As the owner of a tech-heavy portfolio, 2022 has already been a struggle -- but I remain excited.

Due to the power of dollar-cost averaging and adding money to the market weekly, I've added shares of some of the most promising growth businesses in the world at huge discounts.

Today we will look at three stocks that exemplify why I'm excited to buy and hold forever at these low prices.

Image source: Getty Images.

1. Unity Software

Looking for the "pick and shovel" suppliers in emerging industries can be a great way to find new investments. While gaming may not always have tangible picks and shovels, it is clear that Unity Software (U 2.25%) is the leader in providing the tools necessary to create and operate games.

It's down over 50% from its 52-week highs, so one might think that gaming is struggling with the pandemic starting to calm down -- but that couldn't be farther from the truth.

NYSE: U

Key Data Points

Despite facing pandemic- and lockdown-aided comps from 2020, Unity saw a 93% increase in the number of games made using Unity software and a 31% jump in the number of new creators during 2021.

On top of this, gaming revenue grew nearly 30% for Unity in 2021, despite daily active users dropping off at the start of 2021 amid the world's gradual reopening.

However, as promising as this sounds for investors, Unity's non-gaming operations grew even faster at 70% year over year in 2021. Now accounting for 25% of the create segment's revenue -- which accounts for 30% of Unity's total sales -- this burgeoning unit boasts a list of unique partnerships, including eBay, Hyundai Motors, and car manufacturers in Germany, China, and Japan.

With all these moving parts, investors should home in on Unity's dollar-based net retention rate (DBNR) of 140% to measure how its growth progresses over the coming quarters.

DBNR calculates how much more existing customers buy from Unity year over year (including customers lost to churn), with a rate above 100% showing growth -- making its 140% mark excellent.

Furthermore, the company currently trades at the lowest price to sales in its publicly traded history.

U PS Ratio data by YCharts

While it's somewhat pricey, Unity's growth rates and optionality make it a promising investment for under $100 -- especially considering management's expectation to become free cash flow positive in 2022.

2. SoFi Technologies

Potentially drawing the ire of the stock gods, SoFi Technologies (SOFI 0.49%) signed a stadium rights deal with the Los Angeles Chargers for $600 million over the next 20 years, making SoFi Stadium the team's new home.

While these deals seemingly have a Madden cover-like curse for the brands involved, I believe that the financial services specialist could buck this trend. Through its diversified operations, SoFi aims to create financial independence for its 3.4 million members through its young (but rapidly growing) financial services productivity loop.

Image source: SoFi's 2021 Annual Report.

Originally famous for its student loan refinancing, SoFi is quickly becoming a one-stop digital shop for a growing number of banking products. Operating in three business segments -- lending, financial services, and its technology platform, Galileo -- the company experienced incredible growth in 2021, seeing sales rise by 63% year over year.

Despite this massive growth, SoFi has dropped more than 70% below its 52-week highs as it found itself in the center of a broader tech and growth stock sell-off.

NASDAQ: SOFI

Key Data Points

With a company price tag (market capitalization) of $6 billion, it is time to reconsider SoFi's cheaper valuation. Recording around $1 billion in sales during 2021, SoFi now trades at just 8.3 times gross profit -- while its much larger (and slower-growing) new-age banking peer, PayPal, also trades at 10 times gross profit.

Best yet for investors, 2021 was a tipping point in SoFi's history as it became positive on an adjusted EBITDA (earnings before interest, taxes, depreciation, and amortization) basis. SoFi's gradual improvement gives us a baseline to track over the coming years.

Thanks to its intriguing blend of a bargain valuation on a gross profit basis, very high growth, and steadily improving margins, I am willing to buy and hold SoFi for the long term to see how its flywheel of financial services plays out over time.

3. Global-e Online

Fitting the adage, "If you can't beat them, join them," Shopify partnered with Global-e Online (GLBE +0.66%) in 2021, acknowledging the inherent complexity of replicating its unique offerings.

Intent on bringing global direct-to-consumer sales to entrepreneurs worldwide, Global-e Online's mission is "making global e-commerce border agnostic." Supporting over 25 languages, 100 currencies, and 150 payment options, Global-e's platform is wildly complex as it offers businesses global sales potential with local-level insights.

After recording $1.5 billion in gross merchandise volume and $245 million in revenue in 2021 -- figures which grew 87% and 80% year over year, respectively -- Global-e's implied take rate is 16.9%. These sales come from two sources, platform services, and fulfillment, which make up a 43% to 57% split of total revenue.

Thanks to these incredible growth rates and a substantial investment thesis with a burgeoning global e-commerce landscape, the company's stock exploded in its first year as a public company.

NASDAQ: GLBE

Key Data Points

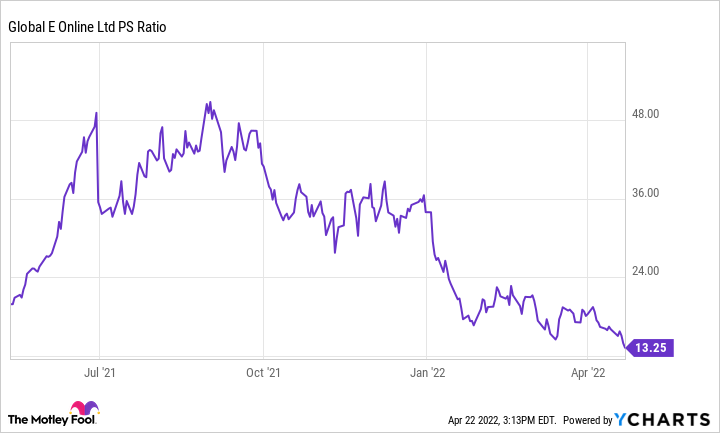

However, like many other younger tech IPOs, Global-e has struggled recently and now trades at the lowest price to sales since it went public.

GLBE PS Ratio data by YCharts

With this dramatically lower valuation, Global-e's potential far outweighs its minuscule market cap of $4 billion -- especially considering its ongoing partnership with the entrepreneurial behemoth that is Shopify.

Better yet, Global-e boasts a DBNR of 152%, making this a great company to consider holding forever.