What happened

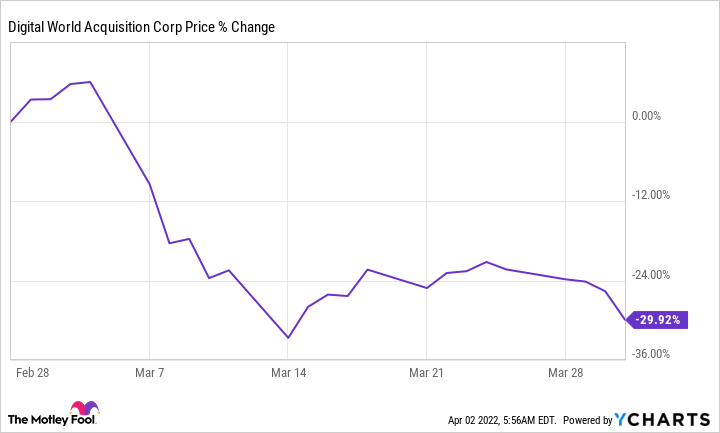

Shares of Digital World Acquisition (DWAC) tumbled 29.9% in March, according to data from S&P Global Market Intelligence. The special purpose acquisition company (SPAC) saw its valuation fall in response to the performance of Trump Media & Technology Group's (TMTG) recently launched Truth Social platform.

Digital World Acquisition is set to take TMTG public through a SPAC merger, and its stock has seen volatile movements in conjunction with anticipation and subsequent performance indicators for Truth Social. The stock saw a dramatic sell-off last month even as the S&P 500 index and the Nasdaq Composite index climbed 3.6% and 3.4%, respectively, across the stretch.

Image source: Getty Images.

So what

Digital World Acquisition's stock has seen some volatile swings after getting a big boost from initially announcing plans to merge with TMTG.

Digital World Acquisition's share price surged in February leading up to and immediately following the launch of Truth Social. The Twitter-like social media platform was launched on Feb. 21 on Apple's iOS mobile platform, and a version for Alphabet's Android mobile operating system is set to launch in the not too distant future.

The application's launch was something of a mixed bag. While it attracted a substantial amount of downloads and shot to the top of Apple's free download chart, Truth Social's debut was mired by bugs and feature outages, and some of these have persisted. Analysis from Sensor Tower suggests that downloads for Truth Social have declined 93% from their initial levels, and the concerning engagement numbers have prompted investors to sell out of the stock.

Now what

Sensor Tower estimates that only 1.2 million people have installed TruthSocial, and the big drop-off in downloads raises questions about the future of the platform. Digital World Acquisition is still on track to merge with TMTG, but that event could also create some volatility for the stock.

Many companies that have been taken public through SPAC mergers have gone on to issue substantial new share offerings to compensate employees and fund business operations. This has a dilutive effect for existing shareholders and can lead to substantial losses.

Digital World Acquisition stock now trades down roughly 35% from its peak in 2022. It's possible that shares could bounce back and go on to reach new highs, but investors should proceed with the understanding that the stock looks like a high-risk, high-reward play.