Oil stocks are on fire in 2022, and Occidental Petroleum (OXY -0.05%) is no exception. The Houston-based driller's stock price has more than doubled in less than four months. After opening this year priced just under $30 per share, it now trades above $60 -- a gain of 111% year to date. So is it too late? Is there still money to be made in a stock that has risen by so much, so quickly?

In this case, perspective is critical. Sure, Occidental is on a tear right now, but a different picture emerges when you look at its share price over a longer time horizon.

Even with this year's monster rally, Occidental's share price today is almost identical to where it was five years ago. In fact, it's actually down 2%. Compare that performance to the S&P 500, which has returned 91% over the past five years.

On this more extended time scale, it's clear: Occidental has been a laggard, and it should have plenty of room to run. But what about the company's fundamentals? Are they sound enough to support a long-term rally for its shares?

Image source: Getty Images.

Higher oil prices have led to improving fundamentals for Occidental

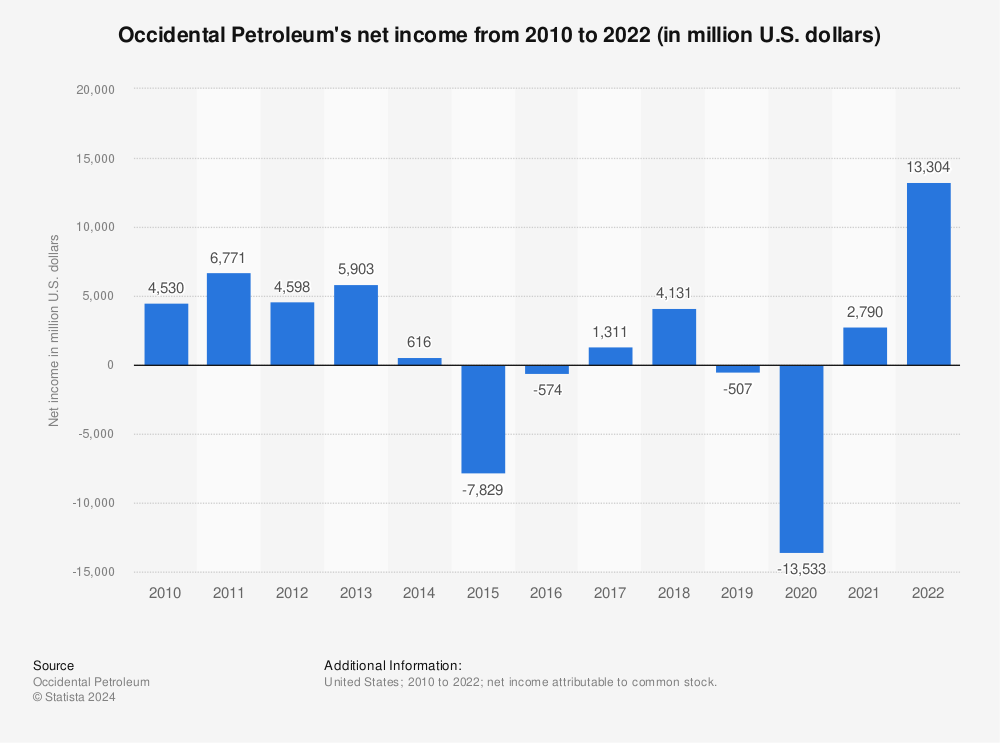

The energy sector is a cyclical industry. Commodity prices, specifically oil and gas prices, can vary wildly, leading to boom and busts cycles for energy producers. Look no further than this chart of Occidental's net income to see how those prices have played havoc with its ability to consistently turn a profit.

Image source: Statista.

After modest profits in 2017 and 2018, its earnings went negative in 2019 as it completed the acquisition of Anadarko Petroleum. A disastrous 2020 followed, in which the company lost $13.5 billion as the COVID-19 pandemic wrecked the worldwide oil markets. However, Occidental bounced back in 2021, posting a $2.5 billion profit on a record $26 billion in revenues. Now, with oil prices hovering near $100 per barrel, Wall Street analysts expect Occidental to bring in $32.8 billion of revenue for 2022, a 25% jump from last year.

What's more, high oil prices are driving record cash flows for Occidental. The company generated $10.4 billion in operating cash flow in 2021, allowing it to repay $6.8 billion of debt. This river of cash will help the company in several ways:

- It will pay down debt: Management has set a goal of retiring an additional $5 billion of debt in 2022.

- Its quarterly dividend (currently $0.13 per share) is secure and could rise if the company generates enough cash.

- Management announced the resumption of a $3 billion share buyback program.

With an improving balance sheet and strong cash flows, Occidental still looks like an attractive stock to own -- even after its impressive start to the year.