run separately, but the market is now awarding Honeywell a valuation premium, and its overall business is very efficiently run. So Honeywell investors might be better served by keeping things just as they are right now.