What happened

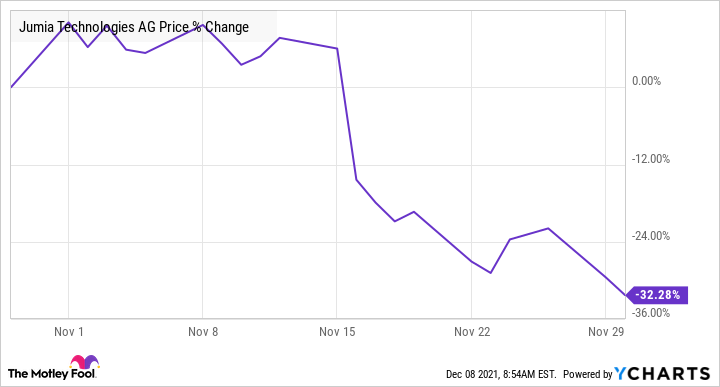

Shares of Jumia Technologies (JMIA 0.45%) were falling last month after the African e-commerce company posted a disappointing third-quarter earnings report. According to data from S&P Global Market Intelligence, the stock finished the month down 32%.

As you can see from the chart below, most of its losses came after the quarterly report came out on Nov. 16.

So what

Jumia stock fell 19% on Nov. 16 as the company turned in another disappointing earnings report with sluggish growth that shows the business is still struggling to gain traction despite big promises.

Image source: Jumia.

Gross merchandise volume (GMV) in the quarter increased 8.1% to $238.1 million, while overall revenue rose 8.5% to $42.7 million as the company shifted its focus away from big-ticket items like electronics and appliances to lower-priced, fast-moving consumer goods that drive frequent purchases. Despite the revenue growth, marketplace revenue, which management had recently billed as the future of the business, stalled, falling from 7.3% to $25.3 million. Instead, first-party revenue was the main driver of the company's growth.

On the bottom line, the company's adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) loss nearly doubled to $52.5 million as it ramped up spending on sales and marketing, moving away from a goal of working toward profitability.

In its guidance, the company called for continued investments in the fourth quarter, and said the pandemic and macroeconomic challenges were creating uncertainty in its guidance.

The stock continued to slide over the rest of the month as investors pulled back from growth stocks, especially riskier ones like Jumia, due to rising interest rates and expectations that the Federal Reserve will tighten its monetary policy.

Now what

Jumia stock recovered some of its November losses after the company reported strong Black Friday results on Dec. 7, sending the stock up 20.8%. The company said it had its largest Black Friday campaign ever with $150 million in GMV from Nov. 5 to Nov. 30, up 30%, and a 39% increase in orders.

Those results will make its fourth-quarter performance well above the third quarter, but there are still a number of reasons to doubt the long-term potential of Jumia, including challenges with African infrastructure, sluggish growth momentum and wide losses. Though the company has at times been dubbed the Amazon of Africa, that is far from the case at the moment. After all, there's a reason why global e-commerce giants like Amazon have mostly avoided Africa.