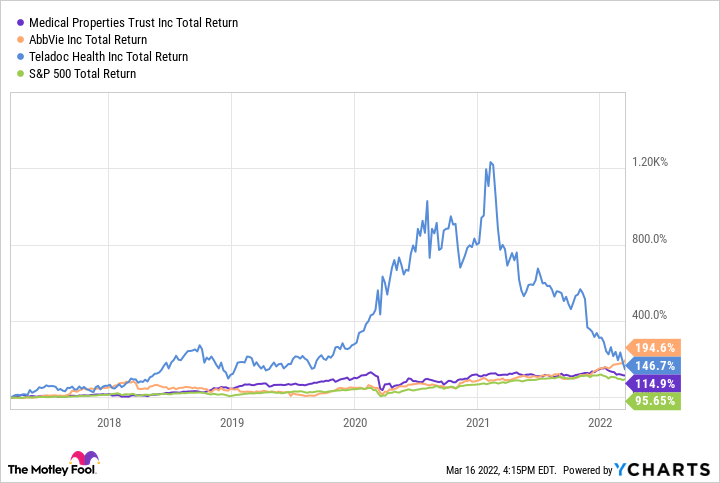

A market mantra is that past returns are no guarantee of future success. However, the longer your view of a stock, the less that is true. Medical Properties Trust (MPW -3.93%), AbbVie (ABBV 0.91%) and Teladoc Health (TDOC -0.95%) all would have doubled your money, or more, if you had invested in them five years ago, based on their total returns. Looking at each stock individually, all three are still good investments.

Medical stocks in general are resilient during recessions and periods of inflation because our population is aging, creating an increased need for medical services. That means higher occupancy rates in hospitals, increased reliance on pharmaceuticals, and a greater likelihood that people will use telehealth services.

Image source: Getty Images.

1. Medical Properties Trust

Medical Properties Trust is a real estate investment trust (REIT) that focuses on building and leasing hospital facilities, primarily general acute care hospitals. As of Dec. 31, 2021, the company had 438 properties across 32 states and nine countries.

Traditional measures of finance, such as revenue and earnings per share, are less useful in quantifying REITs, so it's better to use adjusted funds from operation (AFFO) because that takes into account costs incurred by REITS and additional income sources such as rent increases. In 2021, Medical Properties Trust reported adjusted funds from operation of $811.4 million, up 26.2% year over year, and AFFO per share was $1.37, up 13.2% over 2020.

The company has increased its quarterly revenue for 10 consecutive years, including a rise of 3.5% to $0.29 per share this year, giving it a yield of 5.8%. The company's AFFO payout ratio is 81.7%, a little high, but not cause for alarm for a REIT such as Medical Properties Trust with consistent cash flows. Its average lease length is extremely long -- 17.7 years.

The stock is down more than 15% so far this year, but a $10,000 investment in Medical Properties Trust five years ago would be worth $22,474.78 as of Monday's close.

2. AbbVie

AbbVie has increased revenue every year for the past decade. That's the definition of a dependable company. In 2021, the company reported full-year revenue of $56.2 billion, a rise of 22.7% year over year, and EPS of $6.45, an increase of 135% over 2020. The company released bullish guidance for 2022 with anticipated EPS between $9.26 and $9.46.

The key for AbbVie will be how well its portfolio and pipeline perform as revenue from blockbuster immunology drug Humira declines as it comes off patent protection in the United States in 2023. The drug is already facing pressure from biosimilars in Europe and while it generated $20.6 billion last year in revenue, up 4.3% year over year, its sales fell by 9.6% in Europe.

There are plenty of reasons for optimism that the company will be able to overcome any loss in Humira revenue as its two immunology drugs, Skyrizi ($2.9 billion in 2021 revenue) and Rinvoq ($1.7 billion in 2021 revenue), are increasing label applications and grew U.S. revenue by 79.6% and 94.8%, respectively, year over year (it was just their first year of international sales). Besides those two, AbbVie has 12 other therapies that reported over $1 billion each in revenue in 2021, led by oncology drug Imbruvica, which brought in $5.4 billion.

One of the best things about the company is its quarterly dividend, which it raised last year by 8.5% to $1.41 per share, representing a yield of around 3.7%. Because AbbVie was a part of Abbott Labs before it was spun off as a separate company in 2013, it is considered a Dividend King since it has increased its dividend for at least 50 consecutive years. Since the spinoff, AbbVie has boosted its own dividend by 250%.

AbbVie's stock is up more than 12% this year and a $10,000 investment in the company five years would have been worth 28,872.33 as of Monday's close.

3. Teladoc

Teladoc Health, at first glance, may appear to be a risky bet because the company isn't profitable and never has been. However, the company is growing revenue by leaps and bounds and the pandemic drove home the point that there's an increased need for telehealth services.

In 2021, the company reported a record $2 billion in revenue, up 86% over 2020. Teladoc lost $2.73 per share for the year, but that represented an improvement of 49% over 2020. It also posted $193.9 million in annual cash flow from operations, compared to a loss of $53.5 million the year before.

The company expects 2022 revenue of $2.55 billion to $2.65 billion, representing 25% to 30% growth. In addition, it expects a loss per share of between $1.60 and $1.40, an improvement of between 70.6% and 95%. At that pace, the company could be profitable by 2024.

Telehealth services were a $62.4 billion market in 2021 and are forecasted to grow with a compound annual growth rate of 36.5% through 2028, reaching a $787.4 billion market by then, according to a report by Grand View Research. Teladoc, with its first-to-market status, is poised to benefit from that growth. The stock is down more than 30% this year, but a $10,000 investment in Teladoc five years ago would have more than doubled your investment, as it would be worth $28,742.11 as of Monday.

MPW Total Return Level data by YCharts

The choice is your preference

There are solid reasons for each of these healthcare stocks. Medical Properties Trust appears to be the safest choice of the three because its long-term leases protect its funds from operations. AbbVie poses some risk because of the unknowns regarding the loss of Humira's patent protection, but its other therapies are should replace any Humira decline. Teladoc appears to be the riskiest since it is still likely two years from being profitable. However, it is growing revenue and market trends favor more telehealth services.